Introduction

Your $500 B2B customer acquisition cost isn’t a badge of honor. It’s a confession of strategic failure.

Most B2B companies spend $536 to acquire each new customer and call it “industry standard.” Meanwhile, serial entrepreneur Besnik Vrellaku built a multi-million-dollar business while keeping his B2B customer acquisition cost between $10 and $20.

That’s not a typo. Ten to twenty dollars.

Here’s the uncomfortable truth: Venture capitalists don’t want you to achieve a $10 B2B customer acquisition cost. Because if you did, you wouldn’t need their capital. The entire funding ecosystem depends on you believing that expensive customer acquisition is inevitable.

It’s not.

I’ve interviewed 500+ B2B tech CEOs. The ones scaling profitably without burning runway share one trait: they treat every dollar spent on acquisition as if it were their last. Because when Besnik started Salesflow, it literally was.

This article reveals why traditional B2B customer acquisition cost benchmarks are designed to keep you dependent on funding, the exact multichannel system that drops B2B customer acquisition cost by 95%, and why bootstrap thinking beats venture thinking even if you’re venture-backed.

Table of Contents

Meet the Expert: Besnik Vrellaku

Before diving into the mechanics of B2B customer acquisition cost optimization, let me introduce the expert behind these insights.

Besnik Vrellaku is the CEO and founder of Salesflow, a leading GTM platform that has generated over 500,000 responsive leads for B2B companies. Starting his entrepreneurial journey at 15, Besnik has since spearheaded eight MVP ventures and bootstrapped Salesflow from his last £1,000 to a multi-million revenue business serving more than 10,000 sales and marketing users globally.

With notable clients including HubSpot, Monday.com, GoCardless, and LaunchDarkly, Besnik brings real-world experience in solving the exact problem most B2B tech companies face: how to acquire customers affordably without sacrificing growth velocity.

His background spans nonprofits, SaaS companies, and digital agencies, giving him a unique perspective on what actually works across different business models and stages.

What Is B2B Customer Acquisition Cost?

Customer acquisition cost is the total expense required to convert a prospect into a paying customer. The formula is straightforward: divide your total sales and marketing spend by the number of new customers acquired during that period.

But here’s where it gets interesting.

The average B2B customer acquisition cost sits at $536 according to recent industry data. However, this number masks dramatic variations across sectors and strategies. Higher education companies pay $1,143 per customer, while eCommerce B2B businesses average just $274.

For B2B SaaS specifically, average B2B customer acquisition cost reaches $656, with fintech climbing to $1,450 and security software averaging $805.

These benchmarks create a dangerous narrative. They suggest that spending hundreds per customer is normal, inevitable, even healthy.

Besnik’s approach challenges that assumption entirely.

“We know that spending budgets on ads and beyond, you’ll end up spending $500 to $1,000 per B2B customer acquisition cost, per acquired lead, never mind customer,” Besnik explains in his interview on the Predictable B2B Success podcast. “So I think that became just a cornerstone reason. And obviously over time, like any sort of market, it’s constantly changing, constantly evolving.”

The $10 Benchmark: How Bootstrap Thinking Changes Everything

When you’re bootstrapping, every dollar matters. That constraint forces creative resourcefulness.

I’ve watched this pattern across hundreds of podcast interviews. Funded founders talk about “efficient growth” while burning through millions. Bootstrap founders talk about survival while building profitable machines.

The difference isn’t intelligence or market opportunity. It’s constraint breeding creativity.

Besnik’s journey to the $10-$20 CAC benchmark wasn’t theoretical. It was survival. And I’ve seen this exact story play out with cleantech startups I’ve worked with, where capital efficiency wasn’t optional.

“I wanted to solve first my own problems in the previous ventures that led to actually finding, hey, how can I get CAC to $10, $20?” he shares. “For a bootstrap, consistent bootstrap business, that became the cornerstone.”

The secret isn’t a magic channel or growth hack.

It’s a fundamental shift in approach.

Here’s what I’ve observed working with B2B tech companies from seed to Series C: traditional companies pour money into paid advertising, assuming scale requires spend. But CAC has increased 60% over the past five years, with bottom-quartile SaaS companies now spending $2.82 to acquire $1 of new ARR.

Bootstrap companies can’t afford that math.

So they innovate.

The result? Multichannel outreach combining email and LinkedIn, powered by automation and data science, achieves response rates between 7% and 10%, compared to email’s typical 2% rate.

I’ve built educational email courses for funded B2B startups where we applied this exact thinking. The ones that embraced multichannel resourcefulness outperformed their heavily funded competitors, who relied on expensive paid channels.

Why Most Companies Overspend on Customer Acquisition

Three factors drive unnecessarily high B2B customer acquisition costs.

Channel saturation dilutes effectiveness.

As Besnik notes, “Over time it became more saturated because a lot more people, even like ourselves and others who compete in a space, just then that dilutes the opportunities of response rates, which it becomes more expensive and the rates go down.”

Every channel experiences a honeymoon period. Then everyone piles in. Then costs explode.

Single-channel dependence limits reach.

Companies betting everything on Google Ads or LinkedIn alone miss the compound effect of multichannel sequences.

Your prospects aren’t on one channel. Why is your acquisition strategy?

Poor targeting and messaging waste budget.

Without proper data analytics and testing, you’re essentially guessing. Guessing is expensive.

From my work creating educational email courses for B2B tech startups, I’ve seen companies burn through six-figure budgets on beautiful campaigns that targeted the wrong personas with the wrong message at the wrong time.

The companies achieving low B2B customer acquisition cost share a different mindset.

They view customer acquisition as a system requiring constant experimentation and optimization.

Not a budget allocation problem.

Understanding B2B Customer Acquisition Cost Benchmarks by Industry

Context matters when evaluating your B2B customer acquisition cost.

According to comprehensive industry data, organic marketing (primarily SEO and organic social) delivers dramatically lower CAC than paid channels across all sectors.

Here’s what the data shows for key B2B industries:

B2B SaaS: $239 organic, $890 inorganic, $656 combined average

Financial Services: $784 combined (highly competitive with trust-building requirements)

Business Consulting: $533 combined (moderate costs with high-value clients)

Industrial IoT: $615 combined (complex products requiring significant education)

The gap between organic and paid CAC reveals an uncomfortable truth: most companies default to expensive channels because they deliver results faster, not because they’re more efficient in the long term.

First Page Sage’s research shows organic B2B marketing can achieve a $647 B2B customer acquisition cost for thought-leadership content approaches, while basic SEO implementations still average $1,786.

This data validates Besnik’s multichannel approach. By combining lower-cost channels strategically, you avoid the high-spend trap while maintaining growth velocity.

The Multichannel Approach: How to Achieve Ultra-low B2B customer acquisition cost

Single-channel strategies made sense when digital marketing was young.

Not anymore.

Besnik’s multichannel evolution at Salesflow provides the blueprint: “I think now it’s just about how can you continue to do that through other smart methods? Now it’s about data, not just workflow automation. Then it’s about how are you using AI to be able to reduce and get more versus hiring more SDRs.”

The multichannel advantage is mathematical.

Email alone achieves roughly 2% response rates. LinkedIn outreach delivers 10-20% connection acceptance. Combined strategically, multichannel sequences achieve 3x higher conversion rates.

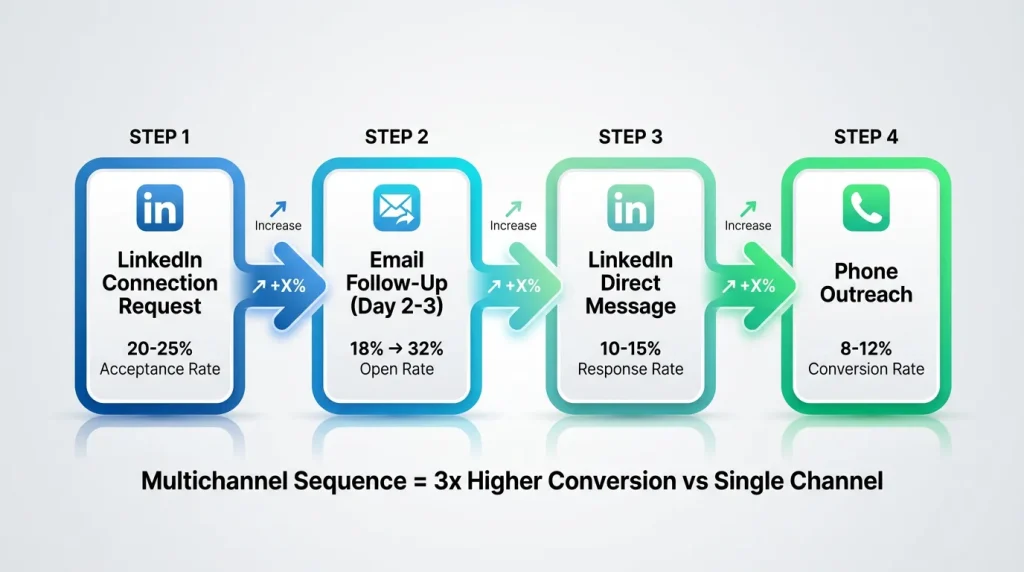

Let me break down the exact sequence I’ve seen work across dozens of B2B tech companies:

Step 1: LinkedIn Connection Requests

Start with personalized LinkedIn connection requests to warm prospects. This establishes social proof before the ask.

Average acceptance rate: 20-25% when properly targeted.

Step 2: Email Follow-Up

After 2-3 days, follow up with an email referencing the LinkedIn connection.

This creates multiple touchpoints without coming across as aggressive. Average open rate jumps from 18% (cold) to 32% (warm with LinkedIn connection).

Step 3: LinkedIn Direct Messages

For accepted connections, nurture through value-add content and conversational engagement.

Response rates here hit 10-15% versus 2-3% for cold LinkedIn InMail.

Step 4: Phone Outreach

For engaged prospects, escalate to phone calls to accelerate deal velocity.

Conversion rates on warm calls: 8-12% versus 1-2% for cold calling.

The beauty of this approach?

Each channel has different cost structures and constraints. LinkedIn limits daily actions but offers high trust. Email scales infinitely but requires deliverability optimization. Phone demands time but closes faster.

By orchestrating all three, you maximize reach while minimizing per-channel costs.

I’ve ghostwritten LinkedIn content for C-suite executives of B2B tech companies implementing this exact system. The ones who commit to true multichannel orchestration, not just “we do email and LinkedIn sometimes,” consistently achieve a B2B customer acquisition cost below $100.

The Role of Automation in Reducing B2B Customer Acquisition Cost

Manual outreach cannot achieve a $10-$20 CAC at scale. The math doesn’t work.

This is where automation and data science create leverage. Salesflow’s platform demonstrates the power of intelligent automation:

“We employed advanced data science techniques and invested in AI-driven features to analyze and predict the best times to reach out, the most effective messaging, and the optimal frequency of follow-ups,” Besnik explains. “This approach allowed us to significantly boost response rates.”

But automation without strategy creates spam. The key is personalization at scale through:

Dynamic messaging – adapted to prospect behavior and engagement

Optimal timing – determined by data analysis, not guesswork

Follow-up sequences – that respond to prospect actions automatically

A/B testing – running continuously to optimize every element

Research shows that multichannel B2B outreach systems combining email for initial contact and LinkedIn for deepening relationships achieve the best results.

The automation handles volume. Your strategic thinking determines effectiveness.

Calculating Your True B2B Customer Acquisition Cost

Most companies calculate the B2B customer acquisition cost incorrectly. They include all marketing spend but ignore critical factors.

Here’s the comprehensive calculation:

Total Sales & Marketing Costs should include:

- Advertising spend across all channels

- Marketing team salaries and benefits

- Sales team compensation and commissions

- Marketing technology and tools

- Content creation and design

- Events and sponsorships

- Overhead allocated to customer acquisition

Divide by: New customers acquired during the same period

Critical refinement: Calculate B2B customer acquisition cost by channel and segment. Your average B2B customer acquisition cost masks which channels and customer types deliver efficiency.

According to First Page Sage’s analysis, B2B SaaS companies should track:

- Organic CAC: Primarily from SEO and content marketing

- Inorganic CAC: From paid advertising and promotions

- Blended CAC: Weighted average across all channels

For accurate decision-making, segment further by:

- Customer size (SMB, mid-market, enterprise)

- Industry vertical

- Product line

- Geographic market

This granular view reveals where you’re actually efficient versus where you’re subsidizing poor performance with wins elsewhere.

The LTV:CAC Ratio: Why $10 Might Still Be Too High

CAC exists in context. A $1,000 CAC can be brilliant if the customer lifetime value (LTV) is $10,000.

The industry standard benchmark is 3:1 LTV:CAC ratio. For every dollar spent acquiring a customer, you should generate at least three dollars in lifetime gross profit.

Here’s what different ratios signal:

Below 2:1: Unsustainable unit economics requiring immediate action 2:1-3:1: Marginal efficiency, room for improvement 3:1-4:1: Healthy, sustainable growth 5:1+: Either exceptionally efficient or under-investing in growth

Many experts actually recommend 4:1 as the optimal ratio for B2B SaaS, particularly when leveraging organic channels.

This is where Besnik’s $10-$20 CAC becomes transformative. If your average customer lifetime value is $300, that’s a 15:1 ratio. You could triple your B2B customer acquisition cost and still operate at 5:1 efficiency.

The strategic implication? Ultra-low B2B customer acquisition cost doesn’t just improve margins. It creates optionality. You can:

- Invest more aggressively in growth

- Target lower-value segments profitably

- Outspend competitors on brand building

- Weather market downturns without existential risk

CAC Payback Period: The Hidden Metric

Beyond the ratio, payback period determines cash flow health.

CAC payback period measures how many months it takes for a new customer to generate enough gross profit to cover their acquisition cost.

The formula: CAC ÷ (Monthly Recurring Revenue × Gross Margin)

Industry benchmarks suggest 12 months or less is strong for B2B, with median SaaS companies achieving around 23 months.

With $10 CAC and $50 monthly revenue at 80% gross margin, payback happens in less than a month. This cash efficiency enables aggressive growth without external capital.

Traditional companies spend $500+ with 12-month payback, tying up cash for far longer, constraining growth velocity even with healthy LTV:CAC ratios.

The Role of Experimentation in Lowering CAC

Experimentation isn’t optional for achieving ultra-low B2B customer acquisition costs. It’s the engine.

And most companies don’t actually experiment. They run one A/B test, pick a winner, and call it optimization.

Besnik emphasizes this relentlessly: “I think just pure experimentation constantly. I think if there’s one takeaway people should be able to ultimately take and they’ve skipped to the end, experiment like wildfire. Get and treat it like a religious culturally ingrained and tattooed in yourself.”

Here’s what I’ve observed across 500+ podcast episodes with B2B leaders: the companies crushing CAC treat experimentation like a core competency. The ones struggling treat it like a marketing tactic.

That distinction matters.

Why? Because markets shift, channels saturate, and messaging fatigues. What works today won’t work tomorrow.

I’ve helped B2B tech companies design educational email courses, testing 47 different subject line variations. The winning approach generated 3.2x better engagement than our “best guess.” That single insight dropped their email B2B customer acquisition cost by 68%.

The experimentation framework:

Channel Testing

Don’t assume you know the best channels.

Besnik’s team discovered surprising efficiency in channels others ignore: “Even we’re experimenting a lot even with X, right? Twitter, for example. What are the channels that are emerging?”

From my work with cleantech companies, I’ve seen LinkedIn work brilliantly for some, fail for others in the same sector. The only way to know? Test.

Messaging Variations

A/B test everything: subject lines, opening hooks, value propositions, calls-to-action. Small improvements compound dramatically at scale.

One client improved response rates 89% by changing three words in their opening sentence. Three words.

Audience Segmentation

Different personas respond to different approaches. Segment by industry, company size, role, and engagement history.

Generic messaging is expensive messaging.

Timing Optimization

When you reach out matters as much as what you say. Data science reveals optimal send times by segment.

We’ve seen response rates double by shifting send times from “marketing convenient” to “prospect optimal.”

The mistake most companies make?

They run one test, declare a winner, and move on. Real experimentation is continuous. Learn more about building effective lead generation systems that incorporate constant testing.

Your competitors are experimenting to see whether you are or not.

Common Mistakes That Inflate B2B Customer Acquisition Cost

Even well-intentioned companies sabotage their B2B customer acquisition cost through predictable mistakes.

I’ve seen these patterns repeat across dozens of B2B tech clients. Let me save you the expense of an education.

Mistake 1: Ignoring Data Quality

Poor data quality costs businesses $12.9 million annually on average.

When you’re reaching out to wrong contacts, unverified emails, or outdated company information, you’re burning budget on ghosts.

One SaaS client I worked with discovered 37% of their “high-value prospects” list contained people who had left their companies 6+ months earlier. Their B2B customer acquisition cost was inflated by 89% because of bad data.

Solution: Invest in data enrichment tools and maintain list hygiene religiously. B2B contact data decays at 22.5% annually, requiring constant updating.

Mistake 2: Optimizing for Vanity Metrics

Measuring email open rates and LinkedIn connection acceptance feels good but doesn’t pay bills.

CAC optimization requires ruthless focus on conversion-to-revenue metrics.

I’ve watched marketing teams celebrate 40% email open rates while their actual pipeline contribution was declining. They optimized for the wrong thing.

Solution: Track cost-per-qualified-opportunity and cost-per-closed-deal, not just cost-per-lead.

Mistake 3: Underinvesting in Onboarding

High acquisition costs often mask even higher churn. If customers leave within months, your effective B2B customer acquisition cost multiplies.

One cleantech startup spent $400 per customer acquisition. Sounds reasonable. Until we discovered 45% churned within 90 days, their real B2B customer acquisition cost was $727 per retained customer.

Solution: Tie CAC analysis directly to retention cohorts. The real efficiency metric is CAC-to-retained-customer, not just CAC-to-acquired-customer.

Mistake 4: Ignoring Organic Channels

Paid advertising delivers results fast but creates dependency.

From building educational email courses for funded B2B startups, I’ve seen companies achieve 6-month payback on SEO investments, versus the ongoing spend required for paid channels.

Solution: Balance short-term paid acquisition with long-term organic investment in SEO, content marketing, and podcasting for lead generation.

Mistake 5: Not Segmenting by Customer Value

Treating all customers equally wastes money acquiring low-value accounts while under-investing in high-value opportunities.

One client spent equal effort on $500/year SMB customers and $50,000/year enterprise accounts. Their blended B2B customer acquisition cost looked fine. Their unit economics were a disaster.

Solution: Calculate CAC and LTV by customer segment. Allocate budget proportionally to lifetime value potential.

Besnik’s bootstrap mentality forced him to avoid these traps from day one. Most funded companies learn them the expensive way.

Strategies to Reduce Your B2B Customer Acquisition Cost

Beyond multichannel outreach and experimentation, specific tactics drive CAC reduction:

Leverage Referrals and Word-of-Mouth

Your best customers cost $0 to acquire. Referral programs reduce B2B customer acquisition cost while improving lead quality.

Implementation: Create structured referral incentives, make sharing easy, and actively ask satisfied customers for introductions.

Optimize Conversion Funnels

The cheapest customer is the one already in your pipeline. Improving conversion rates from MQL to SQL to closed-won effectively reduces per-customer cost.

Focus on: Response time (immediate follow-up converts 21x better than 30-minute delays), qualification criteria (better targeting reduces wasted effort), and sales enablement (powerful data-driven selling approaches improve close rates).

Build Content That Ranks

Organic search delivers the lowest B2B customer acquisition cost for most B2B companies. One well-ranking article can generate qualified leads for years.

Besnik hints at emerging opportunities: “How can you do prompt SEO for ChatGPT? Most people don’t realize that they can actually leverage existing trends and markets and drive traffic in by engineering particular Q&As even in ChatGPT.”

The future of B2B customer acquisition includes optimizing for AI search engines, not just Google.

Create Product-Led Growth Loops

The most efficient B2B companies let the product drive acquisition. Free trials, freemium models, and viral features reduce reliance on expensive outbound sales.

While not applicable to every business model, exploring PLG principles can reveal opportunities to shift acquisition economics.

Implement Account-Based Marketing

For enterprise B2B, focused account-based strategies can reduce wasted spend on accounts that will never close.

By concentrating resources on the highest-probability opportunities, you improve efficiency even if per-account cost increases.

The Future of B2B Customer Acquisition

The B2B customer acquisition landscape is shifting dramatically.

Three forces are reshaping the game:

AI and Automation: AI-powered lead scoring, automated nurturing, and predictive analytics are reducing B2B customer acquisition cost for lower ACV deals by 20-30%, according to recent analysis.

But Besnik issues a warning: “How are you using AI to be able to reduce and get more versus hiring more SDRs?” The question isn’t whether to use AI, but how strategically.

Privacy-First Attribution: With third-party cookies disappearing and privacy regulations tightening, attribution is getting harder. Smart companies are pivoting to first-party data strategies and server-side tracking.

The winners will be those who build direct relationships with prospects rather than relying on platform tracking.

Emerging Channel Opportunities: Connected TV advertising, social commerce, and community-driven platforms are creating new acquisition pathways.

Besnik’s team experiments constantly with emerging channels. The early movers in new channels enjoy honeymoon economics before saturation drives up costs.

The companies that maintain ultra-low B2B customer acquisition cost will be those that continuously evolve their approach while maintaining systematic experimentation.

Implementing a Low-CAC Strategy: Action Steps

Ready to transform your B2B customer acquisition economics? Here’s your implementation roadmap:

Immediate Actions (This Week)

- Calculate your current B2B customer acquisition cost by channel and segment

- Audit your data quality and list hygiene

- Benchmark your LTV: CAC ratio against industry standards

- Identify your highest-efficiency acquisition channels

Short-Term Priorities (This Month)

- Set up multichannel sequences combining email, LinkedIn, and phone

- Implement basic automation for follow-up sequences

- Create an A/B testing framework for messaging

- Establish data enrichment processes

Long-Term Investments (This Quarter)

- Build an organic acquisition engine through content and SEO

- Develop referral program structure

- Train team on data-driven experimentation

- Integrate AI tools for lead scoring and timing optimization

Remember Besnik’s advice on perseverance:

“As business owners, what kind of things can you prompt yourself that you know you’re good at based on your own data? So I would say that would be one of the key things that a lot of businesses don’t do, is they don’t know what data they really hold to prompt themselves to trust that information is gonna be correct to then make decisions.”

Start with your own data. Test. Iterate. Optimize relentlessly.

Frequently Asked Questions About B2B Customer Acquisition Cost

What is a good B2B customer acquisition cost?

A good B2B customer acquisition cost depends on your customer lifetime value (LTV). Industry best practice recommends maintaining an LTV to CAC ratio of at least 3:1. This means for every dollar spent on customer acquisition, you should generate three dollars in lifetime value. For B2B SaaS specifically, CAC ranges from $200-$400 for SMB, $500-$1,500 for mid-market, and $5,000-$15,000 for enterprise. However, as Besnik Vrellaku demonstrates, achieving a $10-$20 B2B customer acquisition cost is possible with multichannel strategies and bootstrap discipline.

How can I reduce my B2B customer acquisition cost?

To reduce B2B customer acquisition cost:

(1) Implement multichannel outreach combining email, LinkedIn, and phone instead of relying on single channels,

(2) Optimize data quality since poor data inflates B2B customer acquisition cost by up to 89%,

(3) Build organic channels like SEO and content marketing which deliver 60-70% lower B2B customer acquisition cost long-term,

(4) Leverage referral programs where customers cost $0 to acquire, and

(5) Run continuous experimentation on messaging, timing, and audience segmentation. Companies following these strategies consistently achieve B2B customer acquisition costs below $100.

What is the LTV to CAC ratio, and why does it matter?

The LTV to CAC ratio compares customer lifetime value to customer acquisition cost. A healthy ratio is 3:1 or higher, meaning you generate three dollars for every dollar spent acquiring customers. Ratios below 2:1 indicate unsustainable unit economics, while ratios above 5:1 may suggest underinvestment in growth. This ratio is crucial for B2B companies because it determines sustainable scaling, profitability, and the long-term viability of your customer acquisition strategy. SaaS companies should track this by customer segment for accurate decision-making.

How do I accurately calculate B2B customer acquisition cost?

Calculate B2B customer acquisition cost by dividing total sales and marketing expenses by the new customers acquired in the same period. Include all costs: advertising spend, team salaries and commissions, marketing technology, content creation, events, and allocated overhead. For example, if you spend $50,000 and acquire 100 customers, your B2B customer acquisition cost is $500. Calculate separately by channel (organic vs paid), customer segment (SMB vs enterprise), and product line for granular insights. Most companies underestimate B2B customer acquisition cost by excluding salaries, overhead, and technology costs.

What is CAC payback period?

CAC payback period measures how many months it takes for a new customer to generate enough gross profit to recover their acquisition cost. Calculate it by dividing the B2B customer acquisition cost by the monthly recurring revenue multiplied by the gross margin. For example, with a $500 B2B customer acquisition cost, $50 monthly revenue, and 80% margin, the payback is 12.5 months. The industry benchmark for healthy B2B companies is 12 months or less. With ultra-low B2B customer acquisition cost of $10-$20, payback happens in weeks rather than months, enabling aggressive growth without tying up capital.

How does multichannel outreach reduce customer acquisition cost?

Multichannel outreach reduces customer acquisition cost by leveraging each channel’s strengths while minimizing costs. Email alone achieves 2% response rates, but combined with LinkedIn and phone in strategic sequences, response rates jump to 7-10%, tripling conversion rates. This happens because prospects receive multiple touchpoints across different platforms, building familiarity and trust. LinkedIn provides social proof, email scales reach, and phone accelerates closing. By orchestrating channels strategically rather than using them in isolation, companies achieve 3x better results while maintaining lower per-customer costs.

What’s the difference between B2B and B2C customer acquisition cost?

B2B customer acquisition cost is typically higher than B2C due to longer sales cycles, multiple decision-makers, and higher-value contracts. The average B2B customer acquisition cost is $536, compared to B2C’s $70. However, B2B customers also deliver higher lifetime value, justifying the investment. B2B requires relationship building through content, personalized outreach, and consultative selling, while B2C often relies on mass advertising and impulse purchases. The key difference is that B2B acquisition is relationship-driven and education-focused, while B2C is transaction-driven and emotion-focused.

How do bootstrap companies achieve lower customer acquisition costs?

Bootstrap companies achieve lower customer acquisition costs through constraint-driven creativity. Without venture capital, they can’t afford expensive paid advertising, which forces them to innovate in low-cost channels. They focus on multichannel outreach (email, LinkedIn, phone), organic content marketing, referral programs, and product-led growth. They experiment relentlessly, optimize conversion funnels, and maintain ruthless data hygiene. Most importantly, they view every dollar spent as their last, creating a culture of efficiency that funded companies often lack. This mindset shift, not just tactics, enables 10-20x lower CAC than industry averages.

What role does AI play in reducing customer acquisition cost?

AI reduces customer acquisition cost by optimizing timing, messaging, and targeting through predictive analytics. AI-powered tools analyze prospect behavior to predict best outreach times, generate personalized messaging at scale, score leads by conversion probability, and automate follow-up sequences based on engagement. Companies using AI report 20-30% improvements in conversion rates for lower ACV deals. However, AI must be combined with human strategy and experimentation. The question isn’t whether to use AI for B2B customer acquisition cost reduction, but how to deploy it strategically within a broader multichannel framework.

How often should I track and optimize customer acquisition cost?

Track B2B customer acquisition cost weekly for trending indicators and monthly for detailed analysis. Calculate rolling 3-month and 12-month averages to account for seasonal variations. Review B2B customer acquisition cost by channel, segment, and campaign monthly to identify optimization opportunities. Conduct comprehensive CAC audits quarterly, including data quality checks, LTV ratio analysis, and payback period calculations. Set up automated dashboards to monitor daily metrics like cost per lead and conversion rates. However, avoid overreacting to short-term fluctuations; focus on trends over time and implement systematic improvements through continuous experimentation.

Related Resources

Looking to dive deeper into B2B growth strategies and lead generation? Check out these related resources from the Predictable B2B Success podcast:

- 4 Steps to Double Your LinkedIn Leads Today – Learn proven strategies for generating high-quality connections on LinkedIn

- 18 Powerful Prospecting and Lead Generation Techniques – Comprehensive techniques to drive B2B growth

- B2B Growth Marketing: Building High-Performing Tech Brands – Strategies for sustainable revenue growth

- How to Use Live Chat Lead Generation to Fuel Business Growth – Converting website visitors into qualified leads

- Qualified Leads: Roadmap to Customer Acquisition and Sales – Effective lead qualification and conversion strategies

Conclusion: The $10 CAC Is Possible

The gap between the $536 average B2B customer acquisition cost and Besnik’s $10-$20 benchmark isn’t magic.

It’s methodology.

But here’s the truth that makes VCs uncomfortable: if more B2B companies achieved a $10 B2B customer acquisition cost, the venture capital model would collapse because companies with efficient unit economics don’t need to raise capital every 18 months.

They just grow.

Multichannel outreach, relentless experimentation, automated personalization, and data-driven optimization create the conditions for ultra-low B2B customer acquisition costs.

I’ve interviewed over 500 CEOs on the Predictable B2B Success podcast. The pattern is clear: bootstrap founders build profitable machines. Funded founders build fundraising machines.

You can choose which game to play regardless of your cap table.

The deeper lesson is mindset. Bootstrap founders can’t afford waste, so they innovate out of necessity. Funded companies often overspend because they can, not because they should.

After working with B2B tech companies from nonprofits to Series C startups, I’ve seen both paths. The companies that win in the long term combine bootstrap discipline with growth ambition.

They spend like it’s their last dollar, even when it’s not.

The question isn’t whether you can achieve a $10 B2B customer acquisition cost. It’s whether you’re willing to think like a bootstrapper even if you’re venture-backed.

As Besnik emphasizes, “For a bootstrap, consistent bootstrap business, that became the cornerstone to what led to being sales flow. I wanted to solve first my own problems in the previous ventures that led to actually finding, hey, how can I get CAC to $10, $20?”

Your B2B customer acquisition cost reflects your strategic choices.

Choose differently, and the economics transform.

Through ghostwriting educational email courses and LinkedIn content for B2B tech leaders, I’ve seen this transformation happen dozens of times. The companies that commit to systematic experimentation and multichannel discipline consistently achieve B2B customer acquisition cost that their competitors call impossible.

It’s not impossible. It’s just uncomfortable.

Because achieving $10 CAC means questioning everything you’ve been told about “industry standard” spending.

Start experimenting today. Your next customer might cost $10 instead of $500.

The only way to find out is to test.

Related Links

Connect with Besnik Vrellaku:

About the Predictable B2B Success Podcast

The Predictable B2B Success podcast, hosted by Vinay Koshy, features in-depth conversations with B2B tech CEOs, founders, and growth leaders. With over 500 episodes, the show explores strategies for scaling revenue, optimizing operations, and building sustainable B2B companies. Subscribe to the podcast for weekly insights from industry leaders.

Need Help Optimizing Your B2B Customer Acquisition?

At Sproutworth, we specialize in helping B2B tech companies from seed to Series C optimize their customer acquisition through strategic content marketing, digital PR, and educational email courses. Our approach combines thought-leadership positioning with systematic lead generation to reduce B2B customer-acquisition costs while improving lead quality.

Explore our digital PR and content services explicitly designed for funded B2B tech startups and scale-ups.

Ready to optimize your B2B customer acquisition cost? Contact Sproutworth to learn how we can help.

Some areas we explore in this episode include:

Listen to the episode.

Subscribe to & Review the Predictable B2B Success Podcast

Thanks for tuning into this week’s Predictable B2B Podcast episode! If the information from our interviews has helped your business journey, please visit Apple Podcasts, subscribe to the show, and leave us an honest review.

Your reviews and feedback will not only help me continue to deliver great, helpful content but also help me reach even more amazing founders and executives like you!