Last Updated: October 2, 2025

Quick Navigation: Reading Time: 18 minutes | Best For: B2B tech CEOs, founders with $2M+ ARR, companies facing acquisition decisions

Table of Contents

Key Takeaways

- Acquire companies for 10% down using creative financing instead of depleting cash reserves

- Target four acquisition categories: vendors you pay, customers who pay you, direct competitors, and complementary businesses

- Focus on EBITDA, not just revenue – profit multiples now dominate valuation discussions

- Implement bi-directional earnouts that reward both buyers and sellers when targets are exceeded

- Prepare for exit from day one – the 5 Ds and a B (divorce, disease, death, debt, disagreements, burnout) can force unexpected sales

- Wait 90 days before making changes post-acquisition to understand existing processes and culture

BY THE NUMBERS: Business Acquisition Strategy

• 10% down payment vs 100% cash required for acquisitions

• $30M revenue from $2.5M combined businesses (10x growth in 24 months)

• 26% of M&A deals include earnouts (median: 24 months)

• 72% of B2B companies report longer sales cycles in 2024

• 47% increase in B2B marketing costs year-over-year

• Only 28% of B2B companies hit revenue targets through organic growth

• 20-30% of businesses that go to market actually sell (Exit Planning Institute)

In 2024, while 72% of B2B companies faced longer sales cycles and saw marketing costs surge by 47%, most tech CEOs continued to focus on organic growth. They burned millions on customer acquisition when their biggest competitor could have become their best acquisition target—for less than 10% down.

That’s not theory. That’s math proven across $450 million in executed transactions.

With B2B sales strategies facing unprecedented headwinds and 63% of leaders citing economic uncertainty as their top growth challenge, there’s a faster path to scale that most funded startups overlook entirely.

Acquisition.

Here’s the uncomfortable truth: You’re probably spending more on customer acquisition than it would cost to acquire an entire company—complete with customers, revenue streams, and battle-tested teams. When you understand how to leverage thought leadership alongside strategic acquisitions, you create compound growth that organic tactics cannot match.

Meet Marty Fahncke: The M&A Strategist Who’s Executed $450M+ in Transactions

EXPERT CREDENTIALS This article features insights from Marty Fahncke, who has personally executed over $450 million in M&A transactions across consumer goods, SaaS, health and wellness, and e-commerce sectors. With over 20 years of specialization in mergers and acquisitions, Fahncke and his team at Westbound Road have developed more than 230 funding strategies for business acquisitions.

When it comes to business acquisition strategy, few experts can match Marty Fahncke’s real-world track record.

Over 30 years of marketing and business growth experience. Twenty years specifically in mergers and acquisitions. More than $450 million in executed transactions across consumer goods, SaaS, health and wellness, and e-commerce.

However, what makes Fahncke’s approach distinct is that he’s not just advising on deals from the sidelines. He and his partners at Westbound Road actively acquire businesses across multiple industries while simultaneously advising clients on both buy-side and sell-side transactions.

His company has developed over 230 different funding strategies for acquiring businesses without depleting cash reserves—a framework that democratizes M&A for companies of all sizes, not just private equity firms and Fortune 500 giants.

Fahncke’s own first exit happened almost accidentally. He and his partners grew a grassroots startup to $1.5 million in revenue in just 18 months. The business got attention—it appeared on television in the United States, Japan, and Brazil. A company approached with an offer. They sold for seven figures.

His second major transaction taught him the real power of acquisition strategy. His B2C company faced fierce competition from a rival. Instead of continuing the costly battle, they acquired the competitor. His $1 million business plus their $1.5 million business didn’t equal $2.5 million. Two years later, the combined entity hit $30 million in annual revenue.

That’s the power of strategic acquisition over pure organic growth.

Watch the Full Episode: Business Acquisition Strategy With Marty Fahncke

In this in-depth conversation, Marty Fahncke breaks down his comprehensive framework for executing acquisitions with minimal cash down, identifying target companies, structuring earnouts, and successfully integrating acquired businesses to achieve maximum growth.

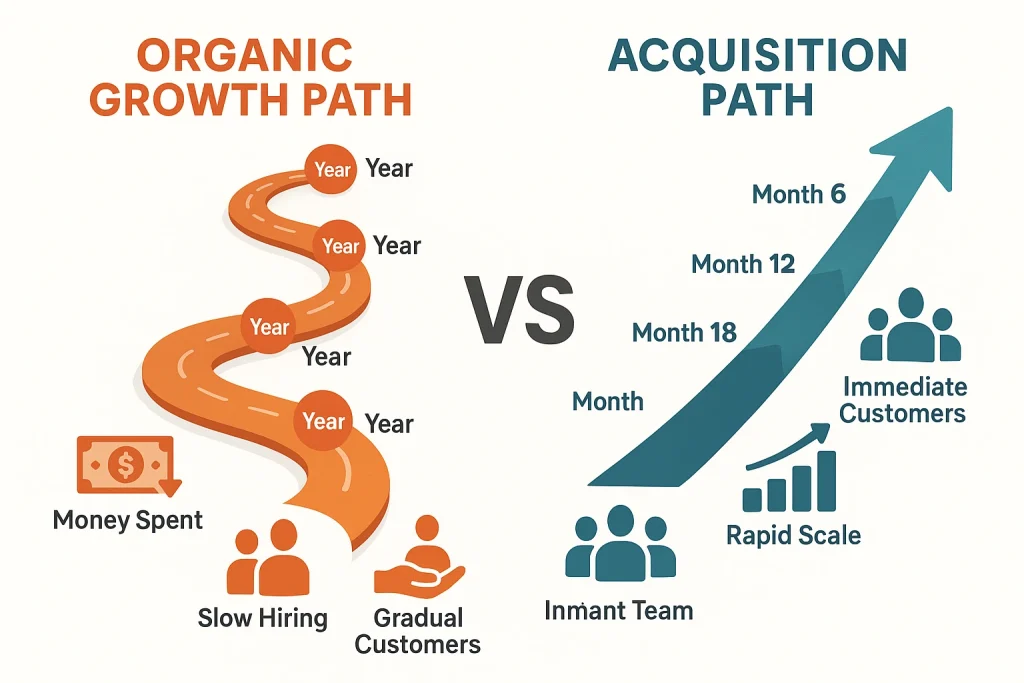

Why Your Organic Growth Strategy Is Bleeding Cash

Marketing costs for B2B brands jumped 47% in the last year. Only 28% of B2B companies hit revenue targets through organic means.

The math isn’t working.

You’re fighting for the same customers. Burning through runway. Watching competitors grab market share while your sales cycle stretches from 3 months to 9.

How do I grow my B2B company faster without burning cash? That’s the question keeping CEOs awake at night. The answer lies in a strategy most overlook: buying growth instead of building it.

Marty Fahncke, who’s executed over $450 million in M&A transactions, puts it bluntly: “You have two $1 million businesses competing against each other. You put them together, and two years later you’re doing $30 million.”

Not $3 million. Not $5 million.

$30 million.

That’s what happened when his e-commerce company acquired its fiercest competitor. Instead of competing on ad spend, they combined forces, teams, customer bases, inventory, and market intelligence.

The result? Nearly 10x growth in 24 months.

EXPERT INSIGHT – Marty Fahncke, M&A Advisor ($450M+ Transactions)

“People think if they’re buying a $2 million business, it’s going to cost them $2 million. The reality is, with leveraging funding options, you can usually do an acquisition for 10% of the overall valuation.”

The 10% Down Payment That Changes Everything

How can I buy a company with a small down payment? This is one of the most common questions from B2B tech CEOs exploring acquisition strategies.

Most founders think acquisitions require massive capital. Private equity money. Board approval. Complex financing structures.

Wrong.

“People think if they’re buying a $2 million business, it’s going to cost them $2 million,” Fahncke explains. “The reality is, with leveraging funding options, you can usually do an acquisition for 10% of the overall valuation.”

Translation: Acquire a $2 million revenue business for $200,000.

Here’s how smart acquirers structure deals without depleting cash reserves:

Seller Financing: Sellers provide a portion of financing, creating tax benefits for them and reducing risk for you. This is one of the most common and effective strategies in strategic business growth.

Revenue-Based Financing: Lenders fund against future revenues of the acquired business, not your balance sheet.

Asset-Based Financing: Leverage the target company’s assets—such as inventory, equipment, and receivables—as collateral.

Third-Party Equity: Private equity firms often don’t seek full ownership. They’ll take minority stakes and share equity.

Management Equity: The existing management team remains in place and invests, becoming partial owners instead of just employees.

Fahncke and his team have developed over 230 funding strategies. But you only need 5-10 of them to structure 90% of deals.

The constraint isn’t capital. It’s creativity.

Your Acquisition Target List: The 4-Quadrant Framework

Should I acquire my competitor or look at complementary businesses? The answer: both could work, depending on your strategic goals.

Every B2B tech company has acquisition targets hiding in plain sight.

Fahncke’s framework is brutally simple:

1. Who You Pay: Your vendors and suppliers. Acquiring up the supply chain gives you cost control and vertical integration. Similar to how companies use demand generation marketing strategies, upstream acquisitions create integrated growth engines.

2. Who Pays You: Your customers. Sometimes your best clients make perfect acquisitions, especially if you’re already embedded in their operations.

3. Who You Compete Against: Direct competitors fighting for the same customers. Stop burning cash competing. Start negotiating.

4. Complementary Businesses: Non-competitors in adjacent spaces that create strategic partnerships when combined.

One of Fahncke’s clients—a digital hosting company—is currently acquiring a web design firm. Why? Web design is both top-of-funnel and transactional. Hosting is the bottom of the funnel and recurring revenue.

Perfect synergy.

The web design firm brings new customers. The hosting company keeps them forever. Both businesses win.

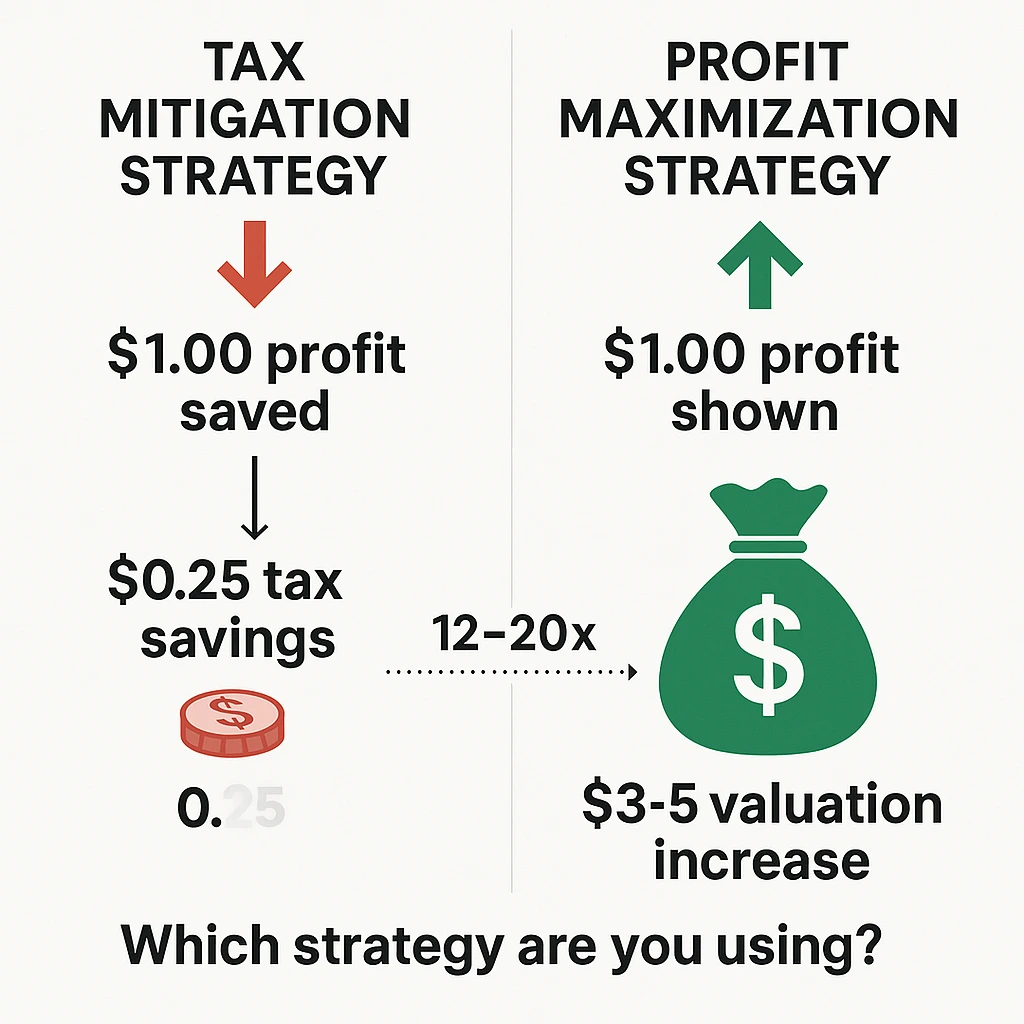

The Hidden Valuation Killer: Tax Mitigation vs. Profit Maximization

Here’s where most bootstrap founders sabotage their exit before they even think about selling.

You run your business to minimize taxes. Write off everything. Show minimal profit. Save 25% on your tax bill.

Smart, right?

Dead wrong.

“Every dollar in profit you wipe out might save you 25% in taxes,” Fahncke warns. “But every dollar in profit you don’t have when you’re ready to sell—that might be a 3x, 4x, 5x multiple.”

Do the math:

- Save $1 in profit → Save $0.25 in taxes

- Show $1 in profit → Add $3-5 to your valuation

You’re optimizing for pennies while leaving millions on the table.

If you plan to exit within three years, switch strategies immediately. Work with your CFO and tax advisors to shift from tax mitigation to profit maximization.

Show the EBITDA. Pay the taxes. Bank the multiple.

The 5 Ds and a B: Why You Must Be Ready to Sell Tomorrow

Fahncke gets calls every week from business owners in crisis.

“I need to sell immediately. My husband passed away. He told me the business was worth three times revenue. It was doing $500,000 a year, so I need $1.5 million.”

The devastating truth? Her husband WAS the business. With no employees, no transferable systems, and just a truck and tools, the business was worth essentially zero.

Every business owner exits eventually. The question is whether it’s planned or forced.

The triggers Fahncke sees repeatedly:

The 5 Ds:

- Divorce

- Disease

- Death

- Debt

- Disagreements (with partners/co-founders)

The B:

- Burnout

You don’t plan for a house fire. But you have insurance.

You don’t plan for a car accident. But you’re covered.

Why isn’t your business ready to sell if something happens tomorrow?

According to research from the Exit Planning Institute, only 20-30% of businesses that go to market actually sell. The primary reason? They weren’t prepared.

AI Is Rewriting Acquisition Valuations Right Now

Fahncke sold his first AI-driven SaaS business in early 2023, just as ChatGPT gained popularity.

“The level of interest was insane. We had hundreds of people trying to buy that business because it was AI-driven, already profitable, and generating revenue.”

That’s rare in tech. Profitable AI companies that generate revenue.

Simultaneously, he watched a B2B music licensing company—solid revenues, healthy profits—crater in valuation. The reason? The market perception was that AI-generated music would render them obsolete.

The valuations diverged within months:

- AI-powered SaaS: Massive interest, premium multiples

- Perceived AI-threatened business: Nearly worthless

Whether fair or not, AI considerations now impact every acquisition discussion.

If your business utilizes AI effectively, it can increase its valuation. If acquirers believe AI could disrupt your business model, expect steep discounts—regardless of current performance.

Smart content strategists understand this shift. That’s why ghostwritten educational email courses and executive LinkedIn content strategy for thought leadership increasingly emphasize AI integration, not AI resistance. B2B tech leaders need to demonstrate AI literacy in their thought leadership, or risk appearing behind the curve to potential acquirers.

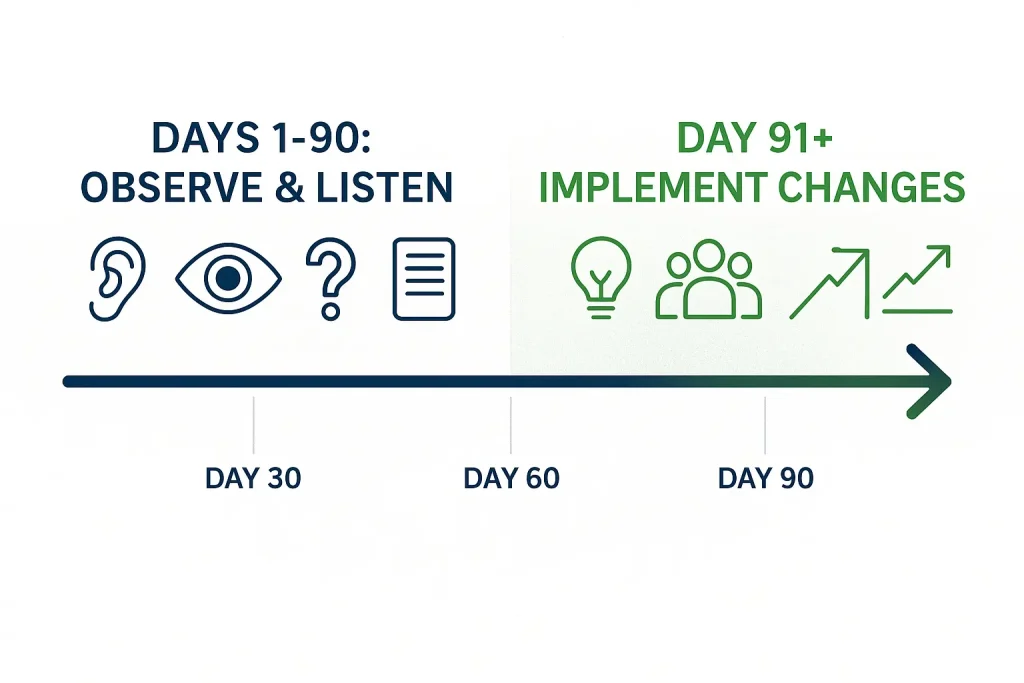

The First 90 Days Post-Acquisition: Do Nothing

Most acquirers charge in and start “fixing” things immediately.

Fatal mistake.

“For the first 90 days, don’t do anything. Don’t change anything,” Fahncke insists. “You will find that there are processes happening in that business that you will break, and you won’t even know they existed beforehand.”

The playbook is counterintuitive:

Days 1-90: Observe, listen, ask questions. The magic question to ask every team member: “And then what?”

“We answer the phone and transfer them to sales.” “And then what?” “Well, their voicemail is usually full…”

That simple question exposes broken processes and hidden inefficiencies without putting anyone on the defensive.

Day 91: Now you can start making strategic changes—with full context.

The key is attribution. If John in accounting reveals a breakthrough process improvement during your listening tour, publicly credit John when you implement it.

“We’re making this change because John had this brilliant insight.”

Teams adopt changes more quickly when they originate from within, rather than from a new owner exerting influence.

EXPERT INSIGHT – Marty Fahncke

“Spend time with people on the front lines. There’s always one person in every company who secretly runs the business. Find that person.”

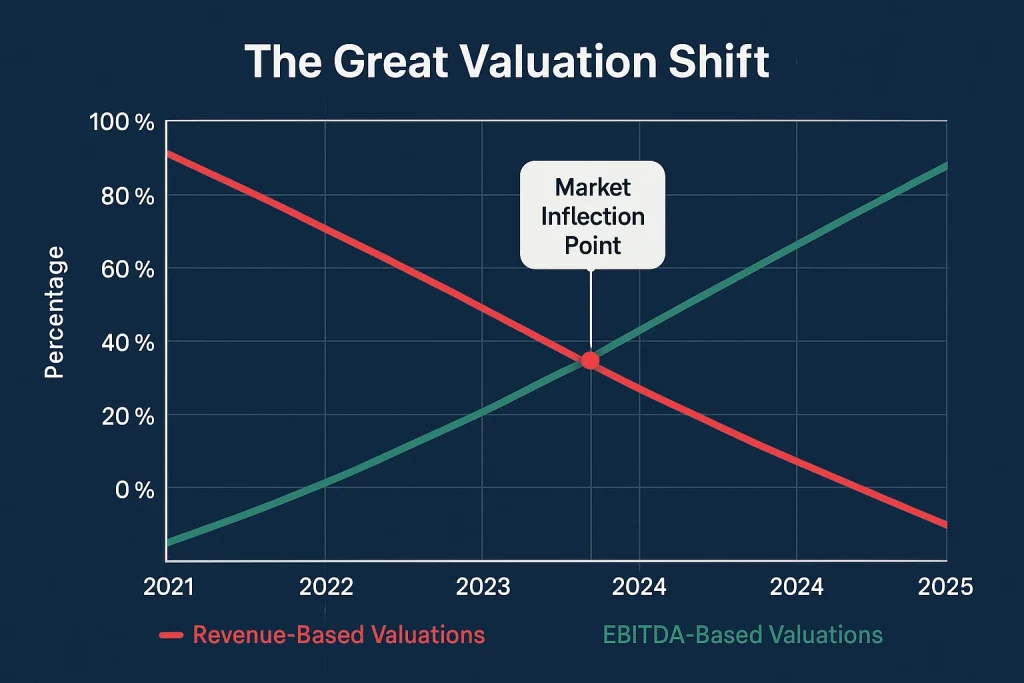

Revenue Multiples Are Dead. EBITDA Is King

In 2021-2022, SaaS companies achieved extraordinary multiples based on pure revenue potential. Hockey stick projections secured eight-figure valuations despite zero profitability.

Those days are over.

What’s the fastest way to increase my company’s valuation? Focus on EBITDA, not just revenue growth.

“Most acquiring businesses are looking to acquire another company that already has cash flow and profitability,” Fahncke explains. “The multiples are more and more based on profits than revenues.”

If you’re still selling on ARR growth alone, you’re speaking yesterday’s language.

Today’s acquirers want to see:

- Positive cash flow

- Proven EBITDA

- Customer retention metrics

- Net revenue retention above 100%

- Clear path to profitability if pre-revenue

The shift mirrors what’s happening in content strategy for B2B tech companies. Generic thought leadership about “growth hacking” and “disruption” no longer converts. C-suite executives want evidence-based insights backed by real profit and loss experience.

That’s why educational content for B2B growth increasingly focuses on unit economics, CAC payback periods, and sustainable growth metrics—not vanity metrics.

Earnouts: The Double-Edged Sword That Protects Everyone

Standard earnouts create asymmetric risk.

“We’ll pay you $6 million, but if you don’t hit these numbers, it drops to $5 million.”

The seller carries all downside risk. The buyer is protected. But there’s no upside if performance exceeds expectations.

Smart deal structure uses bi-directional earnouts:

- Miss benchmarks: Price drops to $5M

- Hit benchmarks: Price stays at $6M

- Exceed benchmarks: Price rises to $7M

Everyone has skin in the game. Both parties win if the acquisition outperforms.

This structure works especially well for retained equity deals where the selling founders remain on after the acquisition. They’re not just collecting a check—they’re building the combined company’s value.

According to SRS Acquiom’s M&A Deal Terms Study, earnouts appear in approximately 26% of private company M&A deals, with a median earnout period of 24 months.

Your Competitive Moat Isn’t Your Product—It’s Your Acquisition Strategy

Every B2B tech CEO obsesses over product differentiation.

Better features. Faster onboarding. Sleeker UI.

Meanwhile, your smartest competitor just acquired three companies in your space.

They didn’t outbuild you. They outbought you.

When we work with B2B tech founders on their content strategy and executive positioning, the most successful ones aren’t just promoting their product. They’re establishing M&A credibility.

Educational email courses that demonstrate strategic thinking. LinkedIn content that showcases market consolidation insights. Digital PR strategies that position them as industry consolidators, not just operators.

Because when you’re ready to acquire—or be acquired—your personal brand as a strategic thinker matters as much as your P&L.

The Exit Plan You Need Today

Fahncke is adamant: “You should always have your business ready to sell, even if you never plan to sell it.”

Not someday. Today.

Here’s the reality: The best exits come from businesses that aren’t desperate to sell. When you’re ready to exit on your terms, you command premium valuations.

When you’re forced to sell under duress—divorce, health crisis, cash crunch—you take whatever you can get.

The prepared founder focuses on:

- Clean Financials: Three years of audited statements showing profit growth

- Documented Systems: SOPs that prove the business runs without you

- Transferable Relationships: Customers tied to the company, not your personal brand

- Recurring Revenue: Predictable cash flow that survives ownership transition

- Strong Team: Management that stays post-acquisition

These aren’t exit preparations. These are business fundamentals that also happen to maximize acquisition value.

The Contrarian Take: Acquisitions Beat Organic Growth in 2025

Here’s my flag in the ground:

If you’re a B2B tech company with over $2M ARR, and you’re still pursuing purely organic growth, you’re choosing the expensive, slow path.

The data is clear:

- 72% longer sales cycles

- 47% higher marketing costs

- Only 28% hit organic growth targets

Meanwhile, acquisition lets you buy revenue, customers, and teams for 10% down.

The opportunity cost of NOT acquiring is massive. Every quarter you compete instead of consolidate, you’re burning capital that could become equity.

This isn’t just about M&A. It’s about strategic positioning in a market where consolidation is the key to success.

The B2B tech leaders I work with on thought leadership and content strategy understand this shift. Their ghostwritten newsletters don’t just talk about product updates. They discuss market consolidation, acquisition strategy, and strategic partnerships.

Because when you’re ready to scale, your narrative needs to support the leap from operator to consolidator.

Organic Growth vs Acquisition Strategy: A Direct Comparison

| Factor | Organic Growth | Acquisition Strategy |

|---|---|---|

| Time to $10M Revenue | 5-7 years | 1-2 years |

| Upfront Capital Required | $2-5M in marketing/sales | $200K-500K (10% down) |

| Customer Acquisition Cost | $500-2,000 per customer | Inherited customer base |

| Market Share Gain | Gradual (3-5% annually) | Immediate (20-50%+) |

| Team Building Time | 2-3 years | Immediate (acquire talent) |

| Risk Profile | Market dependent | Shared with seller (earnouts) |

| Competitive Advantage | Built over time | Purchased immediately |

| Revenue Predictability | Variable, sales-cycle dependent | More predictable (existing revenue) |

| Best For | Early-stage, pre-product-market fit | Established companies ($2M+ ARR) |

Updated September 2025: Current market conditions favor acquisition strategies for established B2B tech companies. With interest rates stabilizing and PE firms sitting on $2.5 trillion in dry powder, sellers are increasingly open to creative deal structures.

Common Questions About Business Acquisition Strategy

People also search for:

- Business acquisition vs organic growth

- How to finance a business acquisition

- Business acquisition checklist

- Due diligence for business acquisitions

- Mergers and acquisitions strategy for small business

- Strategic acquisition planning process

- Buy-side M&A tactics

Frequently Asked Questions About Business Acquisition Strategy

Q: How much does it really cost to acquire a business? A: While businesses may be valued at $2-5 million, you typically only need 10-20% of that as actual cash through strategic use of seller financing, revenue-based financing, asset-based financing, and third-party equity. For a $2 million acquisition, expect to deploy $200,000 to $400,000 in cash.

Q: What is seller financing in business acquisitions? A: Seller financing is when the business seller provides a loan to the buyer for a portion of the purchase price. This allows buyers to acquire businesses with less upfront cash, while providing sellers with tax advantages and residual income. It’s commonly used in 60-70% of small to mid-market acquisitions.

Q: How long does a typical business acquisition take? A: From initial outreach to closing, expect 90-180 days for small to mid-market acquisitions ($1-50M). Larger deals can take 6 to 12 months. The timeline includes the following stages: initial discussions (2-4 weeks), letter of intent (2-3 weeks), due diligence (30-60 days), and closing (30-45 days).

Q: What is EBITDA, and why does it matter more than revenue for acquisitions? A: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company’s operating profitability. In today’s market, acquirers pay 3-5x EBITDA for established companies, while revenue multiples have disappeared, except in high-growth tech sectors. A $2M revenue company with $500K EBITDA is worth more than a $3M revenue company with $200K EBITDA.

Q: Should I acquire a competitor or a complementary business? A: Both can work depending on your strategic goals. Competitor acquisitions can eliminate competition and quickly double market share, but they require careful integration. Complementary business acquisitions expand your offering without direct overlap, making integration easier. The “Four Quadrants” framework (vendors, customers, competitors, complementary businesses) helps identify the best targets for your situation.

Q: What happens if an acquisition fails? A: According to Harvard Business Review, 70-90% of acquisitions fail to deliver expected value. Common failure points include: cultural misalignment, overvaluation, poor integration, and loss of key employees. The best protection is thorough due diligence, earnout structures that tie payment to performance, and a 90-day observation period before making major changes.

Q: Do I need a business broker or M&A advisor? A: For deals under $5M, you can potentially handle directly with legal counsel. For deals valued at $5-50M, an M&A advisor provides significant value in valuation, deal structuring, and negotiation. They typically charge 3-10% of deal value, depending on size. For deals over $50M, investment bankers become valuable for accessing broader buyer/seller networks.

Q: How do I value my own business for an eventual exit? A: Most businesses are valued at 3-5x EBITDA for established companies, though SaaS and tech companies may command higher multiples (5- 10x) with strong metrics. Get a professional valuation every 2-3 years if you’re planning an exit. Key factors affecting valuation include: profit margins, revenue growth rate, customer concentration, recurring revenue percentage, and market position.

Ready to Explore Business Acquisition Strategy?

Immediate Actions You Can Take:

- Create Your Target List: Use the 4-quadrant framework to identify 10 potential acquisition targets (vendors, customers, competitors, complementary businesses)

- Get Your Valuation: Have your business professionally valued by an M&A advisor to understand your current position and what improvements could maximize your exit value

- Audit Your Financials: Review whether you’re showing profit or minimizing taxes. If you’re planning an exit within 3 years, shift to profit maximization now

- Build Your Acquisition Network: Start building relationships with potential targets through strategic content and thought leadership

- Schedule a Strategy Session: Connect with our team to discuss how digital PR and executive positioning can establish you as an industry consolidator

- Download Our Resources:

- Business Acquisition Readiness Assessment

- The 10-Point M&A Checklist

- Profit Maximization Calculator

About the Author

Vinay Koshy is the Founder of Sproutworth, where he helps B2B tech companies expand their influence and scale revenue through strategic content and digital PR. With extensive experience working with nonprofits, SaaS companies, and digital agencies, Vinay specializes in ghostwriting educational email courses for funded B2B tech startups (seed to Series C) and creating LinkedIn content strategies for C-suite executives.

His approach combines data-driven growth tactics with authentic storytelling to help companies establish thought leadership that translates into a robust pipeline. Vinay has a particular focus on cleantech and environmental services companies, helping them communicate complex value propositions to enterprise buyers.

Connect with Vinay on LinkedIn or learn more at Sproutworth.com.

Related Resources from Sproutworth

Looking to deepen your understanding of growth strategies and thought leadership for B2B tech companies? Check out these related articles and podcast episodes:

Articles:

- Thought Leadership Strategy: A Step by Step Guide For Growth

- B2B Sales Growth Trends And Strategies: Driving Revenue in 2025

- 5 Demand Generation Marketing Strategies to Drive Growth

- How to Boost Lead Generation on LinkedIn With Neuroscience Tweaks

- Social Media Growth Strategies: How to Boost Brand Visibility

Podcast Episodes:

- How to Create a Successful B2B Podcast That Drives Business Growth

- How to Monetize a Podcast to Drive Growth and Relationships

- How to Use Podcasting as a Customer Acquisition Strategy

- Marketing vs Branding: How to Leverage Them to Drive Growth

- How to Create Stories That Sell and Drive Business Growth

- Generating Demand: How to Use Demand Generation Strategies

- How To Use Channel Sales Strategies To Drive Massive Growth

Connect With Marty Fahncke

Want to learn more about business acquisition strategies or explore working with Marty Fahncke and his team at Westbound Road?

- Marty Fahncke on LinkedIn: linkedin.com/in/martyfahncke

- Westbound Road: westboundroad.com

Marty is highly responsive on LinkedIn and regularly shares insights about M&A strategies, business valuations, and growth through acquisition. He’s also the only Marty Fahncke in the world (F-A-H-N-C-K-E), making him easy to find and connect with.

Sources & Further Reading

- HubSpot State of Marketing Report 2024

- SRS Acquiom M&A Deal Terms Study 2024

- Exit Planning Institute: Business Owner Readiness Survey

- CB Insights: Why Startups Fail Report

Some areas we explore in this episode include:

Listen to the episode.

Subscribe to & Review the Predictable B2B Success Podcast

Thanks for tuning into this week’s Predictable B2B Podcast episode! If the information from our interviews has helped your business journey, please visit Apple Podcasts, subscribe to the show, and leave us an honest review.

Your reviews and feedback will not only help me continue to deliver great, helpful content but also help me reach even more amazing founders and executives like you!