📊 Key Takeaways:

- 31% higher profit margins with value-based vs cost-plus pricing

- Positioning decisions must come before pricing decisions

- Most SaaS companies lose $100K+ annually from positioning failures

- Framework: Outcome + Customer + Refusals = Defensible Pricing

Table of Contents

Meet Mike Moll: Agency Owner Turned Pricing Strategist

Mike Moll runs Impact Leads, an agency that helps B2B service businesses transform their positioning and pricing to land quality clients without the stress of price-based competition. After nearly going bankrupt twice by trying to be everything to everyone, Mike discovered the positioning and value-based pricing framework that saved his business and now generates transformational results for his clients.

His insights on SaaS pricing models, subscription pricing optimization, and value capture apply directly to SaaS companies navigating the transition from startup to scale-up. Mike has successfully pitched and closed massive brands, including Volvo and the Government of Canada, and his approach to positioning before pricing has helped clients double revenue while cutting client counts in half.

🎧 Want to hear Mike explain this framework in his own words? Listen to the full Predictable B2B Success episode with Mike Moll →

I’ve spent the last year ghostwriting educational email courses for Series B SaaS founders.

The pattern I see repeating costs companies six figures annually.

They nail product-market fit. They close their Series A. Revenue starts climbing.

Then they hit a wall with pricing.

Not because their SaaS pricing strategy is wrong technically. Because they built it backwards.

Here’s what nobody wants to hear: If you’re A/B testing pricing tiers, you’ve already lost. Testing implies you don’t know what you’re worth. That’s a positioning failure disguised as optimization.

📈 Key Stat: 67% of B2B tech buyers prefer vendors with clear positioning and specialized expertise over generalists, even at higher price points.

Source: Gartner Research

The $100K+ Mistake: Pricing Before Positioning

Most SaaS companies approach pricing like a math problem.

They calculate costs, add margin, check competitor rates, and pick a number.

Mike Moll learned this lesson the hard way when his agency almost went bankrupt. Twice.

“I was trying to be everything to everybody,” Mike explains. “Cool, you need a website with your ads. Great, we do that now too. You need social media, email, copy, all this stuff. Great, we’ll do that too.”

The problem wasn’t the services.

It was the positioning vacuum.

When you haven’t defined what you uniquely solve and for whom, pricing becomes a race to the bottom. You’re comparing yourself to every other vendor rather than commanding premium rates for your specialized value.

A cleantech Series B company I recently worked with faced this exact challenge.

They had built exceptional climate-monitoring software but couldn’t explain why it cost 3x as much as competitors’. Their B2B SaaS pricing model was technically sound but commercially weak.

After repositioning around their unique predictive analytics capability, pricing became defensible. They weren’t selling “monitoring” anymore. They were selling “early warning systems that prevent $2M equipment failures.”

Same product. Different frame. Completely different pricing conversation.

According to research by Simon-Kucher, companies that lead with value-based pricing achieve 31% higher profit margins than those using cost-plus or competition-based pricing models. But value-based pricing only works when you’ve done the positioning work first.

As Patrick Campbell from ProfitWell notes, “Your pricing is the exchange rate on the value you create.” This reinforces Mike’s positioning-first approach. If you can’t articulate the value through positioning, you can’t set the exchange rate through pricing.

Why SaaS Companies Build Pricing Backwards

Mike’s observation about service businesses applies directly to SaaS.

“I think the biggest issue I had in my positioning was I was trying to do everything,” he shares. “I was trying to be everything to everyone. I just wanted the win.”

SaaS founders fall into the same trap during hypergrowth.

You add features to close enterprise deals. You build integrations to enter new markets. You create “flexible pricing” to compete on every dimension.

What you actually create is positioning confusion.

When a prospect asks, “What do you do?”, you have to explain your entire roadmap rather than state one clear outcome. Your SaaS monetization strategy becomes a negotiation because you haven’t established a singular value.

In my work with B2B tech executives, the companies that scale pricing successfully do one thing first.

They get brutally specific about what they solve and for whom.

Not “project management for teams.” That’s positioning quicksand.

“Sprint planning for distributed engineering teams at Series A SaaS companies.” Now we can price based on the cost of coordination failure in that specific context.

The difference between these two positions isn’t semantic.

It’s the difference between $49/user/month and $249/user/month.

Companies like Atlassian and Slack didn’t stumble into their pricing models. They positioned first around specific use cases and workflows, then built pricing around those positions. Atlassian serves software development teams specifically, not “all teams that need collaboration.” That positioning clarity enables their premium pricing tiers.

📈 Key Stat: SaaS companies with narrow vertical focus command 40-60% higher prices than horizontal competitors serving “all B2B companies.”

Source: Service Provider Pro Research

The Self-Awareness Framework That Unlocks Pricing Power

Mike advocates for founder self-awareness as the foundation of pricing strategy.

“The self-awareness of the founder is the most important thing,” he emphasizes.

This isn’t therapy. It’s business architecture.

Mike uses a simple rule: if you’re not a 7 out of 10 at something today, delegate it or cut it. Focus your positioning on what you’re genuinely exceptional at delivering.

For SaaS companies, this translates to product focus.

A Series A company I advised wanted to add AI features because “everyone is doing AI.” Their core strength was data pipeline reliability for financial services.

Adding AI would dilute positioning and create pricing confusion.

We killed the AI roadmap. We doubled down on compliance and auditability for FinTech.

Pricing went from $2K/month to $8K/month because we weren’t competing with generic data platforms anymore.

Data from Gartner shows that B2B buyers are 67% more likely to purchase from vendors with clear positioning and specialized expertise. Generalists get commoditized. Specialists get premium pricing.

The self-awareness question for SaaS founders: What outcome are you genuinely world-class at delivering, and for which specific customer type?

If you can’t answer that in one sentence, your SaaS pricing strategy is built on sand.

So what should you do first when setting SaaS prices?

Position before you price. Always.

Define your singular outcome, your specific customer, and what you refuse to do. Only then can you build defensible pricing around that position.

How to Position Your SaaS Before You Price It

Mike’s positioning framework is deceptively simple.

“Originally it was, hey, we do Google ads, we do them for simple businesses, we do them really well. I should have held onto that.”

When he tried to expand into Facebook ads, social media, email marketing, and content creation, revenue grew but profitability collapsed.

Too many services. No clear position.

The fix: “This is all we do. You want Facebook ads? Not even us. Only Google Ads, only this type of company.”

Everything became smooth after that positioning decision.

For SaaS companies, this means making three hard positioning choices. These aren’t nice-to-haves. They’re the foundation of defensible pricing.

1. The Outcome You Own

Not features. Not capabilities.

The specific business result you deliver better than anyone.

When ghostwriting LinkedIn content for Series B tech CEOs, I structure every post around this question: What singular outcome does your SaaS create that justifies premium pricing?

“Reduce churn” is too broad. “Reduce churn for usage-based SaaS pricing models in vertical software” is a position you can price against.

Lincoln Murphy, a customer success expert, emphasizes this: “Your product doesn’t have value. Your customer achieving their desired outcome has value.” This is the core of positioning-first pricing.

2. The Customer You Serve

Series A SaaS companies serving “mid-market B2B” have no position.

That’s a TAM slide, not a positioning statement.

“Series A vertical SaaS companies in healthcare, legal, and financial services navigating compliance requirements” is specific enough to build pricing around.

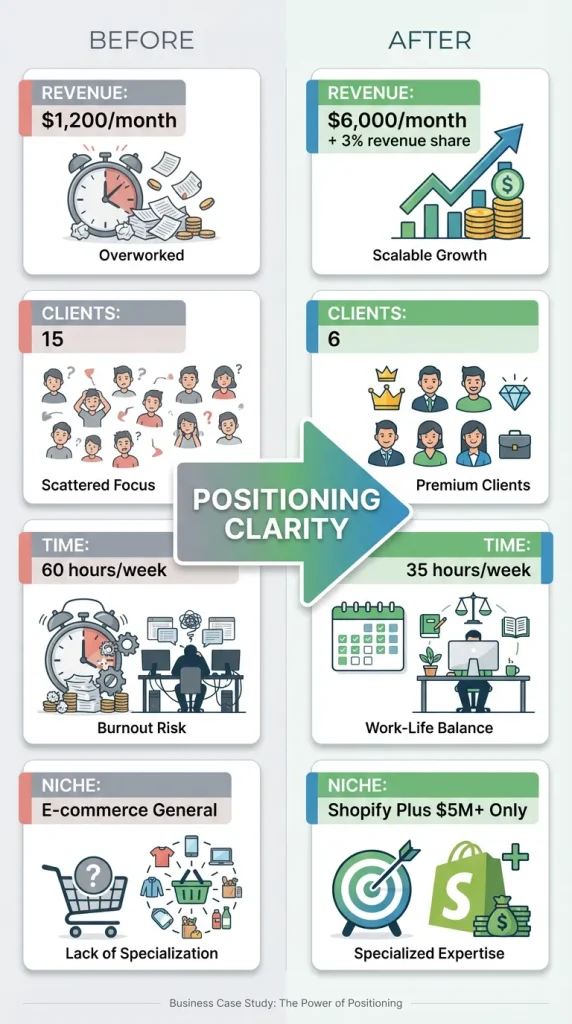

Mike’s client story illustrates this perfectly.

A Google Ads agency serving e-commerce brands repositioned to serve only Shopify Plus stores with $5M+ annual revenue. The client was charging $1,200/month working 60-hour weeks with kids at home.

After repositioning to serve a specific customer type, pricing jumped to $6,000/month plus 3% of earned revenue.

Same person. Different position. Fewer clients, double the revenue.

3. What You Refuse to Do

This is the positioning decision most founders avoid.

Mike turned down Facebook ads. He turned down social media management. He turned down anything that wasn’t his core strength.

For SaaS companies following a first principles approach to growth, this means killing features that dilute positioning.

Saying no to enterprise feature requests that don’t serve your core ICP. Saying no to integrations that expand your competitive set without expanding your value.

Saying no to pricing experiments that undermine your positioning.

According to research from OpenView Partners, SaaS companies that specialize in a narrow vertical command 40-60% higher prices than horizontal competitors. The positioning work happens before the pricing work. Always.

How do you know if your positioning is strong enough to support premium pricing?

Test it with this simple question: Can you explain your unique value in one sentence without mentioning features?

If yes, you have positioning. If you need to list capabilities, you have a product description, not a position.

📈 Key Stat: Usage-based pricing aligned with customer outcomes drives 20-30% higher customer lifetime value than seat-based models.

Source: ProfitWell SaaS Pricing Report

The Value-Based SaaS Pricing Strategy Framework

Once positioning is clear, pricing becomes strategic instead of reactive.

Mike’s value-based framework translates directly to SaaS pricing strategy. “We used to charge like 12 to 1,400 a month and we just switched it to 6,000 a month plus 3% of earned revenue,” he shares about one client transformation.

How did they justify a 5x price increase?

They reframed from deliverables to outcomes.

Here’s how this works for SaaS:

Step 1: Quantify the Problem Cost

Not the problem itself.

The financial cost of not solving it.

If your SaaS prevents inventory stockouts for e-commerce brands, what does a stockout cost them? Lost revenue, customer churn, brand damage. Put a number on it.

When creating educational email courses for cleantech startups, this is always email three. The economic pain of inaction. It sets up pricing conversations 40 emails later.

A Series A logistics SaaS I worked with did this exercise.

Each routing error costs their customers $340 in labor and fuel. Their software prevented 50 errors per month per customer.

Suddenly, their $2,000/month price wasn’t high. It was saving customers $17,000 monthly.

The pricing conversation shifted from cost to ROI.

Tools like ChartMogul help SaaS companies track MRR growth and decline to quantify the value delivered to each customer segment. This data becomes the foundation of value-based pricing.

Step 2: Frame Your Pricing Against the Problem Cost

Mike’s client wasn’t selling “Google Ads management” anymore.

He was selling “$100K in predictable monthly revenue growth.”

The 3% of earned revenue pricing model only works when you’ve positioned yourself as the revenue driver, not the marketing vendor.

For SaaS companies, this means pricing against business outcomes:

- Don’t price “user seats.” Price “time saved per week.”

- Don’t price “API calls.” Price “revenue enabled.”

- Don’t price “storage.” Price “compliance risk eliminated.”

B2B sales growth data shows that companies using value-based pricing models increased average deal sizes by 6% year-over-year, while competitors using feature-based pricing saw deal sizes shrink.

Step 3: Create a Branded Process

This is Mike’s key insight for service businesses that transforms SaaS pricing strategy.

“Position your B2B service as a branded step-by-step process,” Mike advises. “Determine what’s in it for the client at each step. Most people aren’t buying the task items. They’re buying: do I trust this person to do it, do they have a process I can understand, and do I believe this is gonna work for me?”

SaaS companies miss this completely.

They list features in pricing tiers. Basic, Professional, Enterprise. Five features, ten features, unlimited features.

Nobody cares about features.

They care about the process that leads to their desired outcome.

When positioning SaaS pricing, create a methodology:

Instead of “Advanced Analytics Package,” frame it as “The Predictive Revenue Model: Our 4-phase system for forecasting growth.”

Instead of “Premium Support,” frame it as “The Implementation Accelerator: Get to first value in 14 days, not 90.”

The methodology becomes your pricing justification. You’re not charging for software access. You’re charging for a proven process that delivers outcomes.

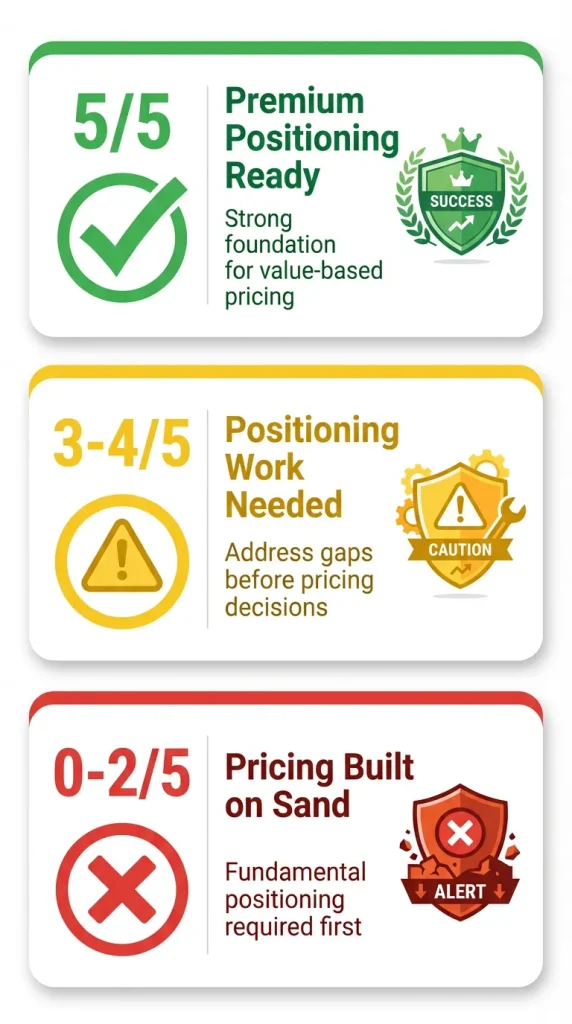

Quick Self-Assessment: Is Your SaaS Positioned for Premium Pricing?

□ Can you explain what you do in one sentence?

□ Do you serve a specific customer type (not “all B2B”)?

□ Can you quantify the problem cost you solve?

□ Do you have a branded methodology?

□ Have you said no to features recently?

Score:

5/5 = Premium positioning ready

3-4/5 = Positioning work needed before pricing

0-2/5 = Pricing built on sand

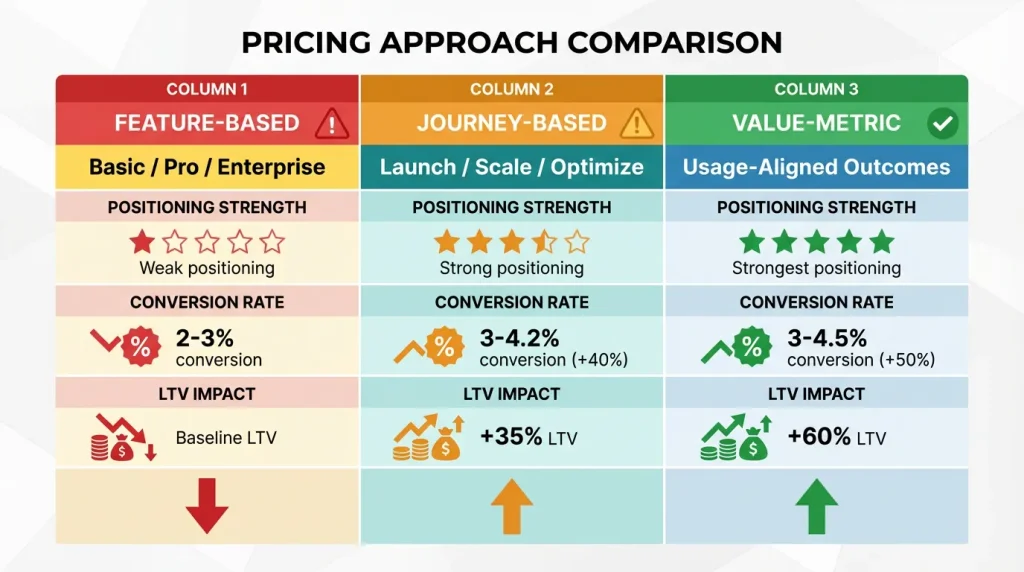

How to Structure SaaS Pricing Tiers Using Positioning

Mike’s advice applies directly to SaaS pricing tier strategy.

Don’t bury value in complexity.

“Most people don’t care about all the little task items that come below it,” Mike explains. “They’re buying: do I trust this person to do it, do they have a process that I can understand, and do I believe that this is gonna work for me?”

Your SaaS pricing tiers should map to customer maturity stages, not feature lists.

A revenue operations SaaS I consulted with had this backwards.

Their pricing was:

- Starter: $99/month, 5 users, basic reporting

- Growth: $299/month, 20 users, advanced dashboards

- Enterprise: Custom pricing, unlimited users, API access

Nobody understood what outcome each tier delivered.

After repositioning around customer journey stages:

- Launch: $499/month, “Get your first RevOps dashboard running in 7 days”

- Scale: $1,999/month, “Align sales and marketing with automated reporting”

- Optimize: $4,999/month, “Full revenue intelligence with predictive forecasting”

Same features. Different framing.

Conversion rate increased 40% and average contract value nearly tripled.

The tiers now reflected positioning. Not capabilities, but outcomes at different business stages.

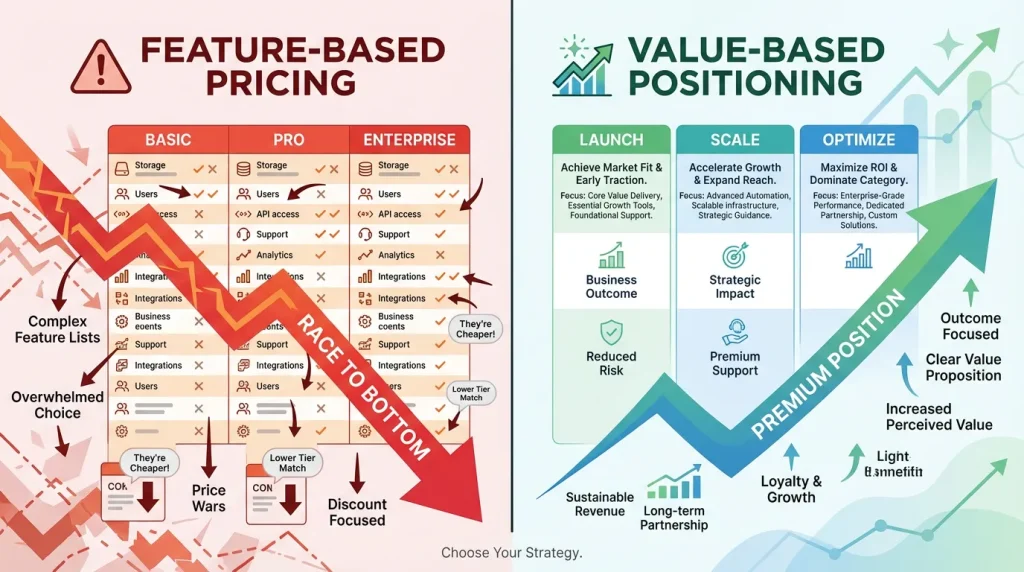

Pricing Tier Approaches Compared

| Approach | Example | Positioning Strength | Typical Conversion Rate | Customer LTV |

|---|---|---|---|---|

| Feature-Based | Basic/Pro/Enterprise with feature counts | Weak – commoditized comparison | Industry avg: 2-3% | Baseline |

| Journey-Based | Launch/Scale/Optimize with stage outcomes | Strong – differentiated value | 40% higher: 3-4.2% | +35% vs feature |

| Value-Metric | Usage-based aligned with customer success | Strongest – natural expansion | 50% higher: 3-4.5% | +60% vs feature |

This aligns with research from ProfitWell showing that value-metric pricing (based on usage aligned with customer success) drives 20-30% higher lifetime value than seat-based pricing models.

What is the best SaaS pricing model for my business?

The best model aligns with how your customers experience value. If value scales with usage, use consumption pricing. If value comes from team collaboration, use seat-based pricing. If value comes from outcomes achieved, use value-based tiers. Positioning determines the model, not the other way around.

The Automation Strategy That Protects Premium Pricing

Mike offers crucial advice about operational efficiency.

“Profitability doesn’t always come from charging more money. If you can do what you do in 50% of the time, that’s more money for you.”

For SaaS companies, this means building automation that protects your pricing position.

The mistake: automating customer-facing value.

The win: automating internal operations.

When you automate the customer experience too much, you commoditize your offering. Self-service is great until it eliminates the positioning that justified premium pricing.

A B2B SaaS company I worked with automated their onboarding so thoroughly that customers no longer experienced the expertise that differentiated them.

Churn increased. They were competing on price instead of process.

Mike’s principle applies: “What are the tasks that are low value? They don’t make the business money, they don’t make the client experience that much better, they don’t directly relate to the transformation for the customer, but they have to be done.”

Automate those. Keep the high-touch elements that reinforce your positioning.

According to McKinsey research, companies that automate internal operations while maintaining customer-facing expertise achieve 30% higher profit margins than those that automate indiscriminately.

In the strategies I develop for B2B tech executives, this is always the balance: efficiency behind the scenes, expertise in front of customers.

Pricing tools like Price Intelligently (now part of ProfitWell) help SaaS companies optimize pricing tiers based on willingness-to-pay data. But these tools work best when you’ve already established clear positioning. The tool can’t fix a positioning vacuum.

📈 Key Stat: Companies that automate internal operations while maintaining customer-facing expertise achieve 30% higher profit margins than those automating indiscriminately.

Source: McKinsey & Company

What Self-Awareness Really Means for SaaS Pricing

Mike asks the question most founders avoid.

“What do you actually want your business to look like?”

This isn’t vision-boarding. It’s revenue architecture.

“I had a customer who was making 17K a month working like 60 hours,” Mike shares. “The guy’s got four kids, one kid on the way. I said, what do you want your day to look like? I wanna work like 35 hours a week, and then I want to go pick my kids up from school.”

The answer changed everything about the pricing strategy.

For that client, scale wasn’t the goal.

Margin was the goal.

They repositioned to premium clients and went from $1,200/month to $6,000/month plus revenue share. Six clients instead of fifteen. Double the revenue, half the hours.

SaaS founders need to answer Mike’s question before building pricing: Do you want 10,000 customers at $49/month or 100 customers at $4,900/month?

Both can hit $5M ARR.

The operational models are completely different. The positioning is completely different. The sales growth strategies are completely different.

One client I work with in the climate tech space made this choice.

They killed their SMB tier entirely. Focused only on enterprise customers with $10M+ revenue.

Revenue per customer went from $800/month to $15,000/month.

Yes, they lost customers. Total revenue increased 3x because their positioning supported premium pricing.

The self-awareness question: What does success look like for you personally, and does your SaaS pricing strategy support that life?

If you want to build a lean, profitable company that gives you time for family, premium positioning is the only path.

If you want to raise a Series C and scale to acquisition, volume positioning might make sense.

Neither is wrong.

Building pricing before you answer the question is wrong.

Should I focus on customer acquisition or customer lifetime value in my SaaS pricing strategy?

This is a false choice created by poor positioning. Strong positioning enables both. When you’re clearly positioned, you attract the right customers (better CAC) who stay longer because you deliver specific outcomes (higher LTV). Weak positioning forces you to choose between volume and value.

The Positioning-First SaaS Pricing Strategy Checklist

Based on Mike’s framework and my experience ghostwriting content for funded B2B tech companies, here’s how to approach SaaS pricing strategy correctly:

Before You Set Any Prices

- Define the one specific outcome you deliver better than anyone

- Identify the exact customer type you serve (stage, vertical, use case)

- List what you will NOT do, even if customers ask

- Quantify the economic cost of the problem you solve

- Create a branded methodology or process

- Decide what your ideal business looks like personally

When You Build Pricing Tiers

- Map tiers to customer journey stages, not feature lists

- Name tiers after outcomes, not capability levels

- Frame pricing against problem cost, not competitor rates

- Include your methodology in the positioning

- Make the transformation clear at each tier

After You Launch Pricing

- Track conversion rates by tier to identify positioning gaps

- Monitor which tier customers grow into (or don’t)

- Collect feedback on perceived value vs actual features

- Adjust positioning messaging before you adjust prices

- Document the transformation stories at each price point

The companies seeing explosive revenue growth aren’t lucky.

They’re strategic about positioning first, pricing second.

Whether you build this internally or work with specialists focused on B2B SaaS positioning and content strategy, the sequence matters.

Position, then price. Never the reverse.

Common Questions About SaaS Pricing Strategy

What is the biggest SaaS pricing strategy mistake?

The biggest mistake is building pricing before positioning. Most SaaS companies calculate costs, check competitors, and set prices without first defining what specific outcome they uniquely deliver and for which exact customer type. This creates commoditization and forces price-based competition instead of value-based differentiation.

How do I transition from feature-based to value-based SaaS pricing?

Start by quantifying the economic cost of the problem you solve for customers. Then frame your pricing against that problem cost, not your development costs. Create a branded methodology that explains how you deliver the transformation, and structure pricing tiers around customer journey stages rather than feature access. The positioning shift must happen first, then pricing follows naturally.

Should SaaS companies use usage-based or seat-based pricing?

The pricing model should align with your positioning and how customers experience value. Usage-based pricing works when value scales with consumption, and customer success is directly tied to usage. Seat-based pricing works when value comes from team collaboration and network effects. The positioning decision comes first, then the pricing model follows from that strategic clarity.

How can I justify premium SaaS pricing to investors and customers?

Premium pricing requires premium positioning. Define your specific niche, create a branded process, and demonstrate measurable outcomes. Investors value margins over volume when you can prove defensible positioning and expansion revenue potential. Customers pay premium prices when you solve expensive problems for specific customer types better than anyone else. Data showing retention rates above 95% and NRR above 120% justifies premium positioning.

When should a SaaS company change their pricing strategy?

Change pricing when positioning changes, not when revenue slows. If you’ve repositioned to serve a different customer type or deliver a different outcome, pricing must follow. But changing prices without repositioning creates confusion and churn. Fix the position first. Most SaaS pricing problems are actually positioning problems in disguise.

How do I calculate the right price for my SaaS product?

Don’t start with costs. Start with the economic value you create for customers. Quantify the problem cost (lost revenue, wasted time, compliance risk). Your price should capture a fraction of that value, typically 10-30% of the total value delivered. Then work backwards to ensure your costs support profitable delivery at that price point.

What’s the difference between SaaS pricing tiers and pricing models?

Pricing tiers are the packages you offer within a model (Starter, Growth, Enterprise). Pricing models are the fundamental structure (seat-based, usage-based, value-metric, flat-rate). Strong positioning determines which model aligns with customer value perception, then tiers segment customers by use case or maturity stage.

Should I offer a free tier for my B2B SaaS?

Free tiers work when they support your positioning strategy and lead to natural expansion. Slack’s free tier works because team collaboration value increases with adoption, creating organic upgrade pressure. But if your positioning is premium and enterprise-focused, a free tier dilutes brand perception. Let positioning guide the decision, not conventional wisdom about freemium models.

Related Resources from Predictable B2B Success

- B2B Sales Growth Trends and Strategies for 2025

- How to Master Financial Acumen to Drive Revenue Growth

- First Principles Approach to B2B Revenue Growth

- B2B Growth Marketing: Building High-Performing Tech Brands

- B2B Buyer Psychology: How Fortune 100 Companies Drive $50B in Revenue

Connect with Mike Moll

LinkedIn: Mike Moll on LinkedIn

Website: MikeMoll.co

Company: Impact Leads

Learn more about Mike’s approach to positioning-first pricing strategy and how he helps B2B service businesses command premium rates through clear market positioning.

The Bottom Line on SaaS Pricing Strategy

Most SaaS companies are leaving six figures on the table because they built pricing before positioning.

They optimized the math but missed the strategy.

The transformation happens when you flip the sequence.

Position first. Price second.

Define what you uniquely solve and for whom. Create a methodology that delivers outcomes. Frame pricing against problem cost, not competitor rates.

This isn’t theory. It’s the framework Mike Moll used to save his agency from bankruptcy and help clients double revenue while cutting client counts in half.

The same framework applies to SaaS pricing strategy at every stage from seed to Series C.

Companies like HubSpot, Atlassian, and Slack built pricing power through positioning clarity. They knew exactly what outcome they owned, which customers they served, and what they refused to do. Their pricing followed from those strategic choices.

Series A and B companies that break through pricing ceilings don’t do it with more features.

They do it with sharper positioning.

Whether you’re building this capability in-house or partnering with specialists in B2B tech positioning and executive content, the foundation is the same: positioning before pricing, outcomes before features, methodology before math.

Your SaaS pricing strategy isn’t a spreadsheet problem.

It’s a positioning problem.

Fix the position, and pricing becomes defensible. Skip the positioning work, and you’ll compete on price forever.

Learn more about strategic content approaches for funded B2B tech companies.

About the Predictable B2B Success Podcast

With 500+ episodes featuring successful B2B tech CEOs, the Predictable B2B Success podcast explores the strategies that separate companies scaling efficiently from those burning through their runways. Host Vinay Koshy brings insights from founders who’ve navigated the challenges of building and scaling B2B technology companies from seed stage through Series C and beyond.

Some topics we explore in this episode include:

Listen to the episode.

Subscribe to & Review the Predictable B2B Success Podcast

Thanks for tuning into this week’s Predictable B2B Podcast episode! If the information from our interviews has helped your business journey, please visit Apple Podcasts, subscribe to the show, and leave us an honest review.

Your reviews and feedback will not only help me continue to deliver great, helpful content but also help me reach even more amazing founders and executives like you!