Last Updated: December 2025

Table of Contents

Guest Expert Introduction

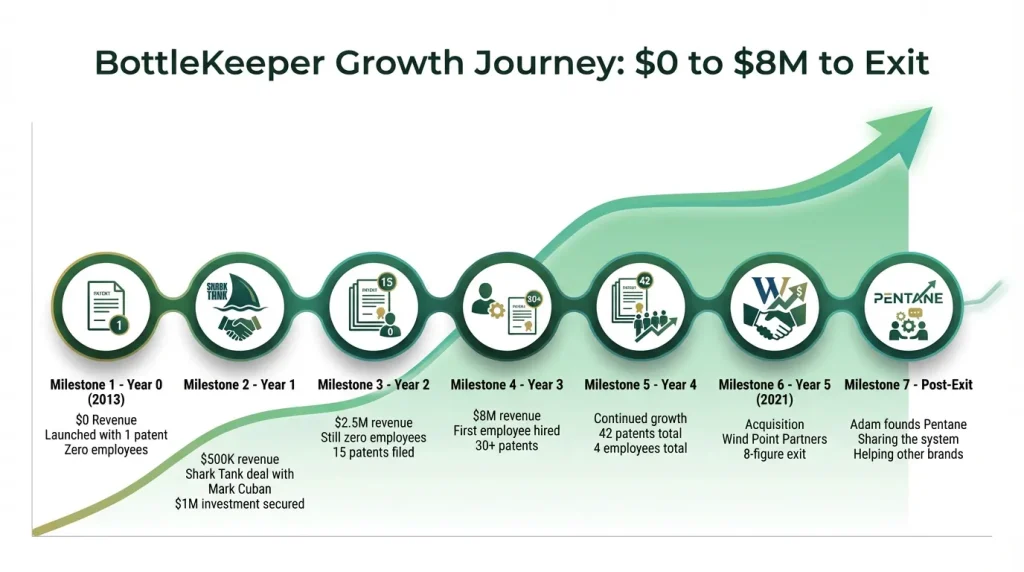

Adam Callinan is a proven entrepreneur who built BottleKeeper, a consumer product brand, from zero to eight figures in revenue without taking on debt, investors, or even hiring employees for the first three years.

After successfully exiting to Wind Point Partners in 2021, Adam founded Pentane, a profitability-focused software platform designed to help e-commerce brands make data-driven decisions. With over a decade of entrepreneurial experience spanning consumer products, technology, and medical devices, Adam brings hard-won insights into building lean, profitable businesses. His approach, featured on Shark Tank where he secured a $1 million investment from Mark Cuban and Lori Greiner, combines analytical rigor with operational discipline to achieve sustainable growth without the typical startup overhead.

About This Episode

KEY STATISTICS:

82% of startups fail due to cashflow problems. Only 40% of funded startups reach profitability. The median B2B SaaS burn rate gives just 12 months of runway. 65% of Series A companies never achieve sustainable unit economics.

Most Funded Startups Are Committing Financial Suicide

Stop me if you’ve heard this one before.

A startup raises a Series A. Immediately hires 15 people. Rents a fancy office. Adds unlimited PTO, catered lunches, and a ping-pong table. Six months later, they’re scrambling for a bridge round because revenue didn’t magically keep pace with their burn rate.

This isn’t the exception. It’s the rule.

82% of startups fail due to cash flow problems. Not product-market fit. Not competition. Not market timing.

Cash flow.

Most funded companies treat revenue growth and profitability as mutually exclusive. They’re wrong. And their bank accounts prove it.

Adam Callinan proved the opposite. He grew BottleKeeper from $0 to $8 million in the first three years with zero employees, zero investors, and zero debt. The company was eventually acquired in 2021 at eight figures in revenue with just four employees and over 40 patents.

Not by luck.

By math.

“We weren’t lucky,” Adam states flatly. “We knew exactly what we were doing, how we were doing it, and why because we dialed in a math-based system that became our source of truth.”

While competitors were raising rounds and building teams, Adam was building spreadsheets and tracking every dollar with obsessive precision. When they were hoping revenue would catch up to expenses, he was making intentional decisions based on data.

Their companies failed. His got acquired.

The difference? He understood something most founders ignore: you can’t expense your way to profitability.

The Silent Killer: How “Adding Weight” Destroys More Companies Than Competition

Here’s what kills early-stage companies faster than anything else.

Not competition. Not market shifts. Not technology disruption.

Frivolous expense addition.

Companies fail because founders add $20,000 in new payroll, then discover six weeks later in their P&L that revenue didn’t keep pace. The result? They’re completely underwater. Surprised. Desperate.

Adam calls this “adding weight” to your business. And it’s fatal.

“Companies get into trouble when they add weight via payroll, health insurance, 401k benefits in a vacuum,” Adam explains. “They don’t understand the impact, negative or positive, those expenses are gonna have on the business.”

Think about that. These founders know their product. They know their market. They might even know their customer.

But they don’t know their math.

They hire before they should. They rent offices they don’t need. They add perks that impress other founders but drain cash faster than leaky pipes.

At BottleKeeper, Adam and his co-founder, Matt Campbell, strategized to add as few fixed expenses as possible. They were “very intentional” with every dollar spent.

They tracked everything. Calculated constantly. Revisited expense types daily.

The foundation of their company wasn’t the insulated bottle they were selling. It was the operational expense clarity that allowed them to intentionally pull levers inside the business to drive net profit.

“We really excelled at understanding how the company spent money,” Adam shares. “At BottleKeeper, we calculated various expense types then tracked, watched, and revisited them constantly in order to ensure we were working with accurate information.”

This isn’t sexy. It won’t get you headlines in TechCrunch. It won’t make for compelling investor pitches.

But it will keep you alive when everyone else is dying.

EXPERT INSIGHT FROM VINAY:

After interviewing 500+ B2B tech CEOs on the Predictable B2B Success podcast, I’ve seen this pattern repeatedly. The companies that scale efficiently track their numbers obsessively. The ones that burn through runway? They’re operating on hope, not data. In B2B growth marketing, this discipline separates winners from cautionary tales.

Hope Is Not a Strategy (But It’s What Most Startups Run On)

Early-stage companies operate on hope more than they’d like to admit.

Hope that the next hire will fix things. Hope that revenue will catch up. Hope the market shifts in their favor. Hope that the problem will solve itself.

Hope is not a strategy.

Adam’s approach eliminates hope entirely.

“Profitability isn’t a mystery. It doesn’t happen by luck,” he states. “The companies that go and operate really profitable businesses don’t do that by luck. They do that by intention.”

After BottleKeeper’s acquisition, Adam helped two companies his wife and he had invested in. Both suffered from the same problem: a lack of data and clarity on how to operate.

They honestly had no idea how to make money.

This is shockingly normal for early-stage companies with sub-$20 million in revenue. But when Adam built the data system internally at BottleKeeper to solve their own problems, they gained the clarity needed to operate with intention and achieve profitability goals deliberately.

“That’s a pretty amazing position to get to as an early-stage brand where we have a tendency to rely a lot more on hope,” Adam notes.

That system eventually became Pentane, the software platform he now offers to other consumer brands facing similar challenges.

The process is straightforward:

First: Set the outcome you’re working to achieve. Get specific. Not “grow revenue.” But “achieve 40% gross margin at $5M annual revenue with 15% net profit.”

Second: Work backward from that outcome using math and structure. Remove emotion. What revenue do you need? At what price points? With what customer acquisition costs? What fixed expenses can you afford?

Third: Track obsessively. Build systems that show you real-time clarity on unit economics. See what’s working and what isn’t.

Fourth: Adjust based on data, not feelings. Let numbers drive decisions.

“You need to be able to see what is happening so that you can tweak,” Adam emphasizes. “But you have to start with a destination. You have to first know where you’re trying to go.”

This is how you replace hope with intention. Math with emotion. Luck with design.

And it’s how you build businesses that actually work.

The Three Expense Categories That Determine Survival or Death

Understanding your expenses isn’t optional. It’s existential.

At BottleKeeper, Adam categorized every expense into three types, then tracked, watched, and revisited them constantly.

He built massive spreadsheets that required manually updating 27 cells every single day to create the visual they needed. Every. Single. Day.

They tried building the system on NetSuite. Disaster.

They tried Salesforce and Diorama. Total disaster.

They always went back to spreadsheets because they needed real-time clarity on exactly how money flowed through the business.

This wasn’t busywork. This was survival work.

The Three Critical Expense Categories:

1. Fixed Operating Expenses

Payroll, rent, insurance, software subscriptions. The weight that never goes away, regardless of revenue. The killer of most early-stage companies.

2. Variable Costs

Manufacturing, shipping, and credit card fees. Costs that scale with revenue but must be tracked precisely to understand true margins.

3. Marketing and Customer Acquisition

Ad spend, promotional costs, referral incentives. The lever you can pull to drive growth once you understand your unit economics intentionally.

“We weren’t operating the business blind,” Adam explains. “We were very intentional with how we spent advertising dollars. We were very intentional with how we added expenses, namely operating expenses or fixed expenses into the business, or in many cases did not.”

This obsessive tracking paid off spectacularly.

While competitors operated blindly, hoping things would work out, Adam knew precisely what advertising spend would generate what return. He knew exactly when they could afford to add an expense and when they couldn’t.

He could pull specific levers to move from the current state to the desired profitability.

That’s not luck. That’s math.

ACTIONABLE FRAMEWORK – YOUR FIRST STEP TODAY:

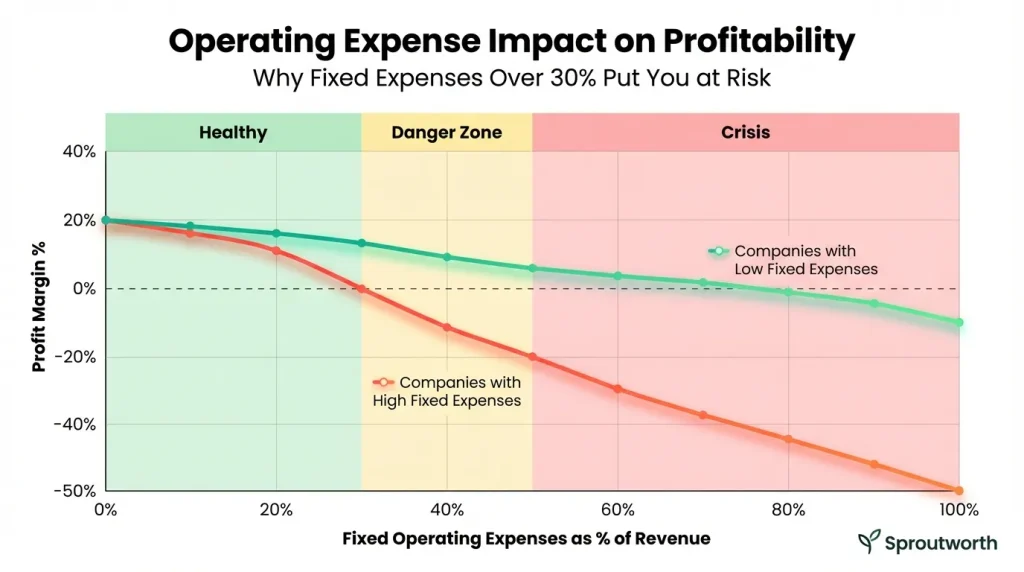

Open a spreadsheet. List every single expense your company has. Categorize each one as Fixed, Variable, or Marketing. Calculate each as a percentage of current monthly revenue. If fixed expenses exceed 30% of revenue, you’re already in danger. If they exceed 50%, you’re in crisis. Take action now.

For B2B brands facing similar challenges, this level of financial discipline separates companies that scale efficiently from those that burn through runway.

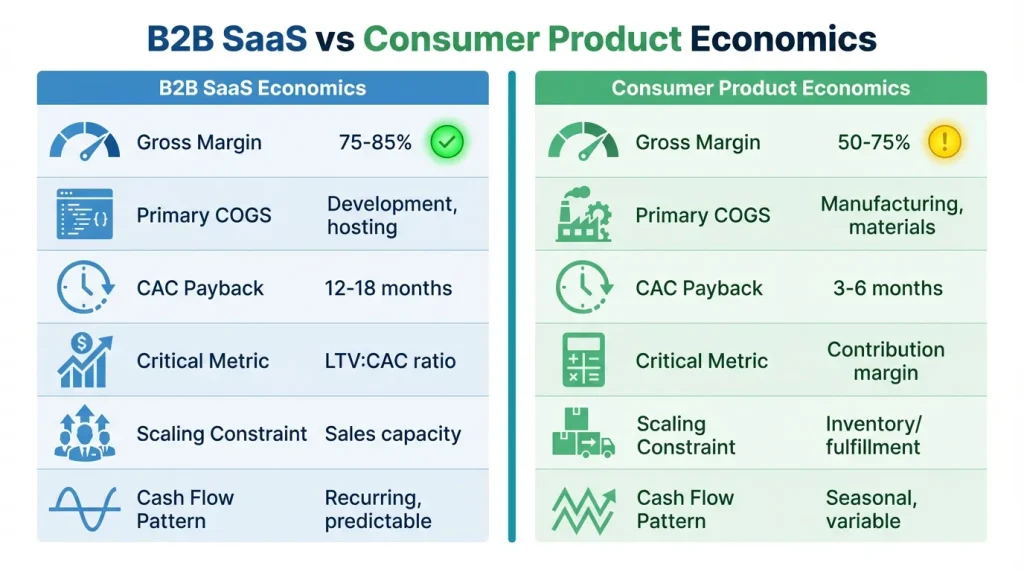

Why B2B and Consumer Economics Are Radically Different (And Why It Matters)

Here’s what most founders miss.

B2B brands and consumer products operate under entirely different economic models. Mix up the two, and you’ll make decisions that destroy your business.

In B2B SaaS, your cost of goods is largely driven by development. Not nothing, but relative to revenues, it is dramatically different than consumer product gross margins.

A strong gross margin in consumer products is 75-80%. Sounds great until you realize what comes next.

You have to ship the product. Pay credit card fees. Advertise the product. Handle returns. Manage inventory. Deal with seasonality.

Each layer eats into that margin like termites in wooden beams.

In B2B SaaS, the math changes entirely. You spend more time building pipelines. LTV becomes exponentially more critical. Customer acquisition happens differently. Sales cycles stretch longer. Complexity compounds faster.

“The marginal structures in those two companies are entirely different,” Adam explains. “In B2B SaaS, you have to spend more time building out pipelines and LTV becomes a much more critical component.”

But here’s the fundamental truth that applies to both:

Understand your unit economics before scaling.

Too many B2B companies add headcount, assuming revenue will follow. They hire sales teams before validating their sales process. They build features before understanding which features actually drive retention and expansion.

The result? Negative unit economics that compound as they scale.

Each new customer actually costs them money. They’re essentially paying people to use their product. This isn’t a business. It’s an expensive hobby funded by investors.

This is where creating a predictable revenue stream becomes critical. You need systems that allow you to forecast with confidence, not hope.

B2B SaaS vs Consumer Product Economics

| Metric | B2B SaaS | Consumer Product |

|---|---|---|

| Typical Gross Margin | 75-85% | 50-75% |

| Primary COGS | Development, hosting | Manufacturing, materials |

| CAC Payback Period | 12-18 months | 3-6 months |

| Critical Metric | LTV:CAC ratio | Contribution margin |

| Scaling Constraint | Sales capacity | Inventory/fulfillment |

| Cash Flow Pattern | Recurring, predictable | Seasonal, variable |

Understanding these differences isn’t academic. It’s operational. It determines which levers you can pull and when.

How BottleKeeper Built a Competitive Moat With 42 Patents (Without Burning Cash)

Creating a moat is essential. But it doesn’t require burning millions in VC money.

At BottleKeeper, the moat was intellectual property. What started as one patent that took three years to get turned into 42 patents by acquisition.

One patent. To 42 patents.

That wasn’t accidental. That was strategic.

“Picking the right intellectual property firm to execute strategy like that, that you can afford is a whole other discussion,” Adam notes. “But it’s really important and was a big part of the outcome that we had.”

Here’s what most founders miss about IP strategy: patents aren’t just legal protection. They’re valuation drivers.

Those 42 patents made BottleKeeper dramatically more attractive for acquisition. They created defensible positioning in a market where knockoffs appear within weeks of any successful product.

“We’re sending out cease and desists on a weekly basis now, where people are calling the fake knockoff product BottleKeeper, which is a trademarked name,” Adam explains. “We can stop those types of things.”

But moats look different depending on your business model.

For software companies like Pentane, the competitive advantage comes from what you do with information, not just providing information. This massively differentiates their approach from other analytics or business intelligence systems.

“It’s not just taking and calculating the data, it’s telling you specifically what to go and do with it from the standpoint of an operator that’s been in your shoes,” Adam emphasizes.

Today, Adam can code using ChatGPT as a non-developer. He can build incredible things for consumer sites in minutes. This accessibility means competition will intensify.

The moat now comes from operational expertise embedded in the product, not just the technology itself.

Additionally, API partnerships create inherent barriers. “You have to have an actual company go in and create accounts with Google and go through the whole developer analytics process,” Adam explains. “It is a freaking nightmare getting APIs.”

This reality creates a moat that will last at least a couple of years, even with AI advancement. But software companies need to think about this constantly because AI is democratizing development at breakneck speed.

For B2B brands, moats might be different: proprietary data, unique positioning, specialized expertise, or thought leadership that establishes category dominance.

The principle remains: build defensibility without burning cash.

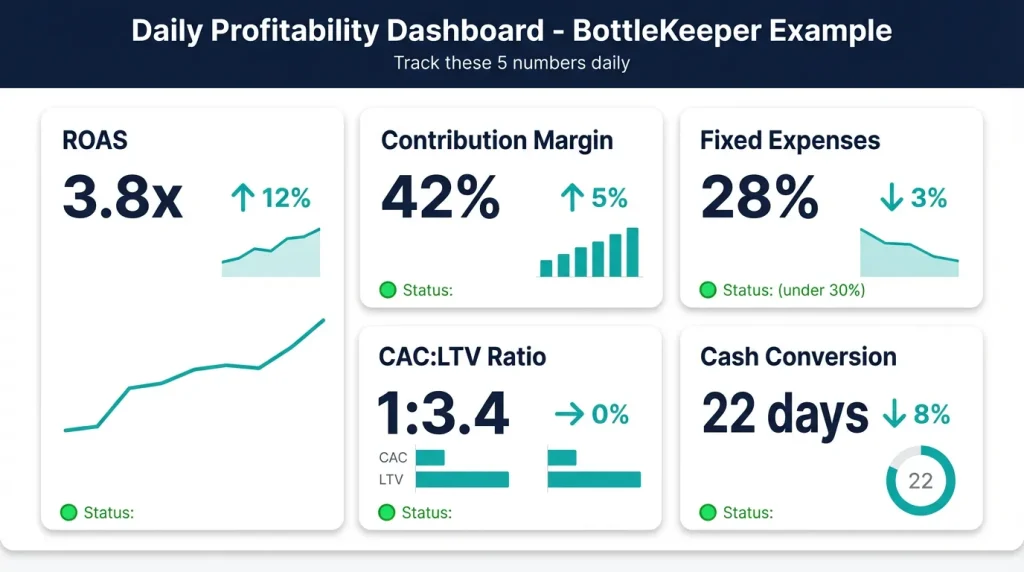

The Five Critical Numbers Every Profitable Business Tracks Daily (Not Weekly)

Most founders track too many metrics. A dashboard with 47 KPIs tells you nothing.

At BottleKeeper, Adam tracked specific numbers religiously. Not weekly. Daily.

These weren’t vanity metrics or nice-to-know data points. They were survival metrics. The levers that determined whether the business lived or died.

The Five Non-Negotiable Numbers:

1. Advertising Spend to Revenue Ratio

Know exactly what ROAS (return on ad spend) you need to hit profitability targets. If performance drops below threshold, adjust immediately. Not next week. Today.

At BottleKeeper, they knew their magic number. When ROAS dipped below it, alarms went off. Literally.

2. Contribution Margin After All Variable Costs

Not just gross margin. The actual dollars remaining after you account for shipping, credit card fees, advertising, and every other variable cost.

This number tells you if you’re actually making money on each transaction or just pretending to.

3. Fixed Operating Expenses as Percentage of Revenue

This ratio determines how quickly you drown when revenue dips.

If fixed expenses are 30% of revenue, a 20% revenue drop is painful. If they’re 70% of revenue, that same 20% drop kills you.

The lower this percentage, the more resilient your business.

4. Customer Acquisition Cost Relative to Lifetime Value

If CAC exceeds LTV, you’re in a death spiral. Math doesn’t care about your growth story or your vision.

Target: LTV should be at a minimum of 3x CAC for healthy businesses. Anything less and you’re gambling with borrowed time.

5. Days of Inventory and Cash Conversion Cycle

How quickly can you turn product into cash?

The faster this cycle, the less capital you need to operate. The slower, the more you’re essentially running a bank for your suppliers and fulfillment partners.

“We tracked these numbers manually every single day by updating 27 cells in a spreadsheet,” Adam shares. “It was tedious. But it was also the foundation of everything we accomplished.”

These five numbers told Adam everything he needed to know about business health. They informed every decision about hiring, advertising, product development, and strategic direction.

For B2B SaaS companies, the specific metrics differ slightly:

- Magic Number (sales efficiency)

- Net Revenue Retention

- Customer Churn vs. Logo Churn

- Burn Multiple

- Months to Payback CAC

But the principle remains: identify the five to seven numbers that truly matter, track them obsessively, and let data drive decisions.

TOOL RECOMMENDATION:

BottleKeeper used spreadsheets. Pentane now automates this. But the principle matters more than the tool. Track your five critical numbers daily. Set alerts when they move outside acceptable ranges. Review weekly with your team. This discipline alone will put you ahead of 80% of competitors.

Why Most Founders Catastrophically Underprice Their Products

Pricing is emotional. And emotion destroys profitability faster than almost anything else.

Founders consistently underprice products because they’re too close to the problem. They think about what they would pay, not what the value is actually worth to customers.

Adam admits he’s probably guilty of underpricing Pentane.

“At BottleKeeper, I would’ve paid incredible amounts of money to have access to Pentane,” he explains. “Instead, we had these massive, insane spreadsheets that we had to manually update every single day.”

If he would have paid “incredible amounts of money,” why isn’t he charging incredible amounts of money?

Emotional response.

“I want to help as many companies as I can, so it needs to be priced in a way that a company comes into it and says, ‘yeah, great, whatever,'” he explains.

This is founder disease. The desire to help, to be accessible, to not seem greedy overrides the mathematical reality of what the solution is worth.

The result? Leaving massive amounts of money on the table.

Here’s what most founders miss: customers who pay more extract more value.

They’re more committed. They take implementation more seriously. They use the product more consistently. They provide better feedback. They become better case studies.

Cheap customers are expensive customers. They churn faster. They demand more support. They complain more. They’re less likely to refer others.

Premium customers are actually cheaper to serve. They value your time. They respect your expertise. They understand what problems you’re solving.

The Better Approach:

Test pricing, like everything else. Start high, validate, then adjust based on data rather than feelings.

Measure not just conversion rates but customer success metrics. Track which price points correlate with highest retention, lowest support burden, and best referrals.

Often, you’ll discover your best customers are the ones paying the most. Not because they’re “bigger” but because they’re more committed.

For B2B brands, this is especially critical. Enterprise buyers expect premium pricing for premium solutions. Underpricing signals lower quality, not better value.

“The price will go up over time as we continue to launch features,” Adam notes. “We’ll lock existing customers into lower pricing. So there’s not some surprise at a much later date, which I always hated at BottleKeeper.”

That’s smart. Reward early adopters. But don’t mistake being early for being correct on pricing.

If your product genuinely solves a $100,000 problem, charging $5,000 isn’t generous. It’s strategic malpractice.

The Ruthless Prioritization That Separates Winners From Bankruptcy

Most companies die from saying yes too much.

Yes to every feature request. Yes to every potential customer. Yes to every growth channel. Yes to every “quick win” that promises immediate results.

This lack of focus kills momentum faster than anything else. You end up doing ten things poorly instead of three things excellently.

At BottleKeeper, ruthless prioritization was non-negotiable.

They strategized to do “as little as possible” when adding fixed expenses. They didn’t hire until absolutely necessary. They automated everything they could.

This forced creativity. When you can’t throw bodies at problems, you find elegant solutions. You build better systems. You focus on high-leverage activities.

But even Adam admits mistakes.

“Slower product innovation was a mistake,” he shares. “It eventually led to new products but was not fast enough.”

Here’s the nuance: the solution isn’t saying yes to every product idea. It’s ruthlessly prioritizing the products that serve your core customers best and saying no to everything else.

For B2B founders, this means defining your ICP (ideal customer profile) with surgical precision, then only building for them.

Stop trying to serve everyone. Pick a niche, dominate it, then expand.

The Prioritization Framework:

Every potential initiative should answer three questions:

1. Does this directly support our path to profitability?

If no, it’s eliminated. Immediately. No discussion.

2. Can this be automated or outsourced?

If yes, don’t hire for it. Build a system or find a contractor.

3. Does this serve our core ICP or distract from it?

If it distracts, say no. Even if it’s a “good opportunity.” Especially if it’s a “good opportunity.”

“Companies get into trouble when they add weight via operating expenses without understanding the impact those expenses are gonna have on the business,” Adam emphasizes.

The same principle applies to time. Adding initiatives without understanding the time cost is just as deadly as adding expenses without understanding the financial cost.

Your attention is finite. Your team’s capacity is finite. Your runway is finite.

Everything you say yes to means saying no to something else. Choose wisely.

FOUNDER REFLECTION FROM VINAY:

In working with B2B tech startups through ghostwriting and content strategy, I’ve seen this repeatedly. The companies that scale efficiently have crystal-clear ideal customer profiles. They know exactly who they serve and ruthlessly say no to everyone else. The ones that struggle? They’re trying to be everything to everyone. Focus isn’t just strategy. It’s survival.

What Never Changes: Operating a Healthy Business Is Never a Bad Decision

When asked what won’t change in the future, Adam’s answer cuts through every trend, every hype cycle, every “new paradigm.”

“Operating a healthy business is never going to be a bad thing.”

This seems obvious. Yet most founders ignore it entirely.

They chase growth metrics that impress investors while ignoring unit economics. They optimize for headlines rather than profitability. They burn cash like it’s infinite because “growth solves everything.”

It doesn’t.

The companies that survive market cycles, funding winters, and competitive threats are the ones built on healthy foundations.

They can weather storms because they’re not bleeding cash during good times. They have options because they’re not desperate. They can make strategic decisions because they’re not in survival mode.

“Even in the days when cash is free, like in 2019, 2020, 2021 where there was so much money in the system and companies were going out and raising crazy, insane valuation rounds,” Adam observes. “They’re hurting right now. They’re going and raising down rounds because they didn’t focus on being profitable.”

The companies that focused on profitability? They’re still raising. But from positions of strength, not desperation.

“Had they focused on being profitable, they’d still be able to go and raise the round that they’re trying to raise,” Adam notes. “If we can at least just focus on creating a healthy company first, all of the rest of that becomes dramatically easier.”

This is the unsexy truth that gets ignored in favor of “growth hacking” and “scaling fast.”

But it’s the truth that determines which companies still exist in five years and which become cautionary tales in blog posts like this one.

What “Healthy Business” Actually Means:

- Unit economics that work without hypothetical scale

- Contribution margins that support actual operations

- Customer acquisition costs below lifetime value

- Cash flow positive or clear path to profitability

- Burn rate that gives real runway, not imaginary runway

- Pricing that reflects value, not founder guilt

You can still raise money to grow into the next thing, launch the next product, or enter the next market. But doing it on the back of a healthy business makes everything easier.

“You can still go and raise to grow into the next thing, to get to the next step, to launch the next product, to go into the next market. Raise money for that,” Adam emphasizes. “But doing it on the back of a healthy business just makes it so much easier.”

Financial health creates optionality. Financial distress eliminates it.

Choose wisely.

How Educational Content Drives Profitable Growth (Without Feeling Like Marketing)

For B2B tech companies from seed to Series C, content marketing isn’t optional. It’s oxygen.

But most content fails spectacularly because it’s generic AI-generated fluff that could apply to any company in any industry.

It lacks the specificity and expertise that C-suite executives actually value.

This is where educational content becomes a competitive weapon. When you combine operational expertise with strategic content distribution, you create compounding assets that work while you sleep.

The key is providing genuine value without expecting immediate return.

Build trust through education, not pitching. Answer the questions your prospects are actually asking. Share the frameworks you use internally. Give away your best insights freely.

This feels counterintuitive. Won’t competitors steal your ideas? Won’t prospects take your advice and implement it themselves?

Sometimes. But here’s what actually happens:

Most prospects lack execution capacity, not information. They know what they should do. They need someone to do it with them or for them.

Educational content establishes expertise. When you explain complex concepts clearly, prospects think “If they can explain it this clearly, imagine how well they can execute it.”

Giving away insights creates reciprocity. People want to work with those who’ve already helped them. Educational content is help at scale.

For funded B2B tech startups struggling with sustainable unit economics, this is often the missing piece.

They pour budget into ads and outbound without building the foundational content assets that reduce acquisition cost and increase lifetime value.

Educational email courses, specifically, can help B2B brands establish authority while nurturing prospects with valuable insights.

Structure them to address specific pain points identified in customer research. Provide solutions that naturally lead to your product or service. The sequential nature builds trust over time, making them particularly effective for complex B2B sales cycles.

According to research, B2B content marketing typically converts at 1.1 to 2.4%, with top performers achieving 5.31% or higher. The difference? Strong viewpoints, personal expertise, readable formatting, and solid evidence.

That’s the VIBE framework in action. That’s how you create content that drives profitable growth.

CONTENT STRATEGY TIP:

Most B2B tech companies create content about what they do. Winners create content about what their customers struggle with. Shift from “Here’s our product features” to “Here’s how to solve your specific problem.” Make half your content applicable even if they never buy from you. That generosity converts at rates generic content can’t touch.

Your Profitable Growth Action Plan: What to Do Monday Morning

The profitable growth strategy Adam used at BottleKeeper isn’t complicated. It’s disciplined.

Here’s your implementation roadmap:

Week 1: Establish Your Destination

Set your specific profitability target. Not vague goals. Concrete numbers.

What gross margin? What operating margin? What revenue? By when?

Write it down. Share it with your team. Make it non-negotiable.

Week 2: Build Your Tracking System

Create spreadsheets that track your five critical numbers in real-time.

Yes, it’s tedious. Yes, you’ll need to update them regularly. But this visibility is non-negotiable for intentional profitability.

Start simple. Track daily. Refine weekly.

Week 3: Categorize Every Expense

List every single expense your company has. Categorize each as Fixed, Variable, or Marketing.

Calculate each as a percentage of current monthly revenue. If fixed expenses exceed 30%, you’re in danger. If they exceed 50%, you’re in crisis.

Week 4: Test and Measure

Remove emotional decision-making. Set hypotheses. Run experiments with controlled variables. Let data answer questions.

Test pricing. Test channels. Test messaging. Test everything.

Ongoing: Prioritize Ruthlessly

Say no to anything that doesn’t directly support your profitability path.

This includes hiring, features, marketing channels, and customers. Yes, customers. Not all revenue is good revenue.

“The line is gonna zig and it’s gonna zag, and you’re gonna have to tweak,” Adam notes. “But you need to be able to see what is happening so that you can tweak.”

For B2B tech founders specifically, combine financial discipline with strategic content marketing. Build the educational assets that reduce acquisition costs. Develop the thought leadership that shortens sales cycles. Create the systems that allow you to scale efficiently.

And if you’re in cleantech or environmental services, remember that the same principles apply. Sustainability in your business model enables sustainability in your mission.

Frequently Asked Questions About Profitable Growth Strategy

Q: Can you really grow profitably without VC funding?

Yes. Adam Callinan grew BottleKeeper from $0 to $8M in three years with no outside funding. The key is ruthless expense management, obsessive tracking of unit economics, and intentional decision-making based on data rather than hope. VC funding can accelerate growth, but it’s not required for profitability. The profitable growth strategy focuses on building sustainable unit economics from day one.

Q: What’s the difference between revenue growth and profitable growth?

Revenue growth is increasing sales regardless of profitability. Profitable growth means increasing revenue while maintaining or improving profit margins. Many startups achieve revenue growth by spending $2 to make $1, which leads to eventual failure. A profitable growth strategy requires positive unit economics from the start, ensuring every dollar of revenue contributes meaningfully to the bottom line.

Q: How much should startups spend on fixed operating expenses?

As a rule of thumb, fixed operating expenses should not exceed 30% of revenue for healthy businesses. If they exceed 50%, you’re in dangerous territory. Adam kept BottleKeeper’s fixed expenses minimal by delaying hiring, automating processes, and ruthlessly prioritizing only essential expenses. This is a cornerstone of any effective profitable growth strategy.

Q: What are the most important metrics for profitable growth?

The five critical metrics are:

(1) Advertising spend to revenue ratio,

(2) Contribution margin after all variable costs,

(3) Fixed operating expenses as a percentage of revenue,

(4) Customer acquisition cost relative to lifetime value, and

(5) Cash conversion cycle. Track these daily, not weekly, as part of your profitable growth strategy.

Q: How do B2B and consumer product economics differ?

B2B SaaS typically has 75-85% gross margins with costs concentrated in development and sales. Consumer products have 50-75% gross margins with costs in manufacturing, shipping, and inventory. B2B focuses on LTV:CAC ratios and longer sales cycles, while consumer products focus on contribution margins and faster cash conversion. Understanding these differences is crucial to implementing the right profitable-growth strategy for your business model.

Q: Should I underprice to gain market share?

No. Underpricing often backfires because

(1) it signals lower quality,

(2) customers who pay less extract less value and churn faster, and

(3) you leave money on the table that could fund growth.

Test pricing scientifically and charge what your value is worth, not what you think customers might pay. Strategic pricing is essential to a successful, profitable growth strategy.

Q: How did BottleKeeper compete without a huge marketing budget?

Through intellectual property (42 patents), product quality, strategic pricing, and a referral program that gave customers free products for referrals. They focused on creating genuine value and letting customers become advocates rather than burning cash on paid advertising alone. This efficient approach exemplifies a lean profitable growth strategy.

Q: What’s the biggest mistake founders make with expenses?

Adding fixed expenses in a vacuum without understanding their impact on the business. Founders hire people, rent offices, or add benefits, assuming revenue will keep pace. Six weeks later, their P&L shows they’re underwater. Always calculate the full cost impact before adding weight to your business. This is the most common pitfall that derails an otherwise sound, profitable growth strategy.

Related Resources

Want to dive deeper into profitable growth strategies and sustainable scaling? Check out these related episodes and articles from the Predictable B2B Success podcast:

- How to Use a Podcasting Strategy to Skyrocket Revenue Growth – Discover how strategic content distribution can reduce customer acquisition costs while building authority.

- B2B Growth Marketing: Building High-Performing Tech Brands – Learn advanced tactics for scaling B2B brands efficiently without burning through runway.

- Demand Creation: How to Build Revenue Engines to Drive Growth – Explore strategies for creating self-sustaining revenue engines that generate compound interest over time.

- How to Create a Predictable Revenue Stream That Rapidly Drives Growth – Understand the critical elements needed to build predictable revenue that minimizes risk.

- B2B Buyer Psychology: Fortune 100’s $50B Strategy – Discover the psychological frameworks that drive billions in B2B revenue and why most companies are marketing to the wrong part of the brain.

- Podcast Strategy for Lead Generation: A Complete Guide – Learn how to leverage podcasting as a powerful lead generation tool for your B2B business.

Related Links

Connect with Adam Callinan and explore his work:

- LinkedIn: Adam Callinan on LinkedIn

- Pentane: https://www.pentane.com/

- Twitter: @Adam_Callinan

The Bottom Line on Profitable Growth Strategy

The path from $0 to $8M without debt or VC isn’t mysterious.

It’s mathematical.

Adam Callinan’s success with BottleKeeper came from obsessive expense tracking, ruthless prioritization, and removing emotion from business decisions. He built systems that provided real-time clarity on unit economics, then used that clarity to pull the right levers at the right times.

For B2B tech founders from seed to Series C, the lesson is clear: a profitable growth strategy doesn’t mean being growth-adverse. It means building sustainable foundations that enable aggressive scaling when the time is right.

Stop relying on hope. Start relying on math.

Track the five critical numbers that determine business health. Say no to expenses that don’t directly drive profitable revenue. Build content assets that reduce acquisition costs over time.

And remember: running a healthy business is never a bad thing.

The companies that master this profitable growth strategy won’t just survive the next funding winter. They’ll thrive regardless of market conditions because they built businesses that actually work.

Not by luck. By intention.

Not by hoping. By tracking.

Not by guessing. By knowing.

This is the profitable growth strategy that transforms startups from cash-burning experiments into sustainable, valuable businesses. It’s the difference between becoming a statistic in the 82% who fail due to cash flow problems and joining the 40% who actually reach profitability.

The choice is yours.

Some topics we explore in this episode include:

Listen to the episode.

Subscribe to & Review the Predictable B2B Success Podcast

Thanks for tuning into this week’s Predictable B2B Podcast episode! If the information from our interviews has helped your business journey, please visit Apple Podcasts, subscribe to the show, and leave us an honest review.

Your reviews and feedback will not only help me continue to deliver great, helpful content but also help me reach even more amazing founders and executives like you!