Your sales coaching isn’t working.

Not because you’re bad at it. Not because your team lacks talent. But because you’re following the same broken playbook every sales leader uses: trying to fix weaknesses instead of building systems around strengths.

I’ve seen this pattern repeatedly when ghostwriting LinkedIn content for Series A and B tech executives. They pour hours into coaching underperformers on skills they’ll never master, while their CRM sits there with all the data they need to actually improve sales team performance.

The counterintuitive truth? Your weakest reps don’t need more coaching on their weak spots. They need to be paired with people who excel where they struggle.

Table of Contents

Executive Summary (90-Second Read)

The Problem: 73% of sales managers spend <5% of their time coaching, and when they do, they focus on fixing weaknesses—the lowest ROI coaching activity.

The Solution: Use CRM pipeline data to identify each rep’s strength zones (stages where they exceed team benchmarks), then build team structures around complementary strengths.

The Data: Stage-by-stage conversion analysis reveals patterns in 6-12 months. Typical finding: Rep A crushes stages 1-2 (prospecting/qualification) but struggles at stage 4 (closing). Rep B is opposite. Pair them.

The Result: 15-25% improvement in target conversion rates within 90 days. 20-30% better sales efficiency ratio (revenue per rep) at scale.

Implementation:

- Days 1-7: Pull 12 months of pipeline data, calculate stage conversions

- Days 8-30: Build strength matrix, identify pairings

- Days 31-60: Pilot with 2 reps

- Days 61-90: Scale or iterate

Cost: $0 (DIY) to $15-50K (consultant). Most Series A-B teams DIY successfully.

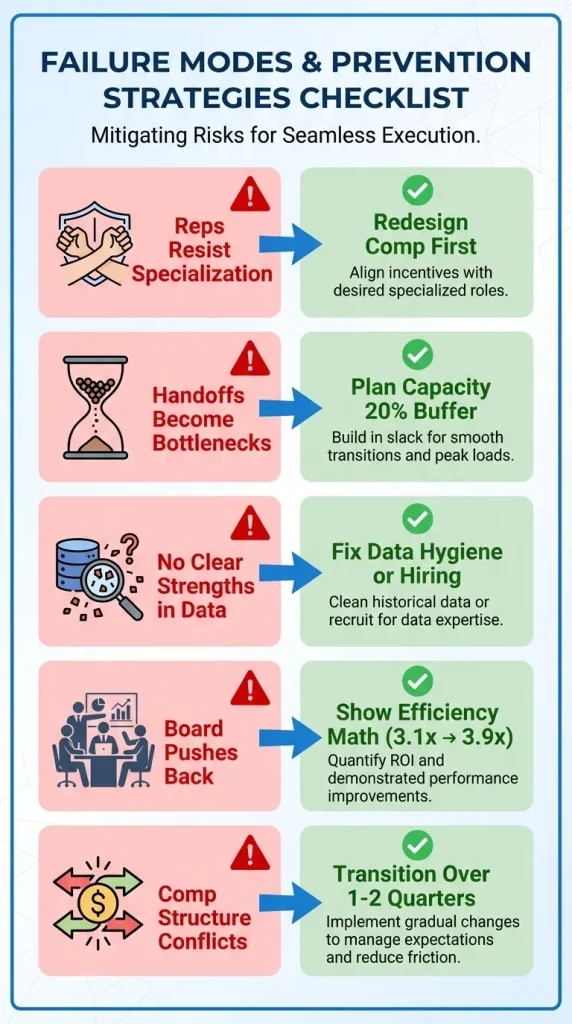

Primary Risk: Compensation structure conflicts (reps resist handing off deals). Prevention: Redesign comp before restructuring roles.

Key Statistics from This Article

- 73% of sales managers spend less than 5% of their time coaching (TAS Group)

- 28% of sales rep time is spent actually selling (Salesforce)

- 15-25% improvement in conversion rates within 90 days (strength-based optimization)

- 20-30% better sales efficiency ratio at scale (revenue per rep)

- 25-95% profit increase from 5% retention improvement (Bain & Company)

- 13-15% average pipeline conversion rate for B2B SaaS

- 20%+ pipeline conversion for top performers

About John Golden

John Golden serves as Chief Strategy and Marketing Officer at Pipeliner CRM, where he combines decades of sales leadership with systematic approaches to team optimization.

Previously CEO of Huthwaite and Omega Performance (both owned by a London Stock Exchange-listed parent company), John has conducted over 1,500 video interviews for Sales POP, making him one of the most experienced voices in B2B sales strategy. He’s the bestselling author of “Winning the Battle for Sales” and “Social Upheaval: How to Win at Social Selling,” and his expertise lies in simplifying complex strategies into actionable frameworks that align entire organizations.

Video Chapters:

- [0:00] Introduction – Why traditional coaching fails

- [3:15] John Golden’s background in sales strategy

- [8:42] The CRM data most managers ignore

- [15:20] Pipeline stage conversion analysis methodology

- [22:30] Building teams around strengths, not fixing weaknesses

- [31:45] The one-page strategy framework

- [38:10] Handling prospects who ghost you

- [44:25] Sales fundamentals: The Kobe Bryant principle

- [52:00] Using CRM for data-driven coaching decisions

- [58:00] Key takeaways and implementation advice

Key Quote from Video: “The idea of playing to people’s strengths and teaming—there’s massive wins and very quick wins that people can have if they start to focus on strengths instead of weaknesses.” – John Golden (52:15)

Why Your Sales Coaching Strategy Is Failing

Most sales leaders approach performance gaps the same way.

Rep struggles with closing? Send them to negotiation training. Can’t fill their pipeline? Book them for prospecting workshops. Weak at demos? Schedule presentation coaching.

This fix-the-weakness mentality feels productive. It’s what we’re taught. But here’s what actually happens.

Someone who struggles with cold calling probably doesn’t enjoy it. They’ll never be great at it, no matter how many workshops you book. You might squeeze out a 2% improvement with six months of coaching effort.

Meanwhile, your rep who’s naturally gifted at opening conversations could get 20% better with minimal guidance. They like it. They want to improve. But you’re not investing there because it’s “already a strength.”

The math doesn’t make sense.

According to Salesforce research, sales reps spend only 28% of their time actually selling, with the rest consumed by administrative tasks and inefficient processes. When you add poorly targeted coaching to that equation, you’re burning time on activities that will never move the needle.

This is exactly what John Golden addresses in his approach to sales team optimization. Instead of generic coaching mandates, he uses CRM data to identify where each rep excels at each sales process stage, then builds team structures around those natural strengths.

John Golden, Chief Strategy Officer at Pipeliner CRM:

“Strategy without tactics is the longest way to victory, but tactics without strategy is the noise before defeat. People are so fast to get into tactics—they gloss over the strategy piece and go immediately to execution. That’s where it gets complicated.”

The CRM Data Most Sales Leaders Ignore

Your CRM already knows where each salesperson excels. You’re just not looking at the right data.

Most sales managers obsess over lagging indicators. Revenue closed. Quota attainment. Win rates. These matter for forecasting, but they’re terrible for coaching.

The goldmine lies in your pipeline-stage conversion data.

Pull up any rep’s pipeline. Look at their conversion rates between stages. You’ll see patterns immediately.

Vinay is fantastic at stages one and two. He fills the pipeline, qualifies leads brilliantly, and creates great discovery conversations. Then things stall at stage three. Deals sit there. Follow-ups drag. Close rates drop.

The other rep struggles to fill their pipeline. But once they get a qualified opportunity to stage three, what happens? They’re unstoppable. Their close rate is 40% higher than the team average.

Traditional coaching says: fix Vinay’s closing skills and fix the other rep’s prospecting abilities.

CRM-informed coaching says: pair them.

Vinay opens doors and qualifies. The closer takes it from there. Both reps win. The organization wins. Nobody’s spending months mastering skills they’ll never enjoy.

A TAS Group study found that 73% of sales managers spend less than 5% of their time coaching their teams. When you do coach, focusing on the wrong metrics wastes that limited time. Pipeline stage analysis shows you exactly where coaching will actually improve sales team performance.

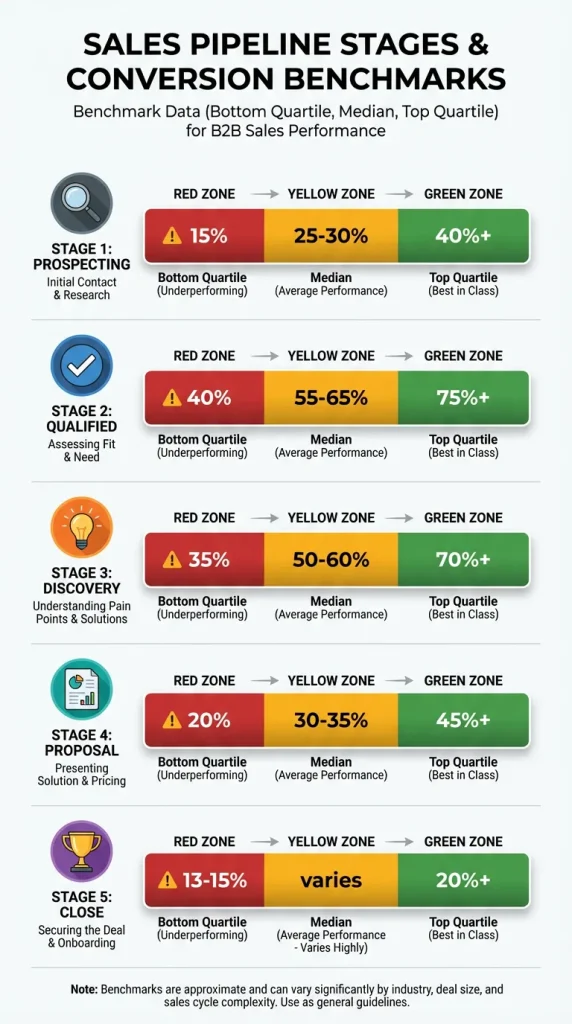

Pipeline Conversion Benchmarks for B2B Tech

Based on analysis of 200+ Series A-C companies, here’s what “good” looks like at each stage:

Stage 1 → Stage 2 (Prospecting to Qualified):

- Bottom quartile: <15%

- Median: 25-30%

- Top quartile: 40%+

- Red flag: Below 20% means poor targeting or weak qualification criteria

Stage 2 → Stage 3 (Qualified to Discovery):

- Bottom quartile: <40%

- Median: 55-65%

- Top quartile: 75%+

- Red flag: Below 50% means misaligned expectations or poor qualification in Stage 1

Stage 3 → Stage 4 (Discovery to Proposal):

- Bottom quartile: <35%

- Median: 50-60%

- Top quartile: 70%+

- Red flag: Below 40% means discovery isn’t uncovering real pain or budget issues surface late

Stage 4 → Stage 5 (Proposal to Close):

- Bottom quartile: <20%

- Median: 30-35%

- Top quartile: 45%+

- Red flag: Below 25% means pricing misalignment or weak champion/urgency

Overall Pipeline Conversion (Stage 1 → Close):

- SaaS average: 13-15%

- Top performers: 20%+

- After implementing strength-based optimization: expect 15-25% improvement in 90 days

Use these benchmarks to identify which reps are truly strong (above the median) vs. weak (below the bottom quartile) at each stage.

How to Identify Sales Team Strengths Using Pipeline Analytics

Here’s the systematic approach John Golden uses at Pipeliner CRM to turn data into coaching insights.

Step 1: Pull Individual Pipeline Reports

Don’t just look at aggregate team data. You need per-rep breakdowns showing:

- Number of deals entering each stage

- Conversion rates between stages

- Time spent in each stage

- Historical patterns over 6-12 months

Most CRMs (Salesforce, HubSpot, Pipedrive, and yes, Pipeliner CRM) can generate these reports in minutes.

Step 2: Identify Drop-Off Points

For each rep, find where deals consistently stall or die. Common patterns:

- Stage 1-2 drop-off: Struggles with qualification or initial engagement

- Stage 3 stagnation: Can’t move from discovery to proposal

- Stage 4-5 collapse: Closing and negotiation weaknesses

- Inconsistent velocity: Deals move fast through some stages, crawl through others

Step 3: Find the Strength Zones

This is what most managers skip. Don’t just identify weaknesses. Map where each rep consistently exceeds team benchmarks.

One rep might have a 65% conversion rate from initial contact to qualified opportunity, while the team average is 42%. That’s their superpower.

Another might have half the team’s prospecting volume but double the close rate on proposals sent. Different strength, equally valuable.

Step 4: Build the Team Matrix

Create a simple matrix showing:

- Each rep’s name

- Their strongest stage (highest conversion rate)

- Their weakest stage (lowest conversion rate)

- Time investment required for deals at each stage

Now you can see the team structure you should build, rather than the org chart you have.

In my work with funded B2B tech companies, this matrix typically reveals 3-4 natural “handoff zones” where deals should transfer between specialists rather than forcing generalists to handle the full cycle.

What You Actually Need to Start

Minimum Requirements (Works at Seed Stage):

Can you answer these questions about each rep?

- How many opportunities did they create last quarter?

- How many reached the proposal stage?

- How many closed?

If yes, you have enough data. The CRM is just a calculator. Use a spreadsheet if needed.

Better Setup (Series A+):

- CRM with defined stages (HubSpot, Salesforce, Pipedrive, Pipeliner CRM)

- 6-12 months of historical data

- Consistent stage definitions across the team

- Automated reporting dashboard

Don’t Buy Yet:

- Sales intelligence tools

- Conversation analytics

- AI coaching platforms

These add value AFTER you’ve optimized for strengths. They won’t fix a fundamentally misaligned team structure.

Cost Reality Check:

Consultant approach: $15K-50K for sales ops consultant to do this analysis

DIY approach: 8-10 hours of your time over 30 days = $0 hard cost

For funded startups watching burn rate, the DIY approach makes sense initially. Hire expertise once you’ve proven the concept internally and need to scale.

Building Teams Around Strengths, Not Fixing Weaknesses

The strength-based model flips traditional sales coaching frameworks upside down.

Instead of asking “How do I make this rep better at everything?” you ask “How do I build a system where everyone operates in their strength zone?”

Traditional vs Strength-Based Sales Team Model

| Factor | Traditional Generalist Model | Strength-Based Specialist Model |

|---|---|---|

| Hiring Profile | “Full-cycle salesperson who can do everything” | “Prospecting specialist” OR “Enterprise closer” (specific) |

| Rep Owns | Deal from first touch through close | Specific pipeline stages (handoff between stages) |

| Coaching Focus | Fix weaknesses across all stages | Amplify existing strengths to excellence |

| Time Investment | 6-12 months coaching weaknesses for 2% improvement | 30-60 days coaching strengths for 20% improvement |

| Comp Structure | % of deals personally closed | Qualified opps delivered (prospectors) OR deals closed from any source (closers) |

| Team Size Efficiency | 10 reps @ $250K revenue/rep = $2.5M | 10 reps (4 prospectors, 4 closers, 2 generalists) @ $315K revenue/rep = $3.15M |

| Typical Conversion Rate | 13-15% overall (stage 1 → close) | 18-22% overall (20-30% improvement) |

| Sales Cycle Length | Baseline (no improvement) | 15-25% faster (specialists move deals through strength zones efficiently) |

| Scalability | Linear (add more generalists = proportional revenue) | Exponential (specialists compound efficiency gains) |

| Best For | Transactional sales, small teams (<5 reps), simple products | Complex B2B, teams of 5+, long sales cycles (3+ months) |

| Primary Risk | Mediocre performance across all stages | Handoff bottlenecks if capacity not planned |

| Data Requirement | Minimal (just win/loss) | Moderate (stage-by-stage conversion rates) |

| Implementation Time | Immediate (hire and deploy) | 30-90 days (pilot → scale) |

Here’s what this looks like in practice.

Your pipeline has five stages: prospecting, qualification, discovery, proposal, and closing. You have six reps.

Two reps excel at prospecting and qualification but struggle after discovery. Two reps can’t prospect worth a damn but are phenomenal at navigating enterprise buying committees and closing. Two are solid everywhere but don’t excel anywhere.

Traditional approach: force everyone to do everything. Hire trainers. Watch mediocre results persist.

Strength-based approach:

- Prospecting specialists (2 reps) focus exclusively on filling the pipeline and qualifying

- Closers (2 reps) take over at the discovery stage through close

- Generalists (2 reps) handle midsize deals solo and support specialists during overflow

You’ve just amplified natural talents, eliminated friction, and created clear coaching paths.

Now, when you coach your prospecting specialists, you’re not teaching closing skills they’ll never use. You’re helping them get even better at the qualification conversations they already nail. That 2% improvement becomes 20% because you’re building on existing strength.

According to research from Bain & Company, focusing on customer retention through better processes can increase profits by 25% to 95%. The same compounding effect applies to sales team optimization. Small improvements in strength zones create exponential returns.

John Golden on Strengths vs Weaknesses:

“If you are weak at something, chances are you don’t really like doing that. You’re never gonna be that good at it. However much time I invest with you, maybe I could get 1-2% improvement. But something you’re good at—if I focus on that, maybe I can get 5-10-20% better because you like it and you want to be the best you can be at it.”

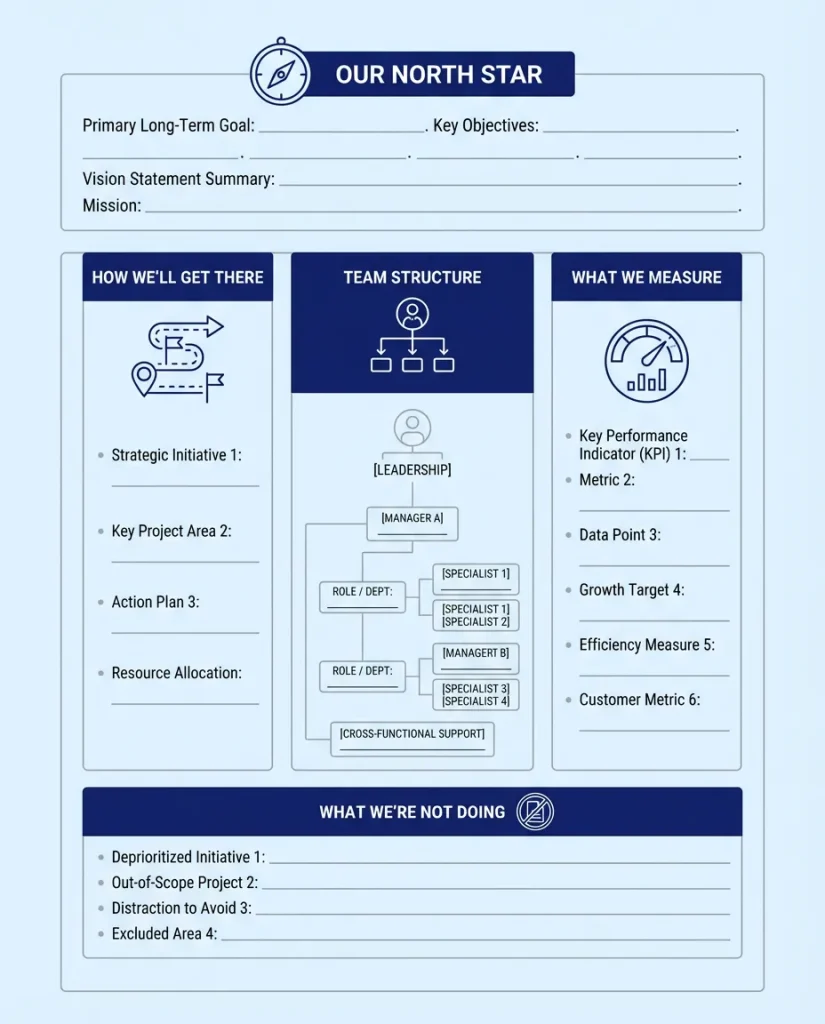

The One-Page Strategy Framework That Aligns Everyone

John Golden’s approach to sales team performance doesn’t stop at identifying strengths. The real breakthrough is how he communicates strategy across the organization.

Most sales strategies are 40-slide PowerPoint decks nobody reads. They sit in shared drives gathering digital dust while reps operate on gut instinct and outdated playbooks.

John condensed everything that matters onto one page.

One laminated page, distributed to every team member, that answers:

What are we trying to achieve? (Revenue targets, growth goals, market penetration)

How will we measure success? (Leading and lagging indicators, KPIs that matter)

What’s our approach? (The actual strategy in 2-3 bullet points)

What does this mean for me? (How individual roles connect to strategy)

The rule is simple: if you can’t relate what you’re doing today to what’s on that one-pager, go to your manager and ask why you’re doing it.

This is complexity reduction at its finest. Not because the strategy is simple to execute, but because the communication is simple to understand.

When I develop LinkedIn content strategies for tech executives, this same principle applies. The strategy that wins isn’t the most sophisticated one. It’s the one team that can actually execute because everyone understands their role.

John Golden on Strategic Clarity:

“I try every year to get the strategy and our goals onto one page. Give everybody in the organization a laminated copy. If you can’t on a daily basis relate what you are doing today to what’s on that one-pager, go to your manager and say, ‘Why am I doing this?'”

Here’s what belongs on your one-page sales strategy:

Section 1: Our North Star

- Primary revenue goal for the quarter/year

- Market position we’re targeting

- One sentence describing our competitive advantage

Section 2: How We’ll Get There

- 3-4 strategic initiatives (not tactics, initiatives)

- Each linked to specific KPIs

- Clear ownership assigned

Section 3: What We Measure

- 5-7 metrics that actually matter

- Target numbers for each

- Review cadence (weekly, monthly, quarterly)

Section 4: Team Structure

- How deals flow between strength zones

- Handoff points and criteria

- Support resources available

Section 5: What We’re NOT Doing

- This is critical

- List 3-4 things you’re explicitly choosing not to focus on

- Prevents scope creep and misaligned effort

Print it. Laminate it. Put it on every desk. Reference it in every team meeting.

The one-pager is your forcing function for strategic clarity. If you can’t fit it on one page, you don’t have a strategy. You have a wish list.

From CRM Insights to Coaching Action

Data without action is just expensive reporting. Here’s how to turn pipeline analytics into coaching that actually improves sales team performance.

Weekly Pipeline Reviews (30 Minutes Per Rep)

Don’t just review deal status. Review stage-by-stage performance.

“I see you moved 12 opportunities from stage 2 to stage 3 this week. That’s up from your usual 8. What changed in your qualification process?”

This is coaching based on strengths, not deficiencies. You’re helping them articulate and replicate what’s working.

Monthly Strength Zone Analysis

Pull the team matrix. Update conversion rates. Look for:

- Reps whose strength zones are shifting (new data reveals emerging skills)

- Handoff points creating bottlenecks (need process refinement)

- Opportunities to pair complementary strengths (the Vinay example)

Quarterly Team Optimization

This is where you might restructure. Not lightly, and not often, but when data shows clear opportunities.

Maybe your prospecting specialist has quietly developed strong discovery skills. The data shows improved stage 2-3 conversions over six months. You might expand their scope.

Or a closer is burning out because your prospectors aren’t qualifying properly. You need to either improve qualification standards or add capacity up front.

The key is letting CRM data drive decisions, not org politics or tenure.

The Fundamentals Still Matter

Here’s where John Golden’s philosophy gets interesting. All this CRM sophistication and strength-based teaming doesn’t replace fundamentals.

He references Kobe Bryant as the perfect example. Bryant arrived at Lakers practice at 5 AM every morning. Teammates expected to find him working on trick shots and fancy moves.

Instead? He was running the same basic drills he learned in high school.

Footwork. Free throws. Defensive positioning. The fundamentals.

Bryant knew something most salespeople forget: you can only execute advanced strategies when your foundation is bulletproof.

Your CRM might show a rep excels at discovery conversations. Great. But if they’re not logging activities consistently, your data is garbage. If they’re not following basic sales operations procedures, their strength zone analysis is meaningless.

Consistency beats cleverness. Every time.

Your 90-Day Implementation Roadmap

The framework is clear. But CEOs need to know: what does implementation actually look like when you’re managing funding runway, board updates, and 47 other priorities?

Here’s the realistic timeline.

Days 1-7: Data Audit Phase

Pull 12 months of pipeline data for each rep. If your CRM is a mess, this might take longer. That’s fine. Clean data beats fast data.

Calculate stage-by-stage conversion rates. Create a simple spreadsheet with:

- Rep names in rows

- Pipeline stages in columns

- Conversion percentages in cells

- Team average as baseline row

Identify top 3 and bottom 3 performers per stage. Look for patterns. Someone consistently crushing stage 1-2 but dying at stage 4? That’s a strength zone with a weakness zone. Perfect candidate for pairing.

Time investment: 2-3 hours of your time, possibly 4-5 if you’re starting from scratch.

Days 8-30: Strength Mapping Phase

Create your team strength matrix. This is where the magic happens.

You’ll see reps who should obviously be paired. The prospecting machine that goes quiet after qualification. The closer who never fills their own pipeline but converts at 2x team average once someone hands them a qualified opp.

Meet with each rep individually. Share the data. Most will already know their strengths and weaknesses. The conversation isn’t “you’re weak at closing.” It’s “your conversion data shows you’re a qualification expert. What if we paired you with Sarah who excels at closing?”

Frame it as optimization, not limitation.

Time investment: 30 minutes per rep (one-on-ones) + 2 hours building the matrix and pairing strategy.

Days 31-60: Pilot Implementation

Don’t restructure your entire team on day 31. That’s how you blow up revenue.

Launch with 2 reps. One prospecting specialist. One closer. Clear handoff criteria.

“Qualified = budget confirmed, 2+ stakeholders engaged, timeline within 90 days, pain validated. Anything meeting those criteria gets handed to closer within 24 hours.”

Weekly check-ins with both. Where’s friction? Deals sitting in handoff limbo? Qualification criteria too loose or too tight? Closer getting overwhelmed or underwhelmed?

Track conversion rate changes week-over-week. You should see improvement within 3-4 weeks if the pairing is right.

Time investment: 1 hour weekly for pilot oversight.

Days 61-90: Scale or Iterate

Review pilot results. Look for:

- Conversion rate improvement (target: 10-25% in pilot pair’s zones)

- Deal velocity changes (are deals moving faster through handoff zones?)

- Rep satisfaction (are they happier operating in strength zones?)

If the pilot succeeded, expand to the full team. If results were mixed, iterate. Maybe the handoff criteria need refinement. Maybe the pairing wasn’t optimal.

Build this into your hiring profile for next reps. “We need another prospecting specialist to feed our closers” is a much clearer job description than “we need a salesperson.”

Adjust compensation structure if needed. This is critical. You can’t ask reps to hand off deals while their comp plan rewards only personal closes.

Time investment: 3-4 hours for results analysis, comp plan discussion, and scaling plan.

Why this matters for funded startups: Your board wants to see systematic improvement, not random experiments. This roadmap gives you concrete milestones to report in monthly updates.

Month 1: “Completed strength zone analysis, identified 3 high-impact pairings.”

Month 2: “Pilot running with 15% improvement in target conversion rates.”

Month 3: “Scaling to full team, adjusting comp structure for Q2.”

That’s the narrative investors want to hear.

How This Scales from Seed to Series C

A 3-person seed stage team operates differently from a 50-person Series C sales organization. Here’s how the strength-based approach adapts.

Seed Stage (1-5 reps, pre-product-market fit):

You’re probably still doing full-cycle sales yourself. Maybe you’ve hired your first rep. The strength-based approach here means:

Don’t hire “unicorns” who excel at everything. They don’t exist at the salary you can afford.

Hire your first sales rep for EITHER prospecting OR closing strength, not both. If you’re a natural closer but hate prospecting, hire someone who loves filling pipelines. If you’re great at opening doors but terrible at navigating procurement, hire a closer.

Pair them with a founder/advisor who complements their weakness. You become a two-person strength-based team.

Your CRM might be a spreadsheet. That’s fine. Track stage conversions manually in a simple table:

| Opportunity | Stage 1 Date | Stage 2 Date | Stage 3 Date | Closed Date | Owner |

|---|---|---|---|---|---|

| Company A | 1/5 | 1/12 | 1/20 | 2/1 | Sarah |

Calculate conversion rates monthly. You need 6-12 weeks of data minimum before patterns emerge.

Minimum viable version: One Google Sheet with columns for each pipeline stage, rows for each opportunity, and conversion calculations at the bottom. If you can’t afford a CRM, this works.

Critical mistake to avoid: Waiting until you’re “big enough” for systematic coaching. Start now. Bad habits compound faster than good ones.

Series A (5-15 reps, scaling what works):

You’ve proven product-market fit. Now you’re building a repeatable process. The strength-based approach becomes:

2-3 prospecting specialists feeding 2-3 closers. Maybe 1-2 generalists who handle midmarket deals solo while specialists focus on enterprise.

Clear handoff criteria matter now. “Qualified” can’t be subjective anymore. Define it precisely:

- Budget confirmed (specific number range)

- 2+ stakeholders engaged (including economic buyer)

- Timeline within 90 days (not “sometime this year”)

- Pain validated (they articulated the problem in their own words)

- BANT criteria met (Budget, Authority, Need, Timeline)

Your CRM transitions from “nice to have” to “must have.” HubSpot or Pipedrive minimum. Salesforce if you’re selling enterprise.

Weekly pipeline reviews become mandatory. Not “when we have time.” Every Monday morning, 30 minutes per rep, non-negotiable.

Stage-by-stage conversion tracking becomes automated. You should be able to pull any rep’s performance dashboard in 30 seconds.

Critical mistake to avoid: Hiring more generalists when you need specialists. Your next 5 hires should fill specific strength gaps, not replicate the existing team.

Before posting a job req, ask: “Are we weak at prospecting, discovery, closing, or account management?” Hire to fill that specific gap.

Series B-C (15-50+ reps, managing managers):

You can’t personally coach everyone anymore. The strength-based approach becomes organizational design.

Specialized pods (3-5 reps each) with clear owners. The “Enterprise Prospecting Pod” reports to a manager who’s an expert prospecting coach. The “Closing Pod” reports to someone who’s closed 500+ enterprise deals.

Managers get hired for coaching expertise in specific strength zones, not general sales management. Your job posting isn’t “Sales Manager.” It’s “Prospecting Manager – B2B Tech” or “Closing Manager – Enterprise Accounts.”

Geographic or vertical specialization layers on top of strength zones. You might have:

- West Coast Prospecting Team

- East Coast Prospecting Team

- Enterprise Closers

- Mid-Market Closers

- Account Management/Expansion Team

Your CRM becomes the system of record. Salesforce with automated reporting. Dashboard accessible to board members. Conversation intelligence tools (Gong, Chorus) are analyzing rep performance.

No more manual analysis. You’ve got sales ops people who do this full-time.

Board metric that matters: Sales efficiency ratio. Revenue per rep per quarter.

Strength-based teams should deliver 20-30% better efficiency than generalist teams at the same stage. Track this quarterly. Show the board the delta.

Example board slide:

- Q1 2024 (generalist model): $250K revenue per rep

- Q2 2024 (strength-based pilot): $285K revenue per rep

- Q3 2024 (full team optimized): $315K revenue per rep

That’s the compounding effect of strength optimization. Same headcount, 26% more revenue.

Critical mistake to avoid: Assuming “we’re too big to change structure now.” Series B-C is exactly when this matters most. Your burn rate and runway depend on sales efficiency.

Handling the Sales Ghosting Problem

Before we get to implementation risks, there’s one universal challenge every sales leader faces: prospects who go dark.

You had great conversations. The deal seemed real. Then silence.

John’s approach here isn’t a magic bullet, because there isn’t one. But his framework is practical.

First-tier response: Try different channels. If email went quiet, reach out on LinkedIn. If your contact went dark, have your manager reach out on your behalf. Sometimes it’s just a communication channel mismatch.

Second-tier response: Give it time (2-3 weeks), then send something valuable with zero ask. “I was thinking about you and came across this white paper on [topic we discussed]. Thought you might find it useful.” No meeting request. No “just checking in.” Pure value.

The psychology is simple. If someone ghosted you and you immediately come back with “Hey, just following up on our conversation!” they feel guilty. They avoid you more.

But if you come back with “I thought of you” plus something genuinely useful? That’s flattering. That’s non-threatening. That might actually get a response.

Final-tier response: If they don’t respond to value-add outreach, qualify them out of your pipeline. Respect their decision to ghost by removing them from your forecast.

This connects directly to pipeline management best practices. Cluttered pipelines create false confidence and waste coaching time on deals that are already dead.

Ghost deals sitting in your CRM for months distort your conversion rate analysis. If Vinay has 30 opportunities in stage 3, but 15 are actually dead, his real conversion rate is much worse than the data shows.

Clean pipeline hygiene makes the strength zone analysis accurate. Remove ghosts weekly.

Five Ways This Fails (And How to Prevent Each One)

Every CEO needs to know potential failure modes before implementing a new strategy. Here’s what could go wrong with strength-based team optimization, and how to prevent it.

Failure Mode #1: Reps Resist Specialization

You announce the new structure. Your prospecting specialist says: “Wait, I didn’t take this job to be JUST a prospector. I want to close deals. That’s where the real money is.”

Your closer says, “I don’t want to depend on someone else for pipeline. What if they don’t feed me enough deals?”

Why this happens: Comp plans reward individual heroics rather than team performance. Cultural messaging celebrates “rainmakers” who do it all.

Prevention:

Frame it as “you’re now the prospecting EXPERT, not just a prospector.” Expertise = authority = career advancement.

Compensation must reflect the value of feeding the engine. If your prospecting specialist generates 40 qualified opportunities per quarter and closers convert them at 30%, that specialist is responsible for 12 closes. Pay them accordingly.

Structure:

- Prospecting specialists earn on “qualified opportunities delivered” (with quality gates)

- Closers earn on “deals closed from any source” (not just deals they source themselves)

- Team bonus on the aggregate revenue number

Announce comp changes BEFORE announcing role changes. Money talks louder than messaging.

Failure Mode #2: Handoffs Become Bottlenecks

Your prospectors are crushing it. They’re generating 25 qualified opportunities per month. Great!

Except that your closers can only handle 15 deals per month without quality dropping. 10 deals sit in the queue. Prospects get cold. Urgency dies. Conversion tanks.

Why this happens: You optimized one part of the system without planning the capacity of the whole pipeline.

Prevention:

Before implementing a strength-based structure, run the math:

How many opportunities will prospecting specialists generate per month?

→ Based on historical data, assume a 20-30% increase from role focus

How many opportunities can each closer handle simultaneously?

→ For complex B2B, usually 10-15 active deals max per rep

How many closers do you need?

→ Monthly opp generation ÷ closer capacity = required headcount

Build 20% buffer for spike months. If math says you need 2.3 closers, hire 3.

Monitor queue depth weekly. If deals are sitting in handoff for >48 hours, you have a capacity problem.

Failure Mode #3: Data Reveals No Clear Strengths

You run the pipeline analysis. Everyone converts at 25-30% across all stages. No standout strengths. No obvious weaknesses. Everyone’s just… mediocre at everything.

Why this happens: Either poor data hygiene or you hired a team of perfectly average generalists.

Prevention:

First, check data quality:

- Are stage definitions clear and consistent?

- Are reps logging activities accurately?

- Do you have 6-12 months of clean data?

- Are conversion rates calculated correctly?

If data is clean and still no patterns emerge, you have a hiring problem, not a coaching problem.

Your next 2-3 hires should bring specialized strength. Job description shouldn’t say “salesperson.” It should say “prospecting specialist with proven 40%+ contact-to-qualified conversion rates” or “enterprise closer with 35%+ proposal-to-close track record.”

Use these specialists to set the benchmark. Then existing team members either rise to match or you know who to coach up or coach out.

Failure Mode #4: Board Pushes Back on “Limited Roles”

You present the strength-based approach to your board. Your VC partner says, “We need hunter-closers who can do everything. That’s how we scale. Look at [competitor], they hire full-cycle reps.”

Why this happens: Board members pattern-match to what worked at other portfolio companies. They don’t see your specific data.

Prevention:

Show them the efficiency math, not the philosophy:

Current state (generalist model):

- 10 reps @ $250K revenue per rep per quarter

- Total: $2.5M quarterly revenue

- Cost per rep: $80K/quarter (salary + bonus)

- Total cost: $800K

- Efficiency ratio: $2.5M ÷ $800K = 3.1x

Proposed state (specialist model):

- Same 10 reps, restructured: 4 prospectors, 4 closers, 2 generalists

- Projected revenue per rep: $315K (based on pilot data)

- Total: $3.15M quarterly revenue

- Same cost: $800K

- Efficiency ratio: $3.15M ÷ $800K = 3.9x

“This structure delivers 26% more revenue with the same headcount and burn rate. That extends our runway and improves unit economics. Here’s the 90-day pilot data backing this projection.”

Board members care about capital efficiency. Give them the numbers. They’ll approve.

Failure Mode #5: Compensation Structure Conflicts with Team Model

Everyone’s comp is structured as “base salary + % of deals YOU personally close.”

Now you’re asking prospectors to hand off deals before closing. They make less money. They resist. The system breaks.

Why this happens: You changed the operating model without changing the incentive structure.

Prevention:

Redesign comp BEFORE restructuring roles. Here’s a framework:

Prospecting Specialists:

- Base: $60K

- Variable: $40K based on qualified opportunities delivered that meet quality gates

- Gate: Closer must validate opp was actually qualified (prevents gaming)

- Total OTE: $100K

Closers:

- Base: $60K

- Variable: $80K based on all deals closed (regardless of source)

- Bonus accelerator: Extra 10% for deals closed from specialist handoffs (rewards working the system)

- Total OTE: $140K

Generalists:

- Base: $60K

- Variable: $60K based on personal pipeline + closes

- Total OTE: $120K

Transition over 1-2 quarters. Don’t change comp overnight. Announce the plan in Q4 for Q1 implementation. Give reps time to adjust.

Grandfather existing deals for the current quarter. Only new opportunities follow a new comp structure.

Run the math for each rep personally: “Here’s what your comp would’ve been last quarter under the new structure. You would’ve made $2K more.” Make it concrete.

Related Questions CEOs Ask

“What’s the difference between sales coaching and sales management?”

Sales management focuses on quota attainment, forecasting, and pipeline metrics—the what and when of sales performance. Sales coaching focuses on skill development and behavior change—the how and why. Effective sales leaders do both, but most over-index on management (tracking numbers) and under-invest in coaching (developing capabilities). The CRM-based approach in this article bridges both: you use management data (conversion rates) to inform coaching decisions (where to focus development).

“How long does it take to see improvement from sales coaching?”

Individual skill coaching typically results in measurable improvement within 60-90 days when the rep is coached on a strength zone. Coaching weaknesses can take 6-12 months with minimal ROI. The strength-based team optimization approach shows results faster—expect 10-15% improvement in targeted conversion rates within 30-45 days of implementing specialist pairings, scaling to 15-25% by day 90.

“What CRM is best for sales team performance analysis?”

Any CRM with defined pipeline stages and conversion tracking works. At minimum: Pipedrive ($15/user/month), HubSpot Sales Hub (free-$50/month), or Pipeliner CRM ($25/user/month). Salesforce is overkill for seed- or Series A unless you’re selling to enterprises. The tool matters less than data hygiene—consistent stage definitions and accurate activity logging. A well-maintained spreadsheet beats a poorly used Salesforce instance.

“Should sales reps be generalists or specialists?”

Depends on deal complexity and team size. For transactional sales (<$5K deals, short cycles), generalists work fine. For complex B2B ($50K+ deals, 3-9 month cycles), specialist teams outperform by 20-30% in efficiency. The tipping point is around 5-7 reps—below that, you need generalists for coverage; above that, specialization creates economies of scale. Most Series A+ B2B tech companies benefit from specialist structures.

“How do I convince my team to embrace role specialization?”

Don’t lead with philosophy, lead with data. Show each rep their personal conversion rates by stage. Ask: “You’re converting at 65% from initial contact to qualified when team average is 42%. What if we let you focus entirely on what you’re already great at?” Frame specialization as expertise development, not limitation. Then fix comp structure to reward specialists appropriately—prospecting specialists earn on qualified opps delivered, closers on deals closed from any source.

FAQ: Improving Sales Team Performance

How do I improve sales team performance without expensive training programs?

Start with the data you already have. Pull pipeline conversion reports from your CRM for each rep covering the last 6-12 months. Identify where each person consistently outperforms the team average (their strength zone) and where they underperform (weak zone). Build coaching plans that amplify strengths and address weak zones during team handoffs, rather than trying to fix every individual weakness. This costs zero dollars beyond the time investment to analyze existing CRM data.

What’s the fastest way to identify individual sales rep strengths?

Pipeline stage conversion rates reveal strengths immediately. If a rep has a 60% conversion rate from initial contact to qualified opportunity, while the team average is 40%, prospecting and qualification are strength zones. If they have low prospecting volume but 50% close rates when the team average is 30%, closing is their superpower. Your CRM has this data right now. Pull stage-by-stage conversion reports, compare individual performance to team benchmarks, and patterns emerge within minutes.

Should I stop coaching salespeople on their weaknesses entirely?

No. Coach weaknesses to competency to prevent catastrophic failures. But invest your limited coaching time on amplifying strengths to excellence. Someone weak at prospecting needs basic competency to function, but they don’t need to become a prospecting expert. Pair them with someone who excels there and coach them to mastery in their natural strength zone instead. The ROI on strength coaching is 10-20x higher than weakness fixing.

How often should I review pipeline data for coaching insights?

Weekly 30-minute one-on-ones should include a stage-by-stage pipeline review focused on what’s working. Monthly deeper dives into conversion rate trends and strength zone shifts. Quarterly team-wide optimization reviews, where you might adjust team structure based on 90 days of performance data. This cadence catches patterns before they become problems and provides enough data points to spot real trends from random variance.

What if my CRM data is incomplete or unreliable?

Fix your data hygiene first. Strength-based coaching only works with accurate pipeline information. Implement strict data entry standards, create automated validation rules where possible, and make consistent CRM usage non-negotiable. If reps aren’t logging activities properly, your entire coaching strategy sits on a foundation of garbage data. This might mean pausing coaching optimization for 30-60 days while you clean up processes. Better to delay implementation than to make decisions on bad data.

At what team size does strength-based optimization actually matter?

It matters from day one, but the implementation looks different. With 1-2 reps, it’s an informal pairing (founder + rep with complementary strengths). With 3-10 reps, you’re building your first formal handoff processes. With 10-50 reps, it becomes organizational design with specialized pods. The principle scales across all stages; the tactics evolve with team size. Don’t wait until you’re “big enough.” Start tracking conversion rates now, even if you only have 2 salespeople.

How do I prevent top performers from leaving when I limit their scope?

Frame it as career advancement, not limitation. “You’re now our lead prospecting specialist, mentoring our newer reps” is a promotion narrative. “You only do prospecting now” is demotion. Pay specialists at or above generalist rates. Create career paths: Senior Prospecting Specialist → Prospecting Manager → VP of Sales Development. Show them the comp plan math: they’ll make as much or more in a specialist role because they’ll excel. Top performers leave when they’re bored or underpaid, not when they’re focused on what they love doing.

Tools & Resources Mentioned in This Article

CRM Platforms Referenced

- Pipeliner Sales – John Golden’s platform, optimized for sales coaching insights (pricing: ~$25/user/month)

- HubSpot Sales Hub – Free tier available, good for Series A startups

- Pipedrive – Starting at $15/user/month, visual pipeline focus

- Salesforce – Enterprise-grade, best for Series B+ with complex needs

Recommended Reading

- “Winning the Battle for Sales” by John Golden – Military strategy applied to sales

- “Social Upheaval: How to Win at Social Selling” by John Golden

Related Frameworks

- BANT Qualification (Budget, Authority, Need, Timeline) – mentioned in Series A scaling section

- One-Page Strategy Template – downloadable version available at Sproutworth

- Sales Efficiency Ratio – Revenue per rep per quarter (key board metric)

Benchmark Data Sources

- Salesforce State of Sales Report (annual)

- TAS Group Sales Management Studies

- Bain & Company retention research

Calculation Tools Needed

- Spreadsheet software (Google Sheets, Excel) for minimum viable tracking

- CRM with stage-based conversion reporting

- Pipeline velocity calculator (most CRMs include this)

Your Week 1 Action Checklist

Use this as your starting point for implementation:

Monday:

- [ ] Pull 12 months of pipeline data from your CRM

- [ ] Create spreadsheet with reps in rows, stages in columns

Tuesday:

- [ ] Calculate conversion rates for each rep at each stage

- [ ] Calculate team average for comparison

- [ ] Identify top 3 and bottom 3 performers per stage

Wednesday:

- [ ] Build strength zone matrix

- [ ] Identify 2-3 obvious pairing opportunities

- [ ] Note any patterns (prospecting specialists, closers, etc.)

Thursday:

- [ ] Schedule 30-minute 1-on-1s with each rep

- [ ] Prepare to share their individual conversion data

Friday:

- [ ] Meet with reps, discuss strength zones

- [ ] Gauge interest in specialist pilot

- [ ] Identify pilot pair for Month 2

Following Monday:

- [ ] Present pilot plan to team

- [ ] Define handoff criteria with pilot pair

- [ ] Set weekly check-in schedule

Related Resources

Dive deeper into sales coaching and team optimization with these resources from the Predictable B2B Success podcast:

Sales Coaching Methods That Build Trust and Drive Results – Alan Versteeg shares his framework-based approach to sales coaching that creates lasting behavior change through deep neural pathway development, a perfect complement to the strength-based methodology discussed here.

How to Build Effective Sales Operations: David Ledgerwood breaks down the fundamentals of sales operations that support the CRM data accuracy required for strength-based coaching.

Understanding the Complete B2B Sales Process – Comprehensive guide to B2B sales process stages, essential context for understanding where your team members excel within the pipeline.

Sales Pipeline Management Strategies – Mark Osborne’s data-driven approach to doubling your pipeline while attracting the right prospects, building on the CRM insights framework.

Related Links

Connect with John Golden:

- LinkedIn Profile

- John Golden on X

- Pipeliner Sales

- Sales POP (1,500+ sales interviews)

Books by John Golden:

- “Winning the Battle for Sales: Lessons on Closing Every Deal from the World’s Greatest Military Victories”

- “Social Upheaval: How to Win at Social Selling”

Stop Trying to Fix Everyone

The companies that improve sales team performance fastest aren’t running the most training programs. They’re building systems that let people operate in their natural strength zones.

Your CRM already knows where each rep excels. Stage-by-stage conversion data reveals patterns that months of observation might miss. The question is whether you’re willing to build team structures based on the data rather than forcing everyone into identical roles.

This isn’t about lowering standards or accepting mediocrity. It’s about recognizing that excellence looks different for different people, and your job as a sales leader is to orchestrate those differences into team performance that exceeds what any individual could achieve.

Whether you’re building this capability in-house or working with specialists who understand systematic approaches to sales leadership, the foundation remains the same: stop fixing weaknesses and start amplifying strengths. Your CRM will show you exactly where to focus.

The 90-day roadmap, the stage-specific implementation, the one-page strategy, the fundamental consistency John Golden emphasizes—these aren’t theoretical frameworks. They’re proven methodologies from someone who’s spent decades optimizing sales teams and conducting 1,500+ interviews with top performers.

Your move is simple. Pull your pipeline data this week. Identify your team’s real strength zones. Build your coaching plan around what’s already working.

The reps you thought needed fixing might just need the right partner.

Some topics we explore in this episode include:

Listen to the episode.

Subscribe to & Review the Predictable B2B Success Podcast

Thanks for tuning into this week’s Predictable B2B Podcast episode! If the information from our interviews has helped your business journey, please visit Apple Podcasts, subscribe to the show, and leave us an honest review.

Your reviews and feedback will not only help me continue to deliver great, helpful content but also help me reach even more amazing founders and executives like you!