Most tech CEOs hire salespeople the same way they hire engineers. Post a job description. Screen resumes. Conduct interviews. Hire whoever “feels right.”

Then 6 months later, they’re scrambling to replace another underperformer who interviewed brilliantly but can’t close deals.

Here’s what Walter Crosby, founder of Helix Sales Development and a sales leader with decades of experience, told me: “If you’re hiring salespeople the same way you hire everyone else in the organization, you’re likely to get it wrong. ‘Cause salespeople are different.”

That’s the core problem. Most CEOs running Series A to Series C tech companies don’t know how to hire salespeople who actually perform. They confuse interview skills with sales ability.

This article breaks down the contrarian approach Walter uses to build performance-based sales teams. No generic HR checklists. Just what works when you need sellers who hit quota, not just talk a good game.

Table of Contents

Quick Answer: How to Hire Salespeople Who Perform

If you want to know how to hire salespeople who perform, the key is reversing traditional hiring: assess sales DNA before selling the role. Use validated assessment tools (OMG, DriveTest) to measure will to sell, competitiveness, and resilience. Create “attract-and-repel” job postings that state challenges up front. Prioritize strategic messaging over product training in onboarding. Test candidates with specific questions about quota attainment, deal losses, and competitive ranking—not generic interview questions.

About the Author

Vinay Koshy is the founder of Sproutworth and host of the Predictable B2B Success podcast, where he’s interviewed 500+ B2B tech CEOs, sales leaders, and revenue executives about scaling from seed to Series C. Over the past decade, he’s worked with funded startups navigating complex B2B sales cycles, developing content strategies that directly support revenue operations and sales team effectiveness.

His work focuses on ghostwriting educational email courses and newsletters for tech executives who need to establish thought leadership without the time investment. He specializes in digital PR and content strategy for cleantech and B2B tech companies, with particular focus on the operational challenges of building predictable revenue engines.

Connect: LinkedIn | Predictable B2B Success Podcast | Sproutworth

Why Hiring Salespeople Differently Matters

The hiring process most tech companies use rewards the wrong behavior.

Traditional interviews favor candidates who sell themselves well. Charismatic presenters. Smooth talkers. People who know exactly what hiring managers want to hear.

But here’s the disconnect: your best sales candidate might be the person who undersells themselves in the interview because they’re focused on asking questions and understanding your needs, not pitching you.

Harvard Business Review research shows an annual sales turnover rate of 25-30%. That means you’re replacing your entire sales organization every four years. The cost? According to LinkedIn’s 2024 Future of Recruiting Report, the average cost per sales hire is $4,700, with a 42-day fill time.

Bad hires cost more. Much more.

When I work with Series A and B tech companies on revenue-focused content strategy, the sales-hiring challenge comes up frequently. CEOs burn 12 months on a single bad sales hire: 3 months recruiting, 6 months realizing they made a mistake, 3 months finding a replacement.

That’s not a hiring problem. That’s a revenue problem. And when you’re burning runway, you can’t afford to get it wrong.

Walter’s experience mirrors this. He’s been promoted to sales management multiple times, often without being prepared. His first promotion story: “I was at a Christmas party. They cornered me and said, Hey, we wanna offer you this position for next year. I was telling my wife on the way home. She’s that’s great. Congratulations. Have you ever managed anybody before? And I’m like, no.”

That “oh crap” moment led him to create Helix Sales Development, specifically to help sales managers make better hiring decisions.

The companies that figure out how to hire salespeople who perform stop treating it like a standard recruitment process. They treat it like what it is: finding producers who can drive revenue under pressure.

Guest Expert: Walter Crosby, Helix Sales Development

Walter Crosby brings an insider’s perspective to sales hiring. After being promoted to sales management roles multiple times throughout his career, always underprepared, he recognized a pattern: business owners assume top salespeople automatically become great sales managers.

They don’t.

“The business owners often think that if you do a great job at sales, that it’s a natural to go become a great sales manager, and it’s usually not the case,” Walter explains.

This realization drove him to found Helix Sales Development, where he helps sales managers transition successfully and build high-performing teams. His approach challenges conventional wisdom about hiring, onboarding, and managing salespeople.

Walter’s background includes selling commercial signage, financial services, fire alarm systems, and working with K-12 educators, universities, contractors, and retail firms. He’s navigated complex B2B sales cycles across multiple industries, giving him a rare cross-sector perspective on what actually works.

His personal area of strength? Coaching. “I love coaching,” he says. But not the generic kind. The type focused on helping salespeople uncover what they don’t know and learn it in ways that directly relate to the deals they’re working on.

Connect with Walter:

LinkedIn: Walter Crosby on LinkedIn

Company: Helix Sales Development

Stop Selling Your Company to Sales Candidates

Most hiring advice tells you to sell your company to candidates. Showcase culture. Highlight benefits. Make them want to work for you.

Walter’s approach? The opposite.

“We’re not selling the company and we’re not selling the role to the candidate ’cause we don’t know that they’re the right fit yet,” he explains. “So we’re constantly discerning whether this person is somebody that’s worthwhile for us to invest in.”

This is the attract-and-repel strategy.

Traditional hiring attracts everyone who can fog a mirror. You get volume, but quality suffers. By the time you realize someone’s wrong for the role, you’ve invested months of salary and training.

For funded tech companies operating on tight timelines, this mistake is expensive. Your board isn’t measuring “hire quality.” They’re measuring revenue growth. A bad sales hire directly impacts the metrics that matter for your next funding round.

Walter’s job postings are designed differently. They clearly communicate expectations and challenges. They don’t oversell the opportunity. They attract people who want that specific type of role and repel those who don’t.

“We use a job posting structure that attracts and repels. We’re trying to differentiate by having that ad allow the salesperson to self-identify as well as repel the people that we don’t want to waste our time with.”

Think about that. Most companies waste time interviewing people who should never have applied.

When I help tech CEOs develop thought leadership content through educational email courses and newsletter ghostwriting, I see this pattern constantly: they understand how to position their product to repel bad-fit customers, but they don’t apply the same thinking to hiring. You wouldn’t waste sales cycles on prospects who’ll never close. Why waste hiring cycles on candidates who’ll never perform?

The strategic shift: Don’t sell. Discern.

It’s not about who wants to work for you. It’s about who has the DNA to succeed in your specific sales environment.

You’re not trying to convince people to apply. You’re trying to help the right people recognize themselves and the wrong people self-select out.

The Sales DNA You Actually Need to Assess

Here’s where traditional hiring fails hardest: it doesn’t measure what actually predicts sales performance.

Resume screening checks experience. Interviews check likability and communication. Reference checks verify employment.

None of that tells you if someone can sell.

Walter uses assessment tools that focus on one thing: “How does this sales person think about sales? Do they have the will to sell? What is their sales DNA look like?”

Research from SalesDrive backs this up. They found that top-performing salespeople share three non-teachable traits: Need for Achievement, Competitiveness, and Optimism. These can be objectively measured.

According to HireRight and Checkster studies, 85% of resumes contain false or misleading information, and 81% of candidates admit to stretching the truth during interviews.

You can’t interview your way to truth. You need objective data.

Walter recommends assessment tools that reveal how candidates think, not just what they say. “That becomes a data point that we use. It’s an important data point, but it allows us to have a look inside of somebody’s head.”

The assessment isn’t pass/fail. It’s diagnostic.

You’re looking for specific patterns:

- Will to sell: Do they actually want to sell, or do they want a comfortable salary?

- Competitive drive: Do they need to win, or are they content being mediocre?

- Resilience: Can they handle rejection without spiraling?

- Strategic thinking: Do they understand complex sales cycles?

These traits matter more than industry experience.

A pattern I notice when developing revenue enablement content for funded startups: the best salespeople aren’t always from your industry. They’re people with the right psychological makeup who can learn your product.

You can teach product knowledge. You can’t teach hunger.

How to Hire Salespeople: The Insider Method Sales Managers Use

Walter’s hiring process looks nothing like traditional recruitment. It’s designed by someone who’s been in the sales trenches and knows what actually matters.

Phase 1: The Job Posting (Attract and Repel)

The posting clearly states expectations, challenges, and what success looks like. It doesn’t hide the hard parts. “We’re looking for performance. We’re looking for salespeople that are going to perform.”

This transparency accomplishes two things:

- Qualified candidates recognize the opportunity

- Unqualified candidates don’t waste anyone’s time

Phase 2: Assessment Tool (Sales DNA Analysis)

Before any interview, candidates complete an assessment focused on sales-specific thinking patterns and will to sell. This provides objective data about psychological fit.

Walter emphasizes: “We use an assessment tool that is focused on one thing. How does this sales person think about sales?”

Phase 3: Phone Screen (Pressure Test)

A short phone screen where the goal isn’t to be friendly. It’s to see how candidates behave under slight pressure.

“We ask questions that they need to be articulate about. We ask questions to make sure that they paid attention to the ad, that they can do the things that we’ve asked for.”

This filters out people who didn’t read the posting or can’t handle basic professional pressure.

Phase 4: In-Depth Interview (Resume and Assessment Review)

This is where you dig into discrepancies. Why did they leave that role? What does this assessment score mean in practice? How have they handled specific situations?

“We do an interview where we look at questions and concerns around resume questions and concerns around that assessment that they took.”

Phase 5: Cultural and Performance Alignment

Only now do you start discussing what makes your company attractive. You’ve already determined they can do the job. Now you’re ensuring they want the job.

“We want them to understand what the expectations of that role is. We wanna understand the culture that performance aspect of the organization.”

Phase 6: Final Decision and Offer

After all that filtering, you know this person can perform. That’s when you sell: “It’s not until that last meeting that we know we got the right candidate. Then that’s where we start talking about, this is why you wanna work at this company.”

This inverted funnel approach saves time by eliminating bad fits early. Traditional hiring wastes time being nice to candidates who should never have made it past resume screening.

For Series A to C tech CEOs juggling board meetings, investor updates, and product roadmap decisions, this efficiency matters. You don’t have time to personally interview 15 candidates. You need a process that gets you to the final 3 qualified candidates without wasting your week.

Interview Questions That Actually Reveal Sales DNA

Once you understand how to hire salespeople using assessments, interviews reveal how candidates think in real-time.

Most companies ask generic questions: “What’s your greatest weakness?” or “Where do you see yourself in five years?” These tell you nothing about sales ability.

Walter’s approach? Questions that force candidates to demonstrate their thinking, not rehearse answers.

Questions to Assess Will to Sell

“Walk me through your last deal from first contact to close. Where did you almost lose it, and exactly how did you save it?”

Listen for: Specific tactics, ownership of near-failures, strategic pivots.

Red flag: Vague answers or blaming others.

“Tell me about a month when you missed quota. What happened, and what specifically did you do differently the next month?”

Listen for: Accountability, concrete changes in behavior, resilience.

Red flag: External excuses without adaptation.

“What’s driving you to leave your current role? Be specific about what’s not working.”

Listen for: Honest assessment, clarity on what they need.

Red flag: Badmouthing people instead of citing structural issues.

Questions to Assess Competitive Drive

“How did you rank on your team last year? Last quarter? Last month?”

Listen for: Specific numbers without hesitation.

Red flag: Vague “top performer” claims without data.

“When was the last time you lost a deal to a competitor? Walk me through what happened and how you responded.”

Listen for: Analysis of why they lost, what they learned, competitive intelligence gathering.

Red flag: Blaming pricing or dismissing the loss.

“If you were ranked #4 on a team of 10, what would you do to crack the top 3?”

Listen for: Specific tactical plan, study of top performers, willingness to change approach.

Red flag: “I’d work harder” without strategy.

Questions to Assess Resilience

“What’s your current close rate? What are the top 3 reasons prospects say no to you?”

Listen for: Honest numbers, pattern recognition, willingness to discuss failure.

Red flag: Unrealistic close rates (above 30% in complex B2B) or inability to articulate objections.

“Describe your worst rejection this year. How long did it take you to make your next call?”

Listen for: Fast recovery time, emotional regulation, persistence.

Red flag: Long recovery periods or emotional spiraling.

“How many outreach touches do you typically make before you give up on a prospect?”

Listen for: High persistence (10+ touches), strategic cadence.

Red flag: Giving up after 2-3 attempts.

Questions to Assess Strategic Thinking

“If you had to sell our product to [specific persona at their target company], what would your first 3 questions be in a discovery call?”

Listen for: Business-focused questions, not product-focused. They should ask about pain points, current solutions, decision process.

“You have 100 leads in your pipeline. How do you decide who to call first tomorrow morning?”

Listen for: Clear prioritization framework (deal size, close date, engagement level, strategic value).

Red flag: “I’d call everyone” or random selection.

“A prospect says ‘Your competitor is cheaper.’ What’s your response?”

Listen for: Value differentiation, questions to understand buying criteria, confidence in defending pricing.

Red flag: Immediately offering discounts.

The Question You Must Ask Sales Managers

If hiring for sales management, Walter recommends:

“Who would be the first person you’d hire for your team if you started tomorrow? Why them specifically?”

Strong candidates have names ready. They’ve been thinking about team building. Weak candidates give generic traits instead of specific people they’ve worked with and want to work with again.

Red Flags in Answers

Watch for these patterns:

- Vague generalities instead of specific numbers and situations

- Blaming external factors without acknowledging what they could control

- Over-rehearsed answers that sound like they read the same sales book everyone else did

- Inability to discuss failure or lessons learned from losses

- Talking at you instead of asking questions about the role

The best salespeople treat the interview like a discovery call. They’re assessing fit as much as you are.

If someone spends the entire interview pitching themselves without asking strategic questions about your business, your customers, or your sales process, they’re showing you exactly who they are: someone who pitches before understanding needs.

Where to Actually Find Sales Candidates (Beyond Job Boards)

Job boards attract volume. You need quality.

Generic job postings on Indeed and LinkedIn get hundreds of applications from people who spray-and-pray their resumes. Most aren’t serious. Many aren’t qualified. All of them waste your time.

Walter’s attract-and-repel strategy starts with where you source candidates, not just how you screen them.

High-Intent Channels (Active Job Seekers)

1. LinkedIn Sales Navigator

Don’t just post jobs. Search for candidates actively.

Filter by:

- Current title + “quota” in profile

- Industry experience at similar company stages (look for people at Seed if you’re Series A, Series A if you’re Series B)

- Geographic location

- Engagement with sales content

Look for candidates who publish content about sales. They’re demonstrating thought leadership and likely higher performers. The salespeople writing LinkedIn posts about their wins and challenges are the ones thinking strategically about their craft.

2. Industry-Specific Sales Communities

- Revenue Collective: B2B sales leaders and executives, particularly strong for SaaS companies

- Pavilion: Go-to-market professionals (requires membership)

- Sales Assembly: Sales development and AE community

- Modern Sales Pros: Active Slack community with 30K+ members

Top performers hang out in communities. Average performers don’t invest in professional development.

3. Sales-Focused Job Boards

Better than generic boards because candidates self-select:

- Salesfolks: Sales-specific platform with transparent company reviews

- RepVue: Transparent company ratings from salespeople (check your own rating here first)

- The Sales Connection: Veteran sales recruiters

- SalesGravy: Sales training company job board

4. Competitor Analysis (Ethical Recruiting)

Monitor who’s hitting quota at companies one stage ahead of you.

Series A? Look at top performers from Seed companies ready for more structure.

Series B? Target proven closers from Series A companies who want more resources.

How to find them:

- LinkedIn Sales Navigator filters

- Company sales team pages

- Sales leaderboard announcements (some companies publish these)

- Industry awards and recognition

Important: Only reach out to people who show signals they’re open to opportunities (LinkedIn “Open to Work” badge, recent profile updates, engaging with job-related content).

Passive Candidate Channels (Not Actively Looking)

5. Referral Networks

Your current top 20% performers know other top performers.

Implement referral bonuses:

- $2,000-$5,000 for successful hire who stays 6+ months

- Paid within 30 days of 6-month mark

- Bonus increases if referral becomes top performer ($10,000 total)

Specific referral requests work better than general asks:

- ❌ “Know any good salespeople?”

- ✅ “Know any B2B SaaS reps who’ve sold to enterprise finance teams?”

The more specific your request, the easier it is for referrers to search their networks mentally.

6. Industry Events and Conferences

- SaaStr Annual: B2B SaaS sales and growth (essential for Series A-C SaaS companies)

- Sales Success Summit: Sales leadership conference

- Outbound: Sales development conference

- Industry-specific trade shows: Where your customers gather

Don’t just collect business cards. Have real conversations about sales challenges. The people showing up to improve their craft are exactly who you want.

7. Your Own Content and Thought Leadership

Track who engages thoughtfully with your content:

- LinkedIn post comments that add value

- Thoughtful questions on your podcast or webinars

- Sharing your content with their own insights

These people are already aligned with your thinking and demonstrating initiative.

This is where educational email courses and newsletter ghostwriting become recruiting tools. When you publish substantive content about your market, industry challenges, and go-to-market strategy, you naturally attract salespeople who think strategically. The reps commenting intelligently on your CEO’s LinkedIn posts or newsletter are pre-qualified candidates showing interest in your company.

What NOT to Do (Common Sourcing Mistakes)

❌ Commission-Only Postings

Attracts desperate candidates, not top performers. Top 20% producers have options. They won’t risk 100% commission unless the opportunity is extraordinary.

For early-stage companies with limited cash, this is tempting. But it backfires. You’ll spend 6 months cycling through unemployed reps who couldn’t cut it elsewhere.

❌ “Hiring Urgently” Messaging

Signals desperation. Creates negotiating disadvantage. Attracts candidates who know you’ll lower standards.

Your board wants faster hiring. But “urgently hiring” in your job post tells candidates you’re struggling. The best salespeople avoid struggling companies.

❌ Spray-and-Pray Outreach on LinkedIn

Generic “I’m hiring” messages to everyone with “Sales” in their title. Response rate: less than 2%. Damages your employer brand.

❌ Hiring Only from Your Industry

Sales DNA matters more than industry knowledge. A hungry SaaS seller can learn manufacturing. A lazy manufacturing seller won’t suddenly develop hunger.

For tech companies in emerging categories (cleantech, AI, blockchain), this matters even more. There aren’t many salespeople with experience in your exact space. Hire for sales ability and capacity to learn, not for industry pedigree.

The Sourcing Ratio That Works

For every 10 strong candidates you want to interview:

- Active job boards: 3-4 candidates (volume play)

- Referrals: 2-3 candidates (quality play)

- Direct sourcing (LinkedIn, events): 2-3 candidates (strategic play)

- Internal pipeline (past candidates, “redshirting”): 1-2 candidates (relationship play)

This mix balances speed with quality.

Monster’s research shows the Pareto Principle applies: 20% of your sourcing channels will produce 80% of your successful hires. Track which channels produce your top performers, then double down.

The Attract-and-Repel Job Posting Strategy

Most job postings read like desperate pleas. “Great culture! Unlimited PTO! Free snacks!”

Walter’s postings do the opposite. They scare away people who can’t handle reality.

Here’s the framework:

1. Lead with Performance Expectations

Don’t bury the quota requirement in paragraph six. Put it up front. “You’ll be expected to close $X in revenue within 90 days.”

For tech companies, be specific about your sales cycle length, average deal size, and realistic close rates. If you’re selling enterprise SaaS with 9-month cycles, say so. Don’t let candidates assume it’s a 30-day transactional sale.

2. Describe the Challenge, Not the Perks

“This is a hunting role. You’ll be making 50+ cold calls daily. You’ll hear ‘no’ more than ‘yes.’ If you need constant validation, this isn’t your role.”

3. Specify Deal Breakers

“We don’t provide warm leads. You build your own pipeline. If you’re used to marketing-qualified leads, you’ll struggle here.”

For Series A companies still figuring out product-market fit, be honest: “Our positioning is still evolving. You’ll need to help us figure out messaging, not execute a proven playbook.”

4. Explain Why People Fail

“The last person in this role left because they couldn’t handle rejection. The person before that wanted more structure than we provide at this stage.”

This radical transparency filters out mismatches before they waste your time.

5. Only Then: Why Winners Win

“If you thrive in ambiguity, love building relationships from scratch, and get energized by competition, this could be your best year ever.”

This strategy accomplishes something traditional postings don’t: it makes candidates self-assess honestly.

The people who read that and think “Hell yes” are exactly who you want. The people who read that and feel anxious? They just saved you 12 months of pain.

Sample Job Description: Attract-and-Repel Template

Account Executive – B2B SaaS

OTE: $120,000 ($65K base + $55K variable) | Series B | Remote-friendly

The Reality

You’ll be making 50+ outbound calls weekly. You’ll hear “no” more than “yes.” Your first 90 days will be uncomfortable as you learn our market.

Last quarter, 70% of our sales team hit quota. The ones who didn’t left within 6 months because they couldn’t handle rejection or wanted more inbound leads than we provide.

If you need constant validation or warm leads handed to you, this isn’t your role.

What You’ll Actually Be Doing

- Building your own pipeline from scratch (we provide lists, you work them)

- Running 6-8 month sales cycles with multiple stakeholders

- Navigating complex procurement processes at Series B-C tech companies

- Losing deals to competitors who undercut on price

You’re a Fit If

- You ranked top 25% on your last sales team (with data to prove it)

- You’ve closed deals $50K+ in B2B SaaS or tech

- You can explain why you lost your last 3 deals

- You get energized by competition, not demoralized by rejection

You’re Not a Fit If

- You need structure and established processes (we’re Series B, still figuring things out)

- You prefer relationship management over hunting

- You can’t handle ambiguity or building your own playbook

What Winners Get

- Uncapped commission with accelerators (top rep made $245K last year)

- Quarterly President’s Club trips

- Fast path to leadership (3 of our managers were promoted from AE in less than 18 months)

- Real impact on product roadmap and go-to-market strategy

Assessment Process

- Apply with resume + 2-minute video: “Why you’re in the top 20% of salespeople”

- Sales DNA assessment (30 minutes)

- Phone screen focused on quota history (15 minutes)

- In-depth interview with sales leader (60 minutes)

- Final interview with CEO + team (45 minutes)

We don’t sell the role until we know you’re the right fit. This process is designed to help both of us make the right decision.

Assessment-Based Hiring Over Charm-Based Hiring

Traditional interviews reward charm. Sales assessments reward capability.

The difference matters.

Walter’s approach uses tools like the Objective Management Group assessment or similar validated instruments. These aren’t personality tests. They’re sales-specific evaluations measuring:

- Desire: How badly do they want to succeed?

- Commitment: Will they do what it takes?

- Outlook: Can they stay positive through rejection?

- Responsibility: Do they own outcomes or blame externals?

- Sales-Specific Skills: Questioning, qualifying, closing

Research from Monster’s recruiting data shows that only 20% of salespeople produce 80% of results (Pareto Principle). The assessment helps identify potential top 20% performers.

The key insight: use assessments as one data point, not the only data point.

“We use an assessment tool that is focused on one thing… That becomes a data point that we use. It’s an important data point.”

Combine assessment data with:

- Phone screen observations (behavior under pressure)

- Interview depth (problem-solving approach)

- Reference checks (actual past performance)

- Trial assignments (if applicable)

This creates a complete picture that traditional interviews miss.

When building sales coaching frameworks for funded tech companies, I emphasize the same principle: objective measurement beats subjective feel. You can’t manage what you don’t measure. You can’t hire what you don’t assess.

Sales Assessment Tools: What to Use and When

If you want to know how to hire salespeople using objective data, Walter’s approach is clear: use assessment tools to look inside candidates’ heads. But which tools actually work?

The assessment tool landscape is crowded. Some are scientifically validated. Others are expensive personality tests that tell you nothing about sales ability.

The Assessment Tools Worth Using

1. Objective Management Group (OMG) Sales Assessment

What it measures:

- Will to Sell (desire + commitment + outlook)

- Sales DNA (21 core competencies)

- Specific skill gaps

Best for: Comprehensive evaluation of experienced sellers

Cost: $250-$350 per assessment

Time: 30-45 minutes

Validation: Used by 200,000+ sales organizations, peer-reviewed research

Pros:

- Predicts actual sales performance with 92% accuracy

- Identifies specific coaching needs

- Benchmarks against 2M+ salespeople database

Cons:

- Expensive at scale

- Overkill for entry-level SDR roles

- Requires certified analyst to interpret properly

When to use: Final-stage candidates for AE, mid-market, and enterprise sales roles

2. The DriveTest® (SalesDrive)

What it measures:

- Need for Achievement

- Competitiveness

- Optimism

Best for: Quick screening of multiple candidates

Cost: $50-$100 per assessment

Time: 15-20 minutes

Validation: Research-backed, focuses on core predictive traits

Pros:

- Fast screening tool

- Lower cost for volume hiring

- Focuses on traits you can’t train

Cons:

- Less comprehensive than OMG

- Doesn’t identify specific skill gaps

- Better as filter than complete evaluation

When to use: Early-stage screening before phone interviews, or for SDR/BDR roles

3. TriMetrix Sales Assessment

What it measures:

- Behaviors (DISC profile)

- Motivators (values driving decisions)

- Competencies (12 sales-specific skills)

Best for: Understanding how candidates sell and what motivates them

Cost: $150-$250 per assessment

Time: 20-30 minutes

Validation: TTI Success Insights research, used globally

Pros:

- Three-dimensional view (behaviors + motivations + skills)

- Good for team composition planning

- Helps with onboarding and coaching strategies

Cons:

- DISC component less predictive than sales-specific measures

- Requires training to interpret effectively

- Can feel like “personality test” to candidates

When to use: Team building and coaching development, not just hiring

4. Profiles Sales Assessment

What it measures:

- Energy (drive and competitiveness)

- Assertiveness (comfort with rejection)

- Sociability (relationship building)

- Manageability (coachability)

- Attitude (optimism and outlook)

Best for: Inside sales and SDR roles

Cost: $100-$200 per assessment

Time: 20-25 minutes

Validation: Profiles International research

Pros:

- Good for high-volume hiring

- Easy to administer and interpret

- Strong predictor for transactional sales

Cons:

- Less effective for complex B2B sales

- Limited skill assessment depth

- Can produce false positives on “salesy” candidates

When to use: SDR/BDR hiring at scale

Assessment Tool Comparison Matrix

| Tool | Cost | Time | Best For | Accuracy | Ease of Use |

|---|---|---|---|---|---|

| OMG | $$$ | 45 min | Comprehensive | Highest | Medium |

| DriveTest® | $ | 15 min | Quick Screen | High | Easy |

| TriMetrix | $$ | 30 min | Team Building | Medium-High | Medium |

| Profiles | $$ | 25 min | Volume Hiring | Medium | Easy |

Which Assessment Tool Should You Use? (Decision Framework)

Learning how to hire salespeople effectively requires choosing the right assessment tool for your situation:

If you’re hiring 1-2 senior AEs or enterprise sellers:

→ Use OMG Sales Assessment ($250-$350)

→ Comprehensive, highest accuracy (92%), worth the investment

If you’re screening 10+ candidates for multiple roles:

→ Use DriveTest ($50-$100) for initial filter

→ Then OMG for final 2-3 candidates

If you’re building a new sales team and need team composition insights:

→ Use TriMetrix ($150-$250)

→ Helps understand behavioral mix and motivators

If you’re hiring 5+ SDRs/BDRs at once:

→ Use Profiles Sales Assessment ($100-$200)

→ Cost-effective for volume, good for transactional roles

If you have zero budget for assessments:

→ Use structured behavioral interviews with the questions in this article

→ Track answers systematically, compare candidates objectively

How to Actually Use Assessments

Step 1: Baseline Your Current Team

Before assessing candidates, assess your current top performers. This creates your benchmark.

If your top 3 performers all score high on “Need for Achievement” but low on “Sociability,” that tells you something about what works in your sales environment.

Step 2: Use Assessments as ONE Data Point

Walter emphasizes: “That becomes a data point that we use. It’s an important data point.”

Assessment results should inform interviews, not replace them.

Red flag approach:

- Low “Will to Sell” score? Ask specific questions about motivation

- Low “Resilience” score? Dig into how they handle rejection

- High “Lone Wolf” indicator? Explore team collaboration examples

Step 3: Combine Assessment + Interview + Reference Check

The Complete Picture:

- Assessment: Reveals psychological fit and potential gaps

- Interview: Validates or contradicts assessment findings

- Reference Check: Confirms past performance matches assessment predictions

If all three align, you have high confidence. If they contradict, dig deeper.

Step 4: Track Assessment Predictiveness

After 12 months, correlate assessment scores with actual performance.

Questions to answer:

- Did high “Competitiveness” scores actually hit quota more often?

- Did low “Optimism” scores churn faster?

- Which assessment dimensions mattered most?

This data refines your hiring model over time.

What Assessments Can’t Tell You

Assessments measure potential and tendencies. They can’t measure:

❌ Coachability in your specific environment

❌ Fit with your actual customers and sales process

❌ Willingness to do the unsexy work (CRM updates, admin)

❌ Alignment with your company’s stage and chaos level

That’s why interviews and reference checks still matter.

Why Product Training Comes Second, Not First

Most companies onboard new salespeople with two weeks of product training.

Walter flips this.

“Often there’s too much time spent on product training, product knowledge, learning the features and benefits of a product,” he explains. “Important. We need to know our products. We need to know our competitors’ products. We need to know our advantages and disadvantages. Absolutely.”

But if you want salespeople who get out of the blocks fast and start building pipeline, product training isn’t the priority.

Strategic messaging comes first.

Your new salesperson needs to know:

- Who to talk to: Specific buyer personas and decision-makers

- What advantages matter: Not features; business outcomes

- What buyers care about: Their priorities, not your product roadmap

- How you’re different: Competitive positioning in buyer language

“We need to be able to tell them who it is that they should be talking to, what our advantages are and what that buyer is concerned about.”

Think about it from the buyer’s perspective. They don’t care about your product. They care about their problem.

Walter puts it bluntly: “That buyer doesn’t care about our product. They don’t care about us and they don’t care about our company. They care about what we can offer to solve a problem that they may have better solve a problem that they didn’t know they had.”

The onboarding sequence that works:

Week 1: Target Market and Messaging

- Who are we selling to? (ICP definition)

- What problems do they have? (Pain points)

- How do we solve it differently? (Positioning)

- What language do they use? (Conversation starters)

Week 2: Product Knowledge (In Context)

- Features that solve identified pain points

- Competitor comparisons buyers actually care about

- Demo flow that matches buyer journey

- Proof points and case studies

Week 3+: Live Practice

- Shadow experienced reps

- Role-play real scenarios

- Make supervised calls

- Get coaching on actual conversations

This sequence gets new hires revenue-productive in half the time.

For tech companies building new categories, this matters even more. If you’re selling AI infrastructure or cleantech solutions, buyers don’t have a clear mental model yet. Your salespeople need to educate the market, not just explain product features.

This is exactly the approach I use when ghostwriting educational email courses for tech CEOs. We lead with the buyer’s problem, establish credibility through market insights, then introduce the solution in context. Your salespeople need to follow the same sequence in conversations.

You can always deepen product expertise. You can’t recover from six weeks of talking to nobody.

The First 90 Days: Manager’s Onboarding Checklist

Knowing how to hire salespeople is only half the battle; onboarding determines if they succeed. Walter emphasizes strategic messaging before product training. Here’s the complete timeline:

Days 1-30: Foundation

Week 1: Market & Messaging

- ✅ ICP definition workshop

- ✅ Buyer persona deep-dive

- ✅ Competitive positioning training

- ✅ Value proposition workshop

Week 2: Product Knowledge (In Context)

- ✅ Product demo focused on solving ICP pain points

- ✅ Competitor comparison (features that matter)

- ✅ Case studies and proof points

- ✅ Demo practice with feedback

Week 3-4: Shadowing & Practice

- ✅ Shadow 5+ discovery calls

- ✅ Shadow 3+ demos

- ✅ Role-play scenarios with feedback

- ✅ First supervised customer calls

Success Metrics:

- Can articulate ICP in 30 seconds

- Can explain top 3 differentiators

- Passed product knowledge quiz (80%+)

- Completed 10+ role-play scenarios

Days 31-60: Ramp to Activity

Quota: 50% of full

Week 5-6: Lead Generation

- ✅ 25 outbound calls daily

- ✅ 10 personalized emails daily

- ✅ Book first 3 qualified meetings

- ✅ Daily coaching on call recordings

Week 7-8: Discovery & Demo

- ✅ Conduct 5+ discovery calls

- ✅ Deliver 3+ demos

- ✅ Advance 2+ deals to proposal stage

- ✅ Weekly deal review with manager

Success Metrics:

- 5 qualified meetings booked

- 3 demos delivered

- 2 proposals submitted

- First deal in pipeline

Days 61-90: Accelerate Performance

Quota: 75% of full

Week 9-12: Close First Deals

- ✅ Full pipeline management ownership

- ✅ Close first 1-2 deals

- ✅ Manage 15+ active opportunities

- ✅ Bi-weekly coaching sessions

Success Metrics:

- First deal closed

- Pipeline value: 3x quota

- Average deal size: Within 20% of team average

- Close rate: 15%+ (new rep baseline)

Red Flags to Watch

Week 2: Can’t articulate value proposition clearly

Week 4: Avoiding phone calls, excessive “research”

Week 6: Not booking meetings despite activity

Week 8: Poor discovery call quality

Week 12: No deals closed or advanced to final stage

Address red flags immediately with coaching. If no improvement after 2 weeks of focused coaching, consider fit issues.

For Series A to C tech companies, these timelines are critical. Your board is measuring sales velocity. A rep who takes 6 months to close their first deal drags down your metrics. Use this checklist to identify problems early.

Building a Performance Culture (Not Just Culture Fit)

Here’s where Walter’s approach gets controversial: he prioritizes performance over culture fit.

Most hiring advice emphasizes “culture fit” as critical. Hire people who align with your values. Make sure they’ll get along with the team. Preserve the culture you’ve built.

Walter disagrees. “We don’t, we’re not hiding the name of the company. We’re just not selling it. So I’ve always avoided working for big companies. ‘Cause I’m not good with the politics side of it.”

His approach: hire for ability to perform, then build culture around performance.

The performance-first hiring criteria:

- Can they hit quota consistently?

- Do they have the will to sell?

- Can they handle rejection?

- Will they do the work required?

Then assess culture:

- Do they align with company values?

- Will they collaborate effectively?

- Can they handle feedback?

- Do they fit the work environment?

But if someone can’t perform, culture fit doesn’t matter. You’re not running a social club; you’re building revenue.

This doesn’t mean hiring jerks. It means being honest about priorities. “We’re looking for performance salespeople that are going to perform. I’m looking for salespeople that have the skills and the mindset to do what they need to do in that role.”

For venture-backed tech companies, this matters even more. Your investors don’t care if your sales team is nice to each other. They care if you’re hitting your growth targets. A friendly underperformer hurts your next funding round just as much as an abrasive underperformer.

The culture element that does matter: alignment beyond sales.

Walter shares a powerful example about culture alignment, but not in sales. It’s about a shipping clerk.

The company positioned itself on superior customer service. One day, the shipping clerk noticed a damaged box in a five-package shipment. He held back that one damaged box, shipped the other four, replaced the broken parts, and repackaged the fifth box correctly.

“The customer was elated,” Walter recalls. When the shipping clerk explained his decision, Walter responded: “No, man. It’s, that’s huge. ‘Cause if we had shipped that box out to the customer, they would’ve got broken parts and they would’ve had a problem that they had to deal with.”

That’s culture: empowering every employee to make decisions aligned with company values.

But for salespeople specifically, performance has to come first. You can coach collaboration. You can’t coach hunger.

Compensation Structure That Attracts Top Performers

You can nail every other aspect of hiring and still lose top candidates if your compensation structure is weak.

Walter doesn’t explicitly discuss compensation in the interview, but the underlying principle applies: be transparent early, and make sure the numbers work for producers.

Top salespeople evaluate On-Target Earnings (OTE) with the same scrutiny they apply to deals. They know the questions to ask. If you can’t answer them confidently, you’ll lose credibility fast.

The OTE Reality Check

OTE = Base Salary + Commission at 100% Quota Attainment

For a $120,000 OTE position:

- Base salary: $60,000-$70,000 (50-60% of OTE)

- Variable commission: $50,000-$60,000 (40-50% of OTE)

- Realistic quota attainment rate: 75% of team hits 80%+ of quota

If only 20% of your team hits quota, your OTE is fictional. Top candidates will discover this during reference checks.

For funded tech companies, investors scrutinize quota attainment rates. If your sales comp plan promises $120K OTE but only 30% of reps hit it, your burn rate looks worse than it should. Fix the quotas or fix the compensation structure.

What the Base-to-Commission Split Signals

70/30 split (Base/Variable):

- Lower risk for new hires

- Appropriate for long sales cycles (6+ months)

- Good for new market entry or complex products

- Attracts strategic sellers over hustlers

50/50 split (Base/Variable):

- Balanced risk-reward

- Standard for most B2B sales (3-6 month cycles)

- Attracts balanced producers

- Industry standard for mid-market SaaS

40/60 split (Base/Variable):

- Higher risk, higher reward

- Appropriate for short cycles (30-90 days)

- Attracts aggressive hunters

- Common in transactional sales or SMB focus

30/70 or worse:

- Red flag for top talent

- Only works with very high deal sizes or proven markets

- Attracts desperate candidates or commission-only specialists

- Expect high turnover

Commission Structure That Drives Performance

Tiered accelerators matter more than flat commissions:

Flat Commission (Weak):

- 10% of revenue regardless of quota attainment

- No incentive to exceed quota

- Encourages “just enough” behavior

Tiered Commission (Strong):

- 0-75% of quota: 8% commission rate

- 75-100% of quota: 10% commission rate

- 100-125% of quota: 15% commission rate

- 125%+ of quota: 20% commission rate

This rewards over-performance. Top sellers can make 150-200% of OTE. That’s the attraction.

Questions Top Performers Will Ask

“What percentage of your sales team hit quota last year?”

If the answer is less than 60%, your quotas are unrealistic or your hiring is broken. Top performers won’t join a team where failure is the norm.

For tech CEOs: if you can’t answer this question with confidence, don’t start hiring yet. Fix your quota setting first.

“What’s the average ramp time to first deal and to full productivity?”

Industry standards:

- Inside sales: 1-3 months to first deal, 3-6 months to full quota

- Mid-market: 2-4 months to first deal, 6-9 months to full quota

- Enterprise: 3-6 months to first deal, 9-12 months to full quota

If you expect new hires at full quota in month 1, you’re delusional.

“Show me your commission calculator and explain a sample deal.”

If you can’t pull up a spreadsheet and walk through a real scenario, you’re not ready to hire salespeople.

“What’s your top performer making? Your median performer?”

Top performers want to know the ceiling. If your best seller made $120K on a $120K OTE role, there’s no upside.

Strong answer: “Our top performer made $250K on a $120K OTE role. Our median performer made $115K.”

Compensation Red Flags That Repel Top Talent

❌ 100% commission with no base

Only desperate or brand-new sellers accept this. Top performers have better options.

❌ OTE based on “if you close one deal per month”

If “one deal per month” was easy, quota would be higher. This signals unrealistic expectations.

❌ No quota attainment data shared

Hiding data means the data is bad. Transparency builds trust.

❌ Clawbacks on commission

If customers churn or deals fall through after commission is paid, clawing it back creates distrust and legal issues.

❌ Complex commission calculations

If it takes an accountant to figure out earnings, salespeople will assume you’re trying to cheat them.

What to Do If Your Comp Plan Is Broken

Before you hire anyone:

- Benchmark against competitors: Check RepVue, Glassdoor, and talk to recruiters about market rates

- Audit quota attainment: If less than 60% hit quota, lower quotas or improve enablement

- Simplify commission structure: If you can’t explain it in 2 minutes, it’s too complex

- Build ramp period into first year: Month 1-3: 50% quota, Month 4-6: 75% quota, Month 7+: 100% quota

- Get legal review: Ensure commission plans are enforceable and clear

Compensation clarity is one of the top 3 factors in offer acceptance rates. You can have the best product, culture, and opportunity, but if comp doesn’t make sense, top performers walk.

The Compensation Conversation in Interviews

Walter’s philosophy of “not selling the role until we know they’re right” applies to compensation discussions too.

Don’t lead with comp. Discuss it after you’ve established mutual fit.

Do be transparent when asked. Refusing to discuss compensation signals you’re hiding something.

Frame it as mutual evaluation: “Here’s our structure. Does this align with your expectations and goals?”

Top performers appreciate honesty. They’ll walk away from unrealistic plans. That’s exactly what you want. Better they walk in the interview than quit in month 4.

The Real Cost of Getting This Wrong

Let’s talk numbers.

Average bad sales hire costs:

- Salary + benefits: $60,000-$90,000 annually

- Training investment: $10,000-$15,000

- Lost opportunity cost: $100,000+ in missed revenue

- Team morale impact: Immeasurable but significant

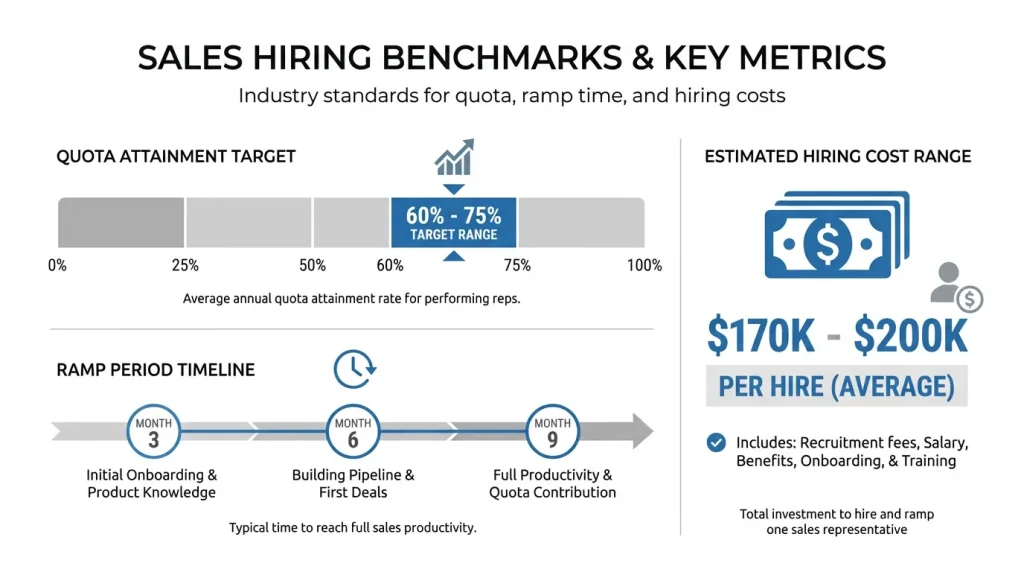

Total: $170,000-$200,000 for one bad hire who lasts 12 months.

But the real cost is time.

You can recover money. You can’t recover a quarter of missed growth because your sales team was underperforming.

Startups that nail sales hiring scale 40% faster than those who don’t. The multiplier effect of the right team compounds quickly.

Time impact breakdown:

- 3 months recruiting

- 2 months onboarding

- 4 months giving them “a chance to ramp”

- 3 months finding replacement

Total: 12 months with underperformance

During those 12 months:

- Your competitors hired better

- Your market opportunity shifted

- Your investors lost confidence

- Your board started asking questions

For Series A and B companies, this can be fatal. You don’t have infinite runway to get hiring right.

Walter emphasizes: “Transformation in sales is hard and that CEO’s gotta be willing to go down that bumpy road.”

Getting hiring right isn’t optional. It’s existential.

The companies that treat sales hiring with the rigor it deserves, using assessment-based processes and attract-and-repel strategies, build predictable revenue machines.

The companies that keep posting generic job ads and hiring based on “good interview vibes” keep replacing underperformers.

Which path are you on?

7 Common Sales Hiring Mistakes (And How to Avoid Them)

Even experienced CEOs make critical errors when learning how to hire salespeople. Avoid these seven common mistakes:

1. Hiring salespeople the same way you hire engineers

❌ Mistake: Using standard interview process for sales roles

✅ Fix: Use sales-specific assessments measuring will to sell, not just communication skills

2. Selling your company before assessing fit

❌ Mistake: Making the role sound amazing to attract volume

✅ Fix: Use attract-and-repel job postings that clearly state challenges up front

3. Prioritizing industry experience over sales DNA

❌ Mistake: Requiring “5+ years in SaaS” or “must have cleantech experience”

✅ Fix: Hire for psychological fit and learning agility; industry knowledge is trainable

4. Starting with product training instead of market training

❌ Mistake: Two weeks of product demos before any customer conversations

✅ Fix: Week 1 focuses on ICP, buyer pain points, and messaging; product comes second

5. Setting unrealistic quotas to “motivate” the team

❌ Mistake: Only 30% of team hitting quota because the numbers are aspirational

✅ Fix: 60-75% should hit quota; if not, quotas are broken, or hiring is broken

6. Expecting full productivity in month 1

❌ Mistake: 100% quota from day 1

✅ Fix: Structured ramp: 50% quota months 1-3, 75% months 4-6, 100% month 7+

7. Not tracking which sourcing channels produce top performers

❌ Mistake: Posting on every job board without measuring effectiveness

✅ Fix: 20% of channels produce 80% of successful hires—track and double down

Sales Hiring Benchmarks: What “Good” Looks Like

Understanding how to hire salespeople requires knowing what success looks like. Use these benchmarks to evaluate your hiring process:

Quota Attainment

- Healthy team: 60-75% hit 80%+ of quota

- Warning sign: Less than 60% hitting quota (quotas too high or hiring broken)

- Red flag: Less than 40% hitting quota (systemic problem)

Ramp Time to First Deal

- Inside sales: 1-3 months

- Mid-market: 2-4 months

- Enterprise: 3-6 months

Ramp Time to Full Quota

- Inside sales: 3-6 months

- Mid-market: 6-9 months

- Enterprise: 9-12 months

Cost Per Hire

- Average: $4,700 (LinkedIn 2024)

- Time to fill: 42 days average

- Bad hire cost: $170K-$200K total (salary + training + opportunity cost)

Compensation Structure

- Base/Variable split: 50/50 most common for B2B (3-6 month cycles)

- Top performer earnings: Should make 150-200% of OTE

- Median performer: Should make 90-110% of OTE

Team Performance

- Sales turnover: 25-30% annually (HBR)

- Resume accuracy: 85% contain false info (HireRight)

- Interview honesty: 81% admit stretching truth (Checkster)

Assessment Costs

- OMG: $250-$350 per candidate

- DriveTest: $50-$100 per candidate

- TriMetrix: $150-$250 per candidate

- Profiles: $100-$200 per candidate

Key Takeaways: Sales Hiring That Works

These are the essential principles for how to hire salespeople who drive revenue:

- Hire for sales DNA, not interview charm: Use assessment tools to measure non-teachable traits (competitiveness, resilience, will to sell)

- Stop selling your company to candidates: Use attract-and-repel job postings that clearly state challenges and filter out bad fits

- Assessment-based hiring beats charm-based: Combine validated assessments (OMG: $250-$350, DriveTest: $50-$100) with structured interviews

- Strategic messaging comes before product training: Week 1 should focus on ICP and buyer pain points, not product features

- Realistic OTE matters: Top performers won’t join if less than 60% of your team hits quota

- 90-day ramp is standard: Month 1-3: 50% quota, Month 4-6: 75%, Month 7+: 100%

- Bad hires cost $170K-$200K: Plus 12 months of lost opportunity

- Track sourcing channels: 20% of channels produce 80% of successful hires

FAQ: How to Hire Salespeople Who Perform

What’s the biggest mistake companies make when hiring salespeople?

The biggest mistake when learning how to hire salespeople is treating them like every other role. Salespeople require different assessment criteria focused on sales DNA, will to sell, and performance history rather than just interview skills and culture fit.

Should I prioritize industry experience when hiring salespeople?

Not necessarily. Sales DNA and will to sell matter more than industry experience. A hungry, competitive salesperson can learn your product. You can’t teach someone to want to win. Focus on psychological fit first, then assess whether they can learn your industry fast enough.

How do I know if a salesperson has the “will to sell”?

Use validated assessment tools that measure desire, commitment, competitiveness, and resilience. Look for candidates who ask questions in interviews rather than just pitching themselves. Check their track record of hitting quota consistently, not just total sales numbers.

What should I include in a sales job posting?

Lead with performance expectations and challenges, not perks. Describe the reality of the role, including why people fail. Specify deal-breakers up front. Only after being honest about difficulties should you explain why winners succeed. This attract-and-repel approach filters for fit.

How long should sales onboarding focus on product training?

Product training should come second, not first. Start with target market definition, buyer pain points, competitive positioning, and strategic messaging. Salespeople who can have intelligent conversations about buyer problems from day one will ramp faster than those who spend weeks learning product features.

Where should I look for sales candidates beyond Indeed and LinkedIn?

Use LinkedIn Sales Navigator for targeted searches, industry-specific sales communities (Revenue Collective, Pavilion, Sales Assembly), sales-focused job boards (Salesfolks, RepVue), ethical competitor recruiting, referral programs with specific asks, industry events, and track engagement with your content.

What compensation structure attracts top sales performers?

For a $120K OTE position: 50-60% base salary ($60K-$70K), 40-50% variable commission, with tiered accelerators that reward over-performance (100%+ quota earners should make 150-200% of OTE). Be prepared to answer: what percentage hit quota last year, average ramp time, and what top performers actually earned.

Which sales assessment tool should I use?

For comprehensive evaluation: OMG Sales Assessment ($250-$350, 45 min). For quick screening: DriveTest ($50-$100, 15 min). For team building: TriMetrix ($150-$250, 30 min). For volume SDR hiring: Profiles ($100-$200, 25 min). Always baseline your current top performers first to create your benchmark.

How long does it take for a new salesperson to be fully productive?

Industry standards: Inside sales (3-6 months to full quota), Mid-market (6-9 months), Enterprise (9-12 months). Structure ramp periods: Months 1-3 at 50% quota, Months 4-6 at 75% quota, Month 7+ at 100% quota. Expecting full productivity in month 1 is unrealistic.

What are the red flags I should watch for in the first 90 days?

Week 2: Can’t articulate value proposition clearly. Week 4: Avoiding phone calls, excessive research time. Week 6: Not booking meetings despite activity. Week 8: Poor discovery call quality. Week 12: No deals closed or advanced to final stage. Address immediately with coaching; if no improvement in 2 weeks, consider fit issues.

Related Questions About Sales Hiring

How long should a sales interview process take?

4-6 weeks from job posting to offer. Phases: Assessment (week 1), phone screen (week 2), in-depth interview (week 3-4), final interview (week 4-5), offer (week 5-6). Faster processes sacrifice quality. Slower processes lose top candidates.

What percentage of salespeople actually hit quota?

Industry average: 60-70% hit 80%+ of quota. If less than 60% of your team hits quota, either your quotas are unrealistic or your hiring process is broken. Top-performing organizations see 75%+ quota attainment.

Should I hire salespeople with industry experience or sales experience?

Sales DNA matters more than industry experience. Hire for psychological fit (competitiveness, resilience, will to sell), then assess learning agility. A hungry seller can learn your industry. You can’t teach hunger.

What’s the difference between OTE and base salary?

OTE (On-Target Earnings) = Base Salary + Commission at 100% quota attainment. For $120K OTE: $60K-$70K base + $50K-$60K variable. If only 20% of your team hits OTE, the number is fictional.

How do I know if my sales compensation plan is competitive?

Check RepVue and Glassdoor for market rates. Audit quota attainment (60%+ should hit quota). Simplify structure (explainable in 2 minutes). Build ramp periods (50% → 75% → 100% quota over first 6 months). Get legal review.

What are the signs a new sales hire won’t work out?

Week 2: Can’t articulate value proposition. Week 4: Avoiding calls. Week 6: Not booking meetings despite activity. Week 8: Poor discovery quality. Week 12: No deals closed or advanced. Address immediately with coaching; if no improvement in 2 weeks, exit.

What’s the most important thing to know about how to hire salespeople?

The most important principle in how to hire salespeople is this: assess sales DNA before selling the role. Use validated tools to measure will to sell, competitiveness, and resilience. Create job postings that attract top performers and repel bad fits. Never hire based on interview charm alone—objective assessment beats subjective feel every time.

The Path Forward

Learning how to hire salespeople who actually perform isn’t complicated. It’s just different from standard hiring.

Stop selling your company to candidates before you know they can do the job. Start assessing sales DNA through validated tools. Build job postings that attract and repel based on reality, not wishful thinking.

Prioritize strategic messaging over product training in onboarding. Measure what matters: quota attainment, competitive drive, resilience under pressure.

The companies seeing consistent sales growth aren’t lucky. They’re strategic about who they bring onto the team.

For tech CEOs navigating the path from Series A to C, sales hiring is one of the highest-leverage decisions you’ll make. The difference between a top-performing sales team and an average one is the difference between hitting your growth targets and missing your next funding round.

If you need help establishing your market position and thought leadership while building your sales team, explore how educational email courses and strategic newsletter content can support your digital PR efforts. When your CEO’s voice is clear in the market, it’s easier to attract the right sales talent.

The right person in a sales seat accelerates everything. The wrong person costs you the market opportunity you’ll never get back.

Some topics we explore in this episode include:

Listen to the episode.

Subscribe to & Review the Predictable B2B Success Podcast

Thanks for tuning into this week’s Predictable B2B Podcast episode! If the information from our interviews has helped your business journey, please visit Apple Podcasts, subscribe to the show, and leave us an honest review.

Your reviews and feedback will not only help me continue to deliver great, helpful content but also help me reach even more amazing founders and executives like you!